Global| Feb 03 2003

Global| Feb 03 2003ISM Index Down

by:Tom Moeller

|in:Economy in Brief

Summary

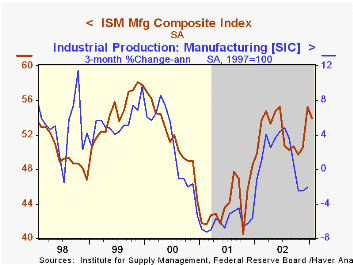

The ISM Composite Index of manufacturing sector activity fell modestly last month from an upwardly revised December level. It was the third consecutive month the index was above 50, thus indicating expansion in factory sector [...]

The ISM Composite Index of manufacturing sector activity fell modestly last month from an upwardly revised December level. It was the third consecutive month the index was above 50, thus indicating expansion in factory sector activity.

The level of the index was about as expected. Updated seasonal factors were the source of revision to past data.

Each of the five component series declined moderately.

The separate index of inflation pressure rose slightly but remained well off the Spring highs.

Over the last ten years there has been a 72% correlation between the ISM Composite Index and the three month growth in factory production.

| ISM Manufacturing Survey | Jan | Dec | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Composite Index | 53.9 | 55.2 | 49.8 | 52.4 | 44.0 | 51.7 |

| Prices Paid Index | 57.5 | 56.9 | 41.5 | 57.9 | 42.9 | 64.8 |

by Tom Moeller February 3, 2003

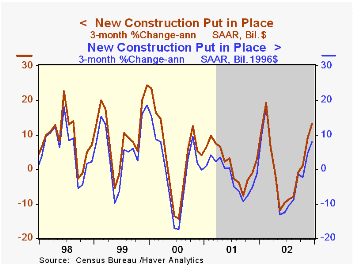

The value of construction put in place rose much more than expected in December and November figures were revised up across the board. Consensus expectations were for a very slight rise.

In constant 1996 dollars, overall construction spending rose 0.7% (-0.2% y/y). Real residential spending surged 2.2% (7.2% y/y). Real nonresidential activity fell 2.3% (-15.2% y/y).

In nominal terms, residential building rose for the fifth month in six. Spending on one-unit structures surged 2.8% (12.2% y/y).

Nonresidential building activity fell hard again, last month led lower by widespread category declines except industrial. Spending on industrial buildings rose for the third consecutive month (-34.8% y/y).

Public construction rose led by notable increases in housing & redevelopment, industrial and highways & streets.

| Construction Put-in-place | Dec | Nov | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Total | 1.2% | 0.9% | 2.0% | 0.7% | 2.5% | 7.3% |

| Residential | 2.9% | 1.1% | 10.0% | 6.9% | 3.3% | 7.4% |

| Nonresidential | -1.9% | 0.9% | -14.0% | -16.3% | -3.1% | 7.1% |

| Public | 1.0% | 2.6% | 4.7% | 6.4% | 7.4% | 5.4% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates