Global| Oct 10 2017

Global| Oct 10 2017German Exports Rise Strongly But Show Little Real Momentum

Summary

Neither German exports nor imports are surging, but exports have a very strong one-month gain in August after a very mild rise in July. Year-on-year exports have decelerated compared to the pace of growth in the same month of one year [...]

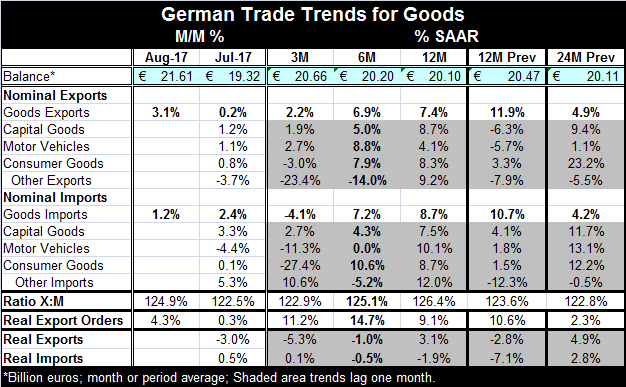

Neither German exports nor imports are surging, but exports have a very strong one-month gain in August after a very mild rise in July. Year-on-year exports have decelerated compared to the pace of growth in the same month of one year ago. In addition, the sequential growth rates for exports over 12 months vs. six months vs. three months reveal a slowing pace. Exports that are up by 7.4% over 12 months are up at only a 2.2% annual rate over three months.

Neither German exports nor imports are surging, but exports have a very strong one-month gain in August after a very mild rise in July. Year-on-year exports have decelerated compared to the pace of growth in the same month of one year ago. In addition, the sequential growth rates for exports over 12 months vs. six months vs. three months reveal a slowing pace. Exports that are up by 7.4% over 12 months are up at only a 2.2% annual rate over three months.

German imports show solid growth, rising by 1.2% in August after a 2.4% gain in July; yet, imports' three-month growth rate is showing contraction and falling at a 4.1% annual rate. Sequential import growth rates are showing imports slowing and receding. Over 12 months imports are up at a very solid 8.7%, compared to having risen by 10.7% over 12 months in August 2016. Imports, like exports, are showing fading momentum.

Export and import details lag by one month. Consumer goods exports and imports are declining over three months, but both flows show a gain over 12 months in excess of an 8% growth pace. Capital goods, on a one-month lagged basis, also are decelerating for exports and imports from 12-month to six-month to three-month. Motor vehicle imports are also showing deceleration on in their sequential growth rates.

The aggregate ratio of exports to imports shows a slight decline compared to its value of one year ago, as imports have outpaced exports. Yet, real export orders rose a very strong 4.3% m/m in August and have sequential growth rates in double digits for nearly all horizons. Yet, real exports on a one-month lag show a net decline over three months and six months, an clear cut deceleration from 12-month to six-month to three-month. Real imports on the same timeline are quite weak but show some small acceleration tendency. Export and import trends bear little relation right now to the strong real export order series. And as note above, real exports have been on imploding trends, showing contraction over three months and six months. They are not following the game plan laid out by real export orders.

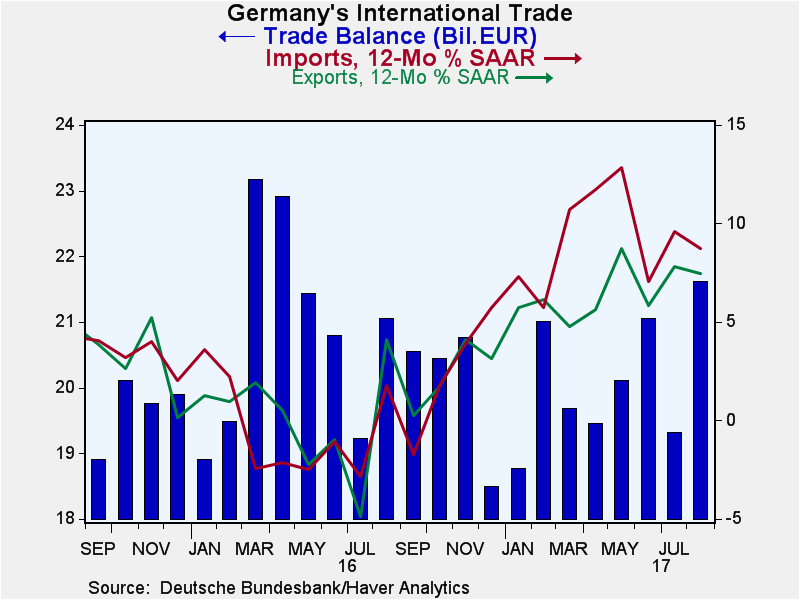

The German trade surplus has been steady at about 20 billion euros over the 12 months ended August 2017, August 2016, and August 2015. For the month of August 2017, the surplus edged up to 21.6 billion euros from 19.3 billion euros in July 2017. German economic activity seems to have picked up in August, but the German trade flows do not show much of it aside from a strong one-month gain in exports. Trends for export and imports are still largely lackluster.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.