Global| May 26 2006

Global| May 26 2006Japan's Net Investment Position Eased in 2005 as the Value of Foreign Investment Surged

Summary

The Bank of Japan today reported on Japan's international investment position for year-end 2005. Total assets abroad stood at ¥506.2 trillion, up 16.7% from the end of 2004. All of the major asset categories climbed by significant [...]

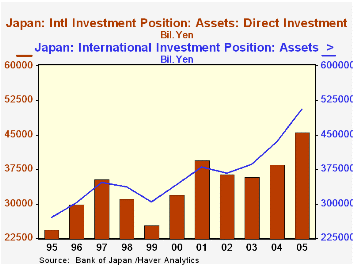

The Bank of Japan today reported on Japan's international investment position for year-end 2005. Total assets abroad stood at ¥506.2 trillion, up 16.7% from the end of 2004. All of the major asset categories climbed by significant amounts, such as direct investment abroad, which was up 18.2%, and holdings of equity securities, which rose 26.9%.

We find it interesting that both of the equity components, direct investment and equity securities holdings, constitute only moderate amounts of total assets abroad. Equities were 5.6% of total international assets at the end of 1995; while they have increased, they still constitute just 9.5% of Japanese investors' holdings abroad. Direct investment has ranged between 8.4% and 10.4% of total assets over the 11-year history of these data; at the end of 2005, this item was 9% of the total. It was also right at 9% of Japanese GDP for the year. In contrast, US direct ownership interests abroad constituted 26.2% of total US assets abroad and 20.2% of US GDP in 2004 (latest available).

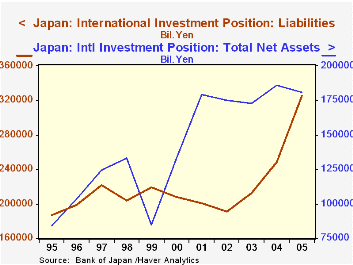

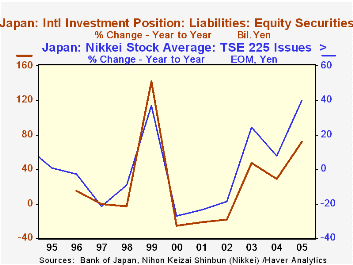

Foreign investors have interests in Japan, of course, and at the end of 2005, these totaled ¥325.9 trillion, up a sizable 31.2% from year-end 2004. The gain was concentrated in equity securities, which increased 71.6%, helped by the 40.2% surge in Japanese stock prices (measured by the Nikkei 225). Foreign direct investment in Japan rose 17.9%, but it is a much smaller amount, only ¥11.9 billion.

With the big gain in the value of liabilities to foreigners, Japan's net investment position actually decreased in 2005, falling 2.7% to ¥180.7 billion. Sometimes such a movement is seen as unhealthy for a country. But on this occasion, it seems more to reflect the emerging improvement in Japan that makes it more attractive for investment.

In releasing these data today, the Bank of Japan added industry and country detail. Haver Analytics will be adding these data to the JAPAN database soon. They will greatly enhance the understanding Japan's capital flows and values in world markets.

| Japan: End of Year, Bil.¥ | 2005 | 2004 | 2003 | 2000 | 1995 |

|---|---|---|---|---|---|

| Assets Abroad | 506,191 | 433,864 | 385,538 | 341,206 | 270,738 |

| Direct Investment | 45,605 | 38,581 | 35,932 | 31,993 | 24,520 |

| Portfolio Investment | 249,493 | 209,247 | 184,353 | 150,115 | 88,257 |

| Equity | 48,200 | 37,972 | 29,394 | 30,133 | 15,040 |

| Debt Securities | 201,294 | 171,275 | 154,959 | 119,982 | 73,217 |

| Domestic Liabilities | 325,942 | 248,067 | 212,720 | 208,159 | 186,666 |

| Direct Investment | 11,903 | 10,098 | 9,610 | 5,782 | 3,448 |

| Portfolio Investment | 181,959 | 120,091 | 92,873 | 101,609 | 56,379 |

| Loans | 98,105 | 90,776 | 83,665 | 76,212 | 97,759 |

| Net Assets | 180,699 | 185,797 | 172,818 | 133,047 | 84,072 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates