Global| Oct 25 2017

Global| Oct 25 2017German IFO Survey Continues with Exceptional Readings

Summary

Back to normal? The German economy is, in some sense, back to normal even as it does excessively well! From mid-2015 through early-2017, the highest diffusion reading has been in wholesaling. But in March 2017, the raw diffusion score [...]

Back to normal?

Back to normal?

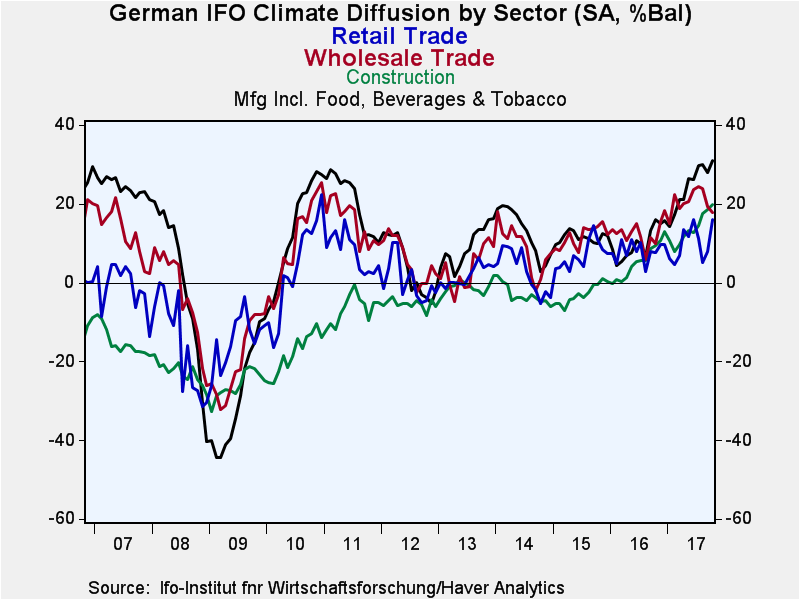

The German economy is, in some sense, back to normal even as it does excessively well! From mid-2015 through early-2017, the highest diffusion reading has been in wholesaling. But in March 2017, the raw diffusion score for manufacturing began to exceed that for wholesaling and the gap has since widened especially over the last two months as the wholesaling index has dropped and the manufacturing index has maintained its level and moved higher. Wholesaling has averaged about nine diffusion points below manufacturing and the normal gap between the two has been restored with manufacturing in the superior position.

Germany: a focus on manufacturing and stability

Germany is a manufacturing and export-oriented economy. While it has an active unionized labor sector, unions and workers are nowhere near as militant as in France where national strikes of various sorts are more common and where farmers when threatened with rollbacks will dump loads of materials on the streets of Paris in protest. In Germany, wages have been more likely to be left lower increasing the power and profitability of the enterprise as German workers have opted for an arrangement that delivers stability. Germans have an almost unnatural fear of boom-bust cycles and the inflation pressures they inevitably bring. It is as though they realize that the welfare of the worker is tied to the health of their firms and workers have decided to cede somewhat to firms on the wage side in return for stable employment, manufacturing stability and the avoidance of inflation.

The Hartz labor reforms conducted about 14 years ago helped to close loopholes in the benefits to put the German labor market on more solid footing. The combination of hardworking West Germany with hardly working East Germany was something else that required attention to make sure that Germany slipped into the path of the West and not of the East.

An export oriented economy

Germany continues to run a very substantial current account surplus and its surplus as a ratio to GDP is extremely large. But now with the euro exchange rate beginning to rise and the dollar at a 3.5-month low, things may be about to change. We may now be looking at the German economy at its peak. Certainly, if the euro exchange rate continues to rise, that will have an impact. And monetary conditions in Europe are now shifting in such a way that even if he wants to stay the course, Mario Draghi is going to find a louder chorus of voices pushing him to begin to retract at least some of the ECB's expansive policies. As this happens, more euro strength is likely and an adverse impact on German exports and manufacturing sector becomes more likely.

This month...

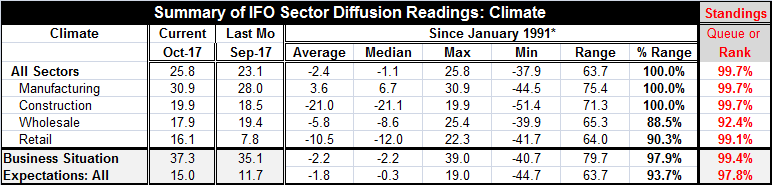

The all sector index diffusion reading rose to 25.8 in October from 23.1 in September, a substantial one-month gain and it now stands at its highest point since January 1991. Similarly, the manufacturing index rose nearly 3 points to stand at 30.9 and reach its highest point since January 1991. The construction sector gained nearly 1.5 points to hit a new high point of its own on that same timeline at a diffusion reading of 19.9. Wholesaling slipped on the month. Still, wholesaling's standing is only 11.5% off its highest level and the diffusion level has been higher less than 8% of the time. On the other hand, retail spurted in the month with diffusion rising to 16.1 from September's 7.8. That gain boosts the retail reading to within 10% of its highest value ever and to a level that has only been higher less than 1% of the time historically. All the sector indexes except wholesaling are in the top 1 percentage point of their respective historic queues and that goes for the all-sector index as well.

Not surprisingly, the business situation index rose by 2.2 points on the month to stand in the top one-percentage point of its historic range of values. Expectations are only slightly less buoyant. Still, they advanced by 3.3 points from September to October and stand in the top 2.2 percentile points of their historic range of values.

Firing strongly on all cylinders...almost

The German economy is doing exceptionally well. The manufacturing sector is strong, retailing has rebounded and consumer confidence is extremely high. Angela Merkel won her reelection bid but still has to put together a coalition government. There is no sign of any anxiety over this although her control over events will be weakened under the new coalition. The various German sectors are doing extremely well; it is unusual to see so many different aspects of the economy performing at top level rates together. One exception here is the services sector. The IFO stopped its separate survey of services years ago so you do not see it represented in the IFO survey. But in the Markit survey we have a diffusion reading on services that shows a weak spot in the German economy as the services sector shows less momentum than the rest of the economy and logs a much lower diffusion rating as well.

Still, the bottom line of the German economy is that performance is quite good. While German inflation is pushing the 2% mark a cause for some anxiety among inflation-hating Germans, the EMU-wide inflation rate that triggers action by the ECB is lower than German inflation. But overall EMU-wide activity is picking up and some shift in ECB policies away from so much laxity is highly likely even absent pressing inflation pressure. That though will have repercussions for the EMU exchange rate and for German competitiveness and export prowess as seen from outside of the euro area.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates