Global| Dec 17 2020

Global| Dec 17 2020INSEE Survey Shows Gain in Mfg and Sharp Improvement in Services; A Second Rebound... and Still a Massive [...]

Summary

Sectors beat up: black and blue French manufacturing and services sectors are stronger month-to-month in the December INSEE surveys. Still, both are well short of where they were before the Covid-19 virus struck. Compared to February, [...]

Sectors beat up: black and blue

Sectors beat up: black and blue

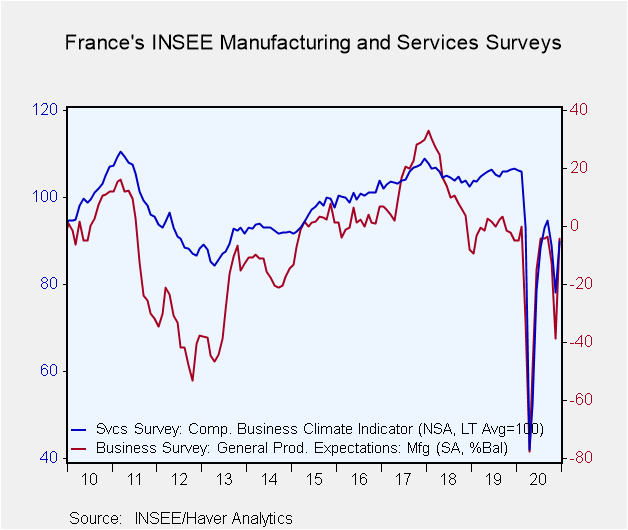

French manufacturing and services sectors are stronger month-to-month in the December INSEE surveys. Still, both are well short of where they were before the Covid-19 virus struck. Compared to February, the manufacturing climate gauge is lower by 7.8 points and on that same timeline the services climate gauge is weaker by 16.2 points. On a long timeline back to 2001, industrial climate has an 18.3 percentile queue ranking while the services sector has a ranking in its 13.3 percentile- both are extremely weak readings. Since February services have been harder, but over the broad longer period to 2001 these two sectors are roughly equally debilitated. To add a further but unrelated complication, today French President Emmanuel Macron has tested positive for Covid-19. He will self-isolate but will remain in charge.

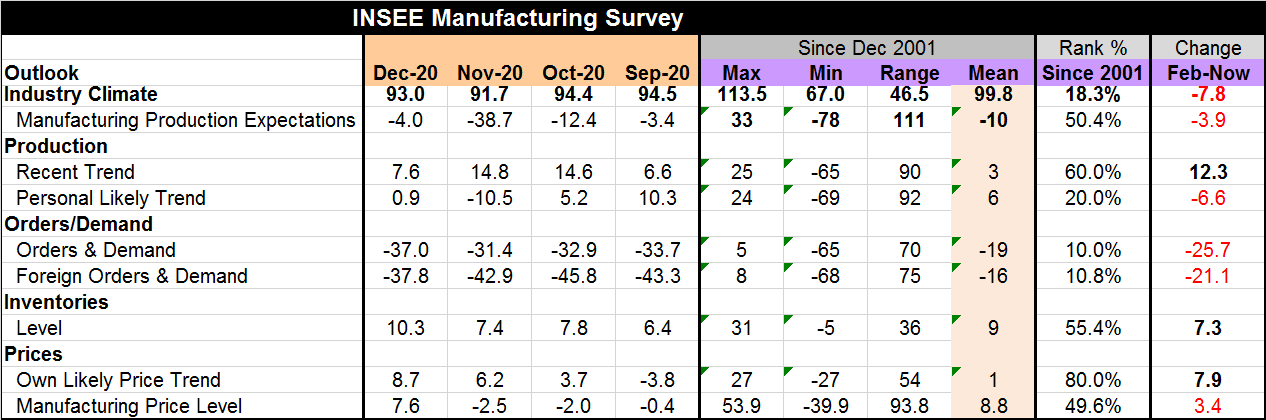

Manufacturing

The French survey may be somewhat confusing, but the graphic may help to clarify events. France was struck by the virus early in the year it then recovered and has since been struck hard by a second wave that caused a second nationwide isolation order. France is just coming out of that second period of restriction. That explains why production expectations (for example) plunged from -12.4 in October to -38.7 in November and are now up to -4.0 and yet still lower by 3.9 points compared to February. These shutdown/reopening moves work their way through the various survey components with different speeds. The recent trend was ‘unaffected in November’ but is now weaker in December while the personal (or ‘own industry’) trend fell sharply in November and has recovered briskly in December. The recent trend reading is still superior to its reading in February, but the personal trend is weaker. Orders and foreign orders oscillate during this period, but both are severely weaker than they were in February. Inventories also are higher than their levels in February. Prices have gradually, irregularly, been on the rise and readings are higher in December than they were in February with own likely price trends especially higher than the overall manufacturing trend…is that wishful thinking?

Services-overview

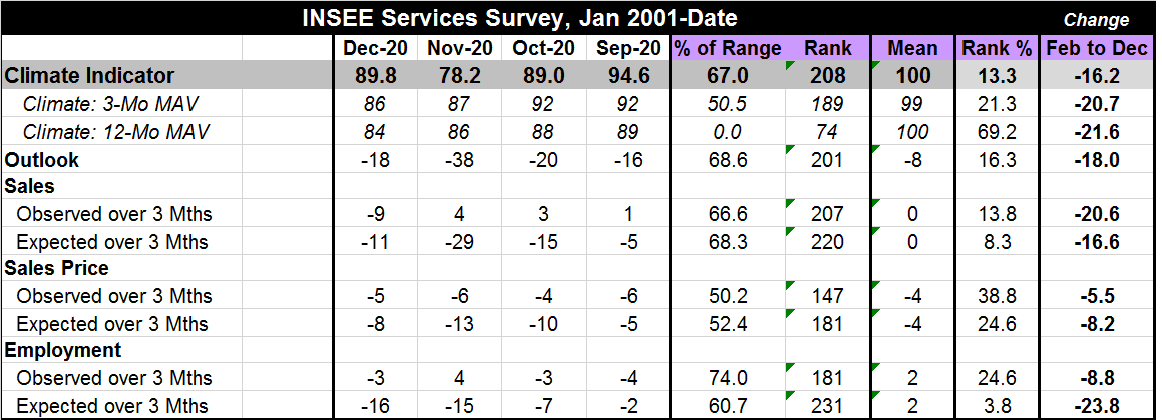

All services components are lower on balance compared to their February levels. The climate indictor ranks in its queue’s 13rd percentile and the strongest component rank is the 69th percentile ranking of the backward-looking 12-month moving average. But we know that is not really good news since the three-month average ranks at its 21st percentile. Services have been decimated by the virus which is largely communicated from one person to another and that reality has stacked the deck against the personal contact-intensive service sector. Restaurants, cinemas, and the hospitality industries have been very hard hit.

The services survey

The outlook that fell from -20 in October to -38 in November and has recovered to -18 in December is still lower by 18 points compared to February and has a historic queue standing in its 16th percentile and that is after improving by 20 points month-to-month. For sales the observed trend (of course) lags the recent shutdown while the expected sales metric is improving apace but (naturally) is weaker than it was in February. The employment response to the survey is one of the most dismal. The observed trend shows the lagging behavior observed-trend responses normally exhibit. By the expected-trend does not show the rebound and life that normally accompanies that metric. Expected sales fell in November and soared in December, but expected employment was set back in November and has weakened further in December...instead of improving. That is quite out of character. Vaccines are coming on stream. France is making some progress as it comes out from under its latest batch of restrictions, but labor market expectations are not responsive in the services sector and that is a bad sign.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates