Global| Jan 27 2017

Global| Jan 27 2017French Confidence Snakes Higher

Summary

French business and consumer confidence continue to work higher in January. The consumer measure has reached the level of 100 for the first time since late in 2007, posting a normalization milestone of sorts. At this level the French [...]

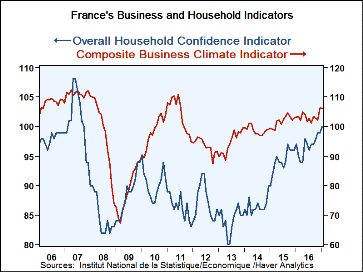

French business and consumer confidence continue to work higher in January. The consumer measure has reached the level of 100 for the first time since late in 2007, posting a normalization milestone of sorts.

French business and consumer confidence continue to work higher in January. The consumer measure has reached the level of 100 for the first time since late in 2007, posting a normalization milestone of sorts.

At this level the French consumer confidence index sits at the 61st percentile of its much longer queue of values. The business reading ranks slightly higher in its 72nd percentile.

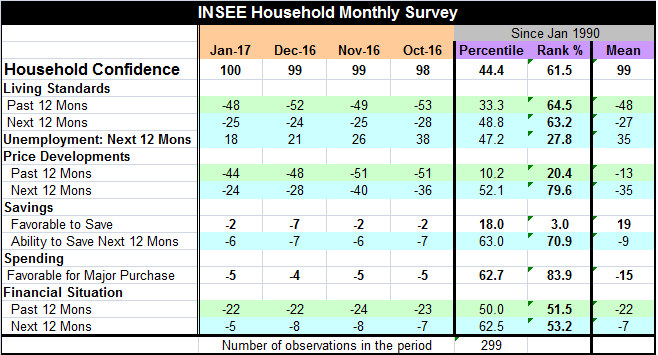

Past living standards are now believed to have been steadily improving as that gauge moved up again in January to -48 from -52 in December. For the next 12 months the living standards fell back to -25 reading from -24 previously, but that series is up from a -28 reading in October.

Moving very strongly in a positive direction are reduced expectations for unemployment. That series has fallen to 18 in January from 21 in December and from 38 as of October of last year. The index reflecting the fear of unemployment has more than halved in the last three months.

Inflation development in the past 12 months are still construed as having been mild with the January reading falling to an historic 20th percentile standing. For the period ahead, the next 12-month expectations have risen to -24 from -28, a rise of four points and a much higher value than the -36 reading of October. The outlook reading has a 79th percentile standing. Of course, oil prices are rising, accounting for much of this gain.

Savings and the ability to save are perceptions that have not changed very much either looking backward or forward. Neither has the spending environment assessment changed by much, but it has an 83rd percentile standing which is relatively strong and the best among the components ranked in this table. The past and expected financial situation is assessed to have changed very little. Both of them have rankings in their low 50th percentile, quite near and slightly above their respective medians.

On balance, France is seeing improvement in business and in household confidence. The details supporting ongoing improvement are not yet in place as the people do not see their financial conditions and very strong, but their fears of the most destabilizing event, unemployment, have faded considerably, accounting substantially for their improved mood.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates