Global| Oct 25 2007

Global| Oct 25 2007Freight Charges Skyrocket; Baltic Indexes Surge to Records

Summary

"Cost, insurance and freight" is an expression to describe the value of imports. The vast majority of the time, the "insurance and freight" portion amounts to a statistical discrepancy, used, at least by economists, merely to [...]

"Cost, insurance and freight" is an expression to describe the value of imports. The vast majority of the time, the "insurance and freight" portion amounts to a statistical discrepancy, used, at least by economists, merely to distinguish definitions of each measure of imports. However, the latter item in the expression is no long a trivial matter. The Wall Street Journal on Monday and then a client query called our attention to the Baltic Exchange Freight Indexes, the world's key gauge of freight charges. These have been soaring.

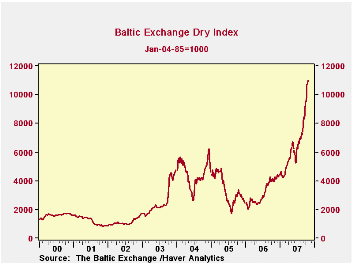

On October 24, the broadest measure, the Baltic Exchange Dry Index reached 10984 (January 4, 1985 = 1000), up a whopping 20.9% just since September 24. Actually, the most recent few days have seen some moderation, but the week of October 8-12 experienced daily hikes ranging from 1.4% to 3.6% each. The index stands an incredible 177.4% ahead of a year ago.

The Baltic Dry Index is a composite of the Baltic Capesize, Baltic Panamax and Baltic Supramax Indexes. Each covers a different group of sea routes around the world, different size and weight of ship and specialization of freight. The common element in these is that all of this freight is raw materials: grain, iron ore, coal, cement and other building materials, among others. Thus, when it becomes as significant as it is presently, it becomes key because it hits at the beginning of the production chain.

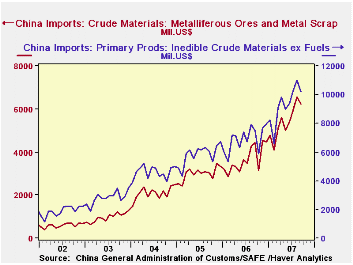

Several recent press accounts have highlighted the role of demand in China. The other day here, Louise Curley talked about the hints of some slowing in Chinese imports; their growth has tapered somewhat, particularly from neighbors Singapore and Korea. At the same time, detail reported today for September's imports show continued strength in just the raw materials that the Baltic Indexes cover. "Crude materials" inflows were $10.2 billion, up 36.3% from a year ago; Q3 as a whole saw 42.5% expansion. Within this category -- which excludes fuels so is not impacted by oil prices -- ferrous ores and metal scrap surged 40.9% from September 2006 to $6.2 billion; for those items, Q3 was 54.4% ahead of last year's period. The anecdotal evidence cites increasing shipments from Brazil as feeding this demand, as well as other producers. Those heavy volumes also feed the freight indexes, since ships must make longer trips and resulting port congestion means they must wait some days to unload, which also increases the cost.

The cause, some reports argue, is a shortage of ships, which, of course, have long building lead-times. By 2009, there will be a number of new freighters and container ships to bring some relief. A long time to wait.

These data are contained in Haver's BALTIC database, a proprietary database from the London-based Baltic Exchange. The Exchange is a clearinghouse of world shipping information.

| Oct 24 | Oct 23 | Week Oct 19 | Sept | June | Dec 2006 | Year Ago | |

|---|---|---|---|---|---|---|---|

| Baltic Exchange Dry Index, 01/04/85 =1000 | 10984 | 10944 | 10752 | 8574 | 5772 | 4336 | 3978 |

| Baltic Capesize Index, 03/01/99 = 1000 | 15487 | 15514 | 15361 | 11856 | 7616 | 5858 | 5404 |

| China Imports, Mil.$ | -- | -- | -- | -- | -- | -- | Sept '06 |

| Crude Materials, Inedible | -- | -- | -- | $10212 | $9355 | $7954 | $7492 |

| Ferrous Ores & Metal Scrap | -- | -- | -- | $6234 | $5408 | $4483 | $4425 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.