Global| Nov 30 2005

Global| Nov 30 2005Euro-zone Growth Picks Up to 0.6% in Q3; Chain-Linking Introduced to Eurostat Aggregates

Summary

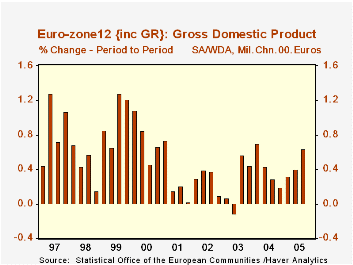

Eurostat made its first full report of Q3 GDP today. Total growth was 0.6%, the same as estimated a couple of weeks ago in the "flash" report for both Euro-zone12 and the EU25 . This new figures represent the routine addition of more [...]

Eurostat made its first full report of Q3 GDP today. Total growth was 0.6%, the same as estimated a couple of weeks ago in the "flash" report for both Euro-zone12 and the EU25 . This new figures represent the routine addition of more countries, specifically Denmark and Poland. But in this report, Eurostat made important methodological changes as well, most notably shifting to chain weighting to calculate the volume measures of GDP and its components. They also changed the treatment of "FISIM", the imputed value of "financial services indirectly measured".

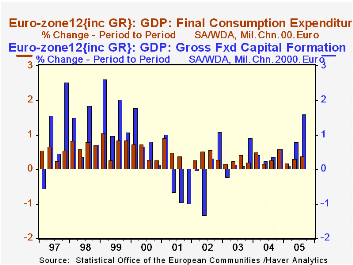

As to the performance, seen in the table below, growth picked up somewhat to 0.6% in Q3 from 0.4% in Q2. Final consumption grew 0.4%, slightly more than the 0.3% in the prior period; both public and private consumption participated. Exports were the other source of advance, surging by 3.4% after 2.2% in Q2. This put yearly expansion of exports at 5.2% from Q3 2004, largely keeping up the strong 5.9% pace set for last year as a whole. Imports gained a little more in the latest quarter. Overall capital formation looks weak, but importantly, the slowdown here is due to much smaller inventory accumulation; fixed investment advanced considerably, 1.6%, after 0.8% in Q2. This is the strongest investment gain since early 2000.

Regarding the methodology, the change to FISIM involves allocating it to the specific industry sectors where it applies and removing it as an explicit adjustment between gross value added and gross domestic product. The net numerical result appears as an upward revision to nominal GDP, according to Eurostat, of about 1.0% in the Euro-zone and about 0.6% for the EU25.

Chain-linking is by now fairly well-known, and actually had remarkably little impact on total reported Euro-zone growth. History runs back only to 1995; perhaps the effect would have been greater in earlier years. Eurostat's press release shows changes in total growth of only 0.1%, up or down, in some quarters, but not in all and without trend. It's important to note that not all Euro-zone countries yet produce chain-weighted accounts. Italy and Belgium are two countries where no chaining is done; France's quarterly data is also not yet chained. So data for these three countries in particular remain in fixed-weight terms in the relevant Haver databases (ITALY, BENELUX and FRANCE, as well as EUROSTAT and G10).

| EuroZone12 GDP: Chained 2000 Euros | Q3 2005 | Q2 2005 | Q3 2004 (yr/yr) | Yearly Totals|||

|---|---|---|---|---|---|---|

| 2004 | 2003 | 2002 | ||||

| GDP | 0.6 | 0.4 | 1.6 | 1.8 | 0.7 | 1.0 |

| Final Consumption | 0.4 | 0.3 | 1.5 | 1.3 | 1.2 | 1.4 |

| Gross Capital Formation | 0.2 | 1.2 | 1.6 | 3.5 | 1.7 | -2.9 |

| Exports | 3.4 | 2.2 | 5.2 | 5.9 | 1.3 | 1.8 |

| -Imports | 2.8 | 2.6 | 5.2 | 6.1 | 3.1 | 0.4 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates