Global| Dec 01 2005

Global| Dec 01 2005ISM Index Fell As Expected and Still Firm

by:Tom Moeller

|in:Economy in Brief

Summary

The Institute of Supply Management (ISM) reported that the November Composite Index of activity in the manufacturing sector fell one point to 58.1. The decline about matched Consensus expectations and the average of the last three [...]

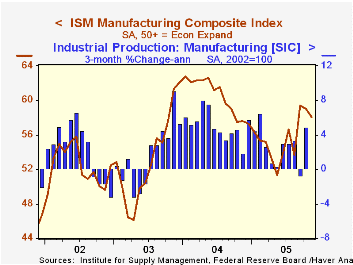

The Institute of Supply Management (ISM) reported that the November Composite Index of activity in the manufacturing sector fell one point to 58.1. The decline about matched Consensus expectations and the average of the last three months, at 58.9, was the highest in over a year.

During the last twenty years there has been a 64% correlation between the level of the Composite Index and the three month growth in factory sector industrial production.

As during October, three of the index's five components fell last month. New orders fell another 1.9 points but remained well up from the May low. The moderate decline in production also left the level up from the Spring low and the pace of supplier deliveries quickened to the fastest pace since August .

Job creation in the factory sector improved to the best level since February with a 1.6 point gain. During the last twenty years there has been a 67% correlation between the level of the ISM Employment Index and the three month growth in factory sector employment.

Pricing power in the factory sector eased to the lowest level since August with a ten point m/m decline.

| ISM Manufacturing Survey | Nov | Oct | Nov '04 | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Composite Index | 58.1 | 59.1 | 57.6 | 60.5 | 53.3 | 52.4 |

| New Orders Index | 59.8 | 61.7 | 60.7 | 63.5 | 57.9 | 56.5 |

| Prices Paid Index (NSA) | 74.0 | 84.0 | 74.0 | 79.8 | 59.6 | 57.6 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates