Global| Nov 17 2005

Global| Nov 17 2005Housing Starts Down

by:Tom Moeller

|in:Economy in Brief

Summary

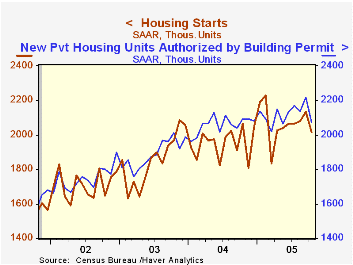

Housing starts in October fell 5.6% m/m to 2.014M units following an upwardly revised gain in September.The drop was to the lowest level since March and compared to Consensus expectations for a lesser decline to 2.06M starts. The 3.7% [...]

Housing starts in October fell 5.6% m/m to 2.014M units following an upwardly revised gain in September.The drop was to the lowest level since March and compared to Consensus expectations for a lesser decline to 2.06M starts.

The 3.7% decline in single-family starts reversed all of an upwardly revised 3.0% increase in September. Single family starts fell hard throughout the country. A 6.7% decline (-7.1% y/y) in the West was accompanied by a 7.2% drop (-6.6% y/y) in the Midwest. In the Northeast, single family starts were notably weak and fell 8.5% (+3.2% y/y) to the lowest level since April. Only an unchanged reading (11.6% y/y) in the South tempered the declines..

Multi family starts cratered 14.8% m/m after a downwardly revised 0.6% increase in September.

Building permits fell a hard 6.7% m/m to the lowest level since April as single family permits fell 4.9% (+4.9% y/y).

China: An Evolving Housing Market from the Federal Reserve Bank of San Francisco is available here.

| Housing Starts (000s, AR) | Oct | Sept | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Total | 2,014 | 2,134 | -2.3% | 1,950 | 1,854 | 1,7 10 |

| Single-family | 1,704 | 1,770 | 2.3% | 1,604 | 1,505 | 1,363 |

| Multi-family | 310 | 364 | -21.7% | 345 | 349 | 347 |

| Building Permits | 2,071 | 2,219 | -1.1% | 2,058 | 1,8 88 | 1,749 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates