Global| Jun 25 2008

Global| Jun 25 2008FOMC Left Fed Funds Rate Unchanged at 2.00%

by:Tom Moeller

|in:Economy in Brief

Summary

As widely expected, the Federal Open Market Committee left the Federal funds rate unchanged today at 2.00%. The Fed had been steadily lowering the rate since its high of 6.25% in July of last year, where it had been for roughly 12 [...]

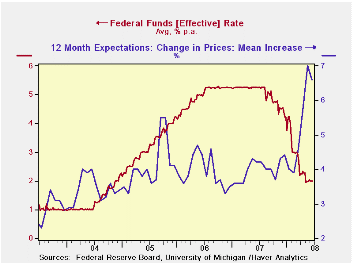

As widely expected, the Federal Open Market Committee left the Federal funds rate unchanged today at 2.00%. The Fed had been steadily lowering the rate since its high of 6.25% in July of last year, where it had been for roughly 12 months.

The discount rate also was left unchanged at 2.25%.

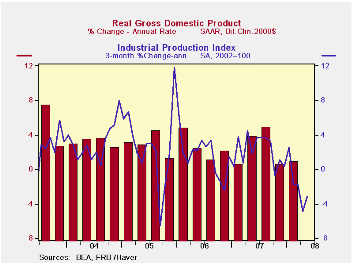

Regarding the economy the Fed indicated "that overall economic activity continues to expand, partly reflecting some firming in household spending." To the downside was noted a greater number of risks that "labor markets have softened further and financial markets remain under considerable stress. Tight credit conditions, the ongoing housing contraction, and the rise in energy prices are likely to weigh on economic growth over the next few quarters."

Regarding price inflation it was stated that the "Committee expects inflation to moderate later this year and next year." However risks to this outlook were deemed high given an elevated level of energy, other commodity prices and inflation expectations.

The Fed's statement indicated that the downside risks to economic growth have diminished and that the upside risks to inflation have increased.

The decision was unanimous except that Richard W. Fisher, President of the Federal Reserve Bank of Dallas, preferred an increase in the target for the federal funds rate at this meeting.

For the complete text of the Fed's latest press release please follow this link here.

Liquidity Crisis from the Federal Reserve Bank of Philadelphia can be found here.

| Current | Last | May | 2007 | 2006 | 2005 | |

|---|---|---|---|---|---|---|

| Federal Funds Rate, % (Target) | 2.00 | 2.00 | 1.98 | 5.02 | 4.96 | 3.19 |

| Discount Rate, % | 2.25 | 2.25 | 2.25 | 5.86 | 5.95 | 4.18 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates