Global| Sep 13 2005

Global| Sep 13 2005European Inflation Becoming a Rising Concern to Central Banks

Summary

Inflation in Europe has remained surprisingly subdued in the face of sharply rising oil prices. However the data released today for three Euro Zone countries--France, Germany and Spain--and the United Kingdom suggest that this [...]

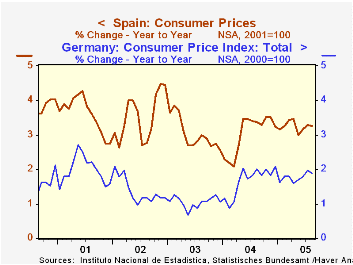

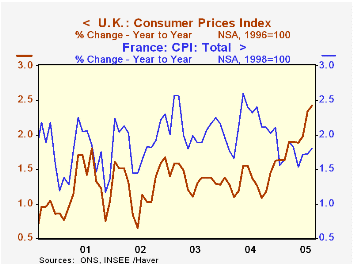

Inflation in Europe has remained surprisingly subdued in the face of sharply rising oil prices. However the data released today for three Euro Zone countries--France, Germany and Spain--and the United Kingdom suggest that this situation may be about to change. Although the August year-over-year percentage increases in consumer price indexes (the generally accepted definition of inflation) for Germany and Spain were lower than the July increases, those for the U. K. and France were significantly higher. Data for Germany and Spain are shown in the first chart and those for the U.K. and France in the second chart.

Of the four countries, the sharpest change has occurred in the U.K. Over that past five years, inflation in the UK showed little trend as it varied between 0.65% and 1.98% -- for the most part, well below the Bank of England's 2% inflation target rate. In late 2004, however, inflation began to rise sharply, and, for the last two months has been above the target rate, 2.3% in July and 2.4% in August. In spite of the July rise in inflation above its target rate, the Bank of England voted 5 to 4 to lower the base rate from 4.75% to 4.50% on August 4 to counteract slow growth. Should inflation continue above the target rate, further reductions in the base rate, even if growth remains sluggish, may now be less likely.

Among the countries in the Euro Zone, France is the other country, reporting today, to show some recent increase in the rate of inflation. Inflation in France had seemed to trending downward in the last part of 2004 but now shows some signs of reversing that trend. In contrast to France, inflation in Spain and Germany rose sharply in early 2004 and has since remained trend less at the higher level. In the face of sluggish growth in the Euro Zone, the European Central Bank has maintained its base rate at 2% since June, 2003. With the increased risk of higher inflation, slow growth would be unlikely to trigger a further decline in the base rate, while any indication of improved growth is very like to trigger an increase in the base rate.

Both France and Germany have had relatively low rates of inflation, while Spain has been among the high inflation group within the Euro Zone. As an indication of the relative position of the Euro Zone countries on the inflation scale, one can compare the level of the Harmonized Consumer Price Indexes which are comparable across countries and have the same base year,1996. For example, in 2004, the Harmonized Consumer Price Index for France averaged 113.3, that for Germany, 110.7, and for Spain, 124.1.

| Year-over-Year Percent Change in CPI Index | Aug 05 | Jul 05 | Aug 04 | M/M dif | Y/Y dif | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|---|

| U. K. | 2.43 | 2.34 | 1.27 | 0.09 | 1.16 | 1.34 | 1.36 | 1.27 |

| France | 1.81 | 1.72 | 2.31 | 0.09 | -0.60 | 2.13 | 2.11 | 1.92 |

| Germany | 1.87 | 1.89 | 2.01 | -0.02 | -0.14 | 1.67 | 1.05 | 1.37 |

| Spain | 3.27 | 3.28 | 3.38 | -0.01 | -0.11 | 3.05 | 3.03 | 3.53 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates