Global| Apr 15 2011

Global| Apr 15 2011Foreign Investors' Holdings Take Smaller Share of Treasury Debt: Other TIC Data Mixed

Summary

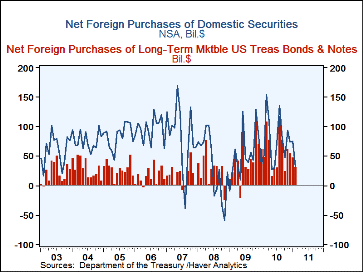

Foreign investors made net purchases of $32.4 billion worth of U.S. long-term debt and equity securities in February, according the U.S. Treasury's International Capital ("TIC") data published today. This is noticeably less than [...]

Foreign investors made net purchases of $32.4 billion worth of U.S. long-term debt and equity securities in February, according the U.S. Treasury's International Capital ("TIC") data published today. This is noticeably less than recent monthly amounts at and above $70 billion, but it hardly seems that this important investor group is turning away from U.S. financial markets. They bought a net of $30.6 billion in Treasuries, compared to an average of $50 billion in each December and January, and they were net sellers of U.S. corporate bonds, $2.5 billion on balance, and U.S. Government agency securities, $1.7 billion in February. But they bought $6.1 billion in equities, continuing a steady pace of moderate monthly increases. This sustained inflow of funds from abroad to the U.S. stock market seems a notable endorsement of the U.S. economy.

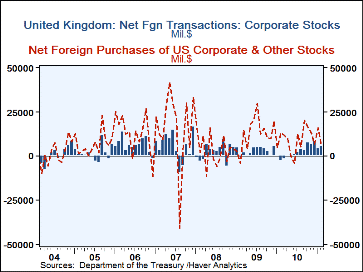

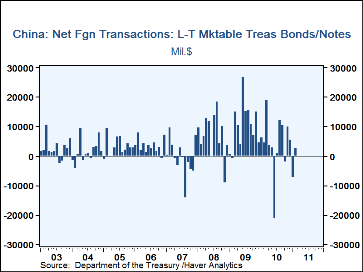

The most active source of funds in U.S. equities appears to be the U.K., which accounted for almost half of the equity purchases by foreign investors over the last six months. China, which is often thought of first these days when the phrase "foreign investor" is mentioned, rarely makes more than token purchases in this sector. At the same time, we note that China has been less active in the Treasury market of late. See in the third graph that they were net sellers in October 2010 and January 2011. Their February net purchase of $2.6 billion didn't come close to offsetting the $7.5 billion net sale in January.

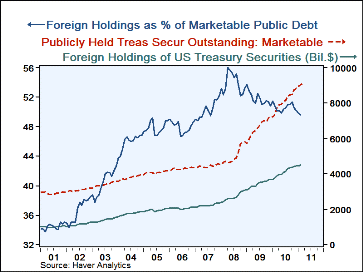

Which brings us to one more point. The TIC data also include estimates by the Treasury of total holdings of U.S. Treasury securities by foreign investors. The Treasury's TIC analysts conduct an annual benchmark survey of foreign holdings of U.S. securities, dated June 30. They then utilize monthly purchase and sales reports to produce updated monthly estimates of holdings. Media reports highlight the major role foreign investors have in carrying our debt, especially government debt. The latest estimates suggest, however, that such participation has peaked. And it may have done so as early as April 2008, when foreign investors owned just under 56% of marketable public debt outstanding. The February 2011 estimate stands at 49.6%, down from 49.8% in January and the smallest share since August 2007. Over this period, interest rates on the debt have gone down and up and down and up; there is a slight negative correlation between rate levels -- indicated by the 10-year constant maturity yield -- and the share of Treasury securities owned by foreign investors, but that measure is itself is too variable to imply anything concrete about the relationship. This is an intriguing situation, isn't it, when we intuitively attribute a definitive role for foreign investors in the direction our financial markets move.

The TIC data are found in Haver’s USINT database. The information there also includes aggregate flows in Treasury bills and other short-term assets as well as banking system data on claims on and liabilities to foreign counterparties.

| Net Foreign Purchases of Long-Term U.S. Securities (Bil.$) | Feb. | Jan. | Dec. | Feb'10 | Monthly Average | ||

|---|---|---|---|---|---|---|---|

| 2010 | 2009 | 2008 | |||||

| Total | 32.4 | 74.4 | 73.9 | 51.3 | 75.9 | 53.2 | 34.6 |

| Treasuries | 30.6 | 46.5 | 54.2 | 48.2 | 58.8 | 44.9 | 26.2 |

| China (All security types) | 4.5 | -3.8 | 3.5 | 2.2 | 2.0 | 8.2 | 10.9 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates