Global| May 18 2020

Global| May 18 2020Japan's GDP Comes Up Short Again; Recession Time: No Measurable Growth in Three Quarters Running

Summary

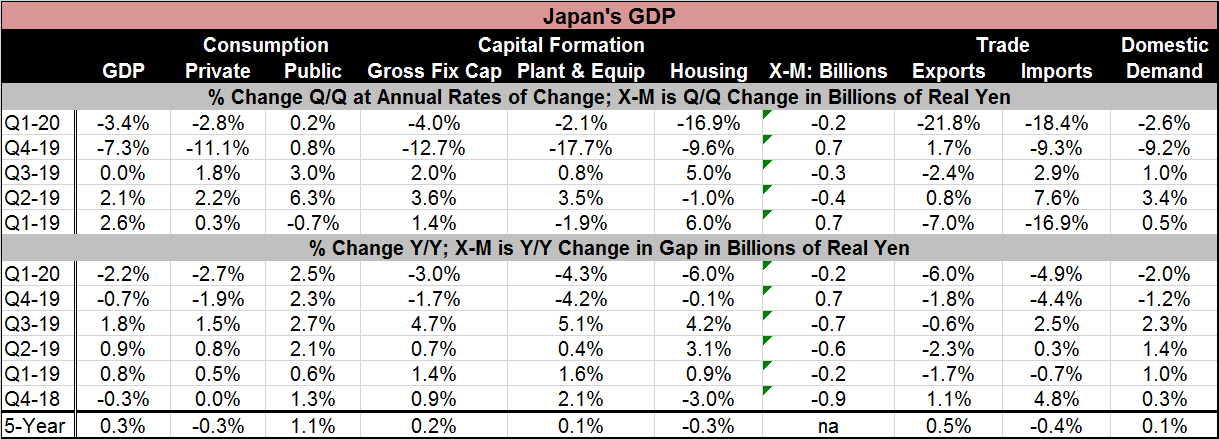

Japan has not seen a measureable percentage increase in real GDP since Q2 2019. Real GDP fell by 3.4% annualized in Q1 2020. It fell by 7.3% in Q4 2019 and it was flat in percentage terms in Q3 2019. On those numbers, Japan is in [...]

Japan has not seen a measureable percentage increase in real GDP since Q2 2019. Real GDP fell by 3.4% annualized in Q1 2020. It fell by 7.3% in Q4 2019 and it was flat in percentage terms in Q3 2019. On those numbers, Japan is in recession in anyone's book. And it continues to struggle.

Japan has not seen a measureable percentage increase in real GDP since Q2 2019. Real GDP fell by 3.4% annualized in Q1 2020. It fell by 7.3% in Q4 2019 and it was flat in percentage terms in Q3 2019. On those numbers, Japan is in recession in anyone's book. And it continues to struggle.

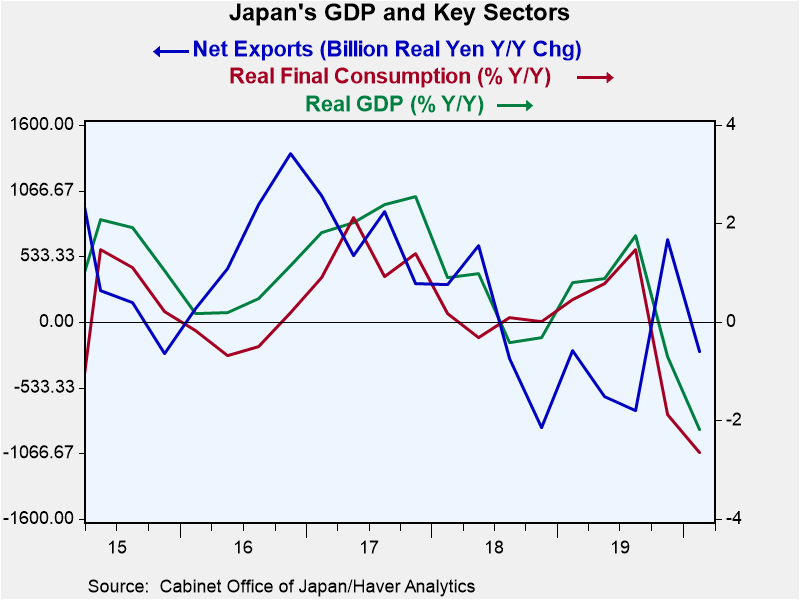

The graph shows that Japan's GDP really is dictated, as in most modern economies, by consumption trends. Japan's international sector is also important, but it is not the overall driver of growth. Still, with a shrinking domestic population and a high mountain of debt, Japan needs all the help it can get to drive growth. Real exports were at a -21.8% pace in Q1, a definite negative for this economy.

Japan trades most intensively with China and secondly with the U.S. Just to make matters a bit worse, Japan was earlier caught in the crossfire of tensions when the U.S. and China began their trade war, putting Japan's economy on more precarious footing just as the impact of the virus was about to bite. Both the U.S. and China economies are struggling. The U.S. is in the grip of a new recession and China is trying to spur growth. These difficulties weigh on Japan's growth through the export channel. However, the arithmetic effect on GDP has not been as hard as weak exports suggest since imports also fell at an elevated -18.4% pace dropping sharply for the second quarter in a row. Year-over-year Japan's exports are down by -6% compared to -4.9% for imports. Falling imports lessen the subtraction from GDP and tend to buffer the negative impact from exports on domestic growth. Still, falling exports weaken domestic output trends and falling imports indicate declining domestic demand so the combination is no picnic.

Japan's private consumption has fallen for two months running. But over the last four quarters, they have been some step up in public consumption. Quarterly figures show that public consumption has since tailed off, but year-on-year public consumption is up by 2.5% or more for three quarters running supported by a quarterly annualized gain in such spending of 6.3% in Q2 2019.

Japan's domestic demand is falling quarter-to-quarter for two quarters in a row. The drops have been substantial enough to drive Japan's year-on-year domestic demand negative for two quarters running as well.

Capital spending has been drying up in this environment. With weaker growth corporate spending has pulled back as firms have no need for expansion and have turned to protecting cash reserves in difficult times. Spending on plant and equipment in Japan fell at an annualized pace of -2.1% in Q1 2020 after plunging at an annualized rate of -17.7% in Q4 2019.

Japan is also fighting off the effects of the coronavirus having seen large parts of its economy shut down. There is now a trend to remove restrictions beginning to take effect through much of Japan's economy as the worst of the epidemic is believed to have passed. Tokyo is still under restrictions.

The trade war, the virus, the slowing in international trade all came at a bad time for Japan that had already applied a higher consumption tax and was determined to try to do something about its large stock of public debt. But the various blows to the economy have undermined those efforts. Japan's structural weakness stemming from a shrinking population and its practice of not using women in the workforce very prominently has held the economy back. Japan continues to struggle and it is not yet out of the woods. The global environment remains challenging.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates