Global| Jul 18 2019

Global| Jul 18 2019Japan's Trade Deficit Narrows; The Impact of a Trade War Lurks

Summary

Japan sits in a position where it risks being collateral damage in a U.S.-China trade war. It could also be a beneficiary, but that seems less likely. As the trade war ‘disrupts' supply chains that run through China, a number of firms [...]

Japan sits in a position where it risks being collateral damage in a U.S.-China trade war. It could also be a beneficiary, but that seems less likely. As the trade war ‘disrupts' supply chains that run through China, a number of firms are looking to relocate the China portion. Since these are most likely to be high volume and low wage operations, Japan is not likely to be the recipient of the relocation. More likely, Japan that has China as its largest trading partner (and the U.S. as its second largest trading partner) will find that slower growth in China as a result of the trade war will cool conditions for Japanese firms operating in China or exporting to it from Japan with likely blow-back effects of a negative sort to slow Japan's domestic economy. That's the collateral damage.

Japan sits in a position where it risks being collateral damage in a U.S.-China trade war. It could also be a beneficiary, but that seems less likely. As the trade war ‘disrupts' supply chains that run through China, a number of firms are looking to relocate the China portion. Since these are most likely to be high volume and low wage operations, Japan is not likely to be the recipient of the relocation. More likely, Japan that has China as its largest trading partner (and the U.S. as its second largest trading partner) will find that slower growth in China as a result of the trade war will cool conditions for Japanese firms operating in China or exporting to it from Japan with likely blow-back effects of a negative sort to slow Japan's domestic economy. That's the collateral damage.

Japan's trade data

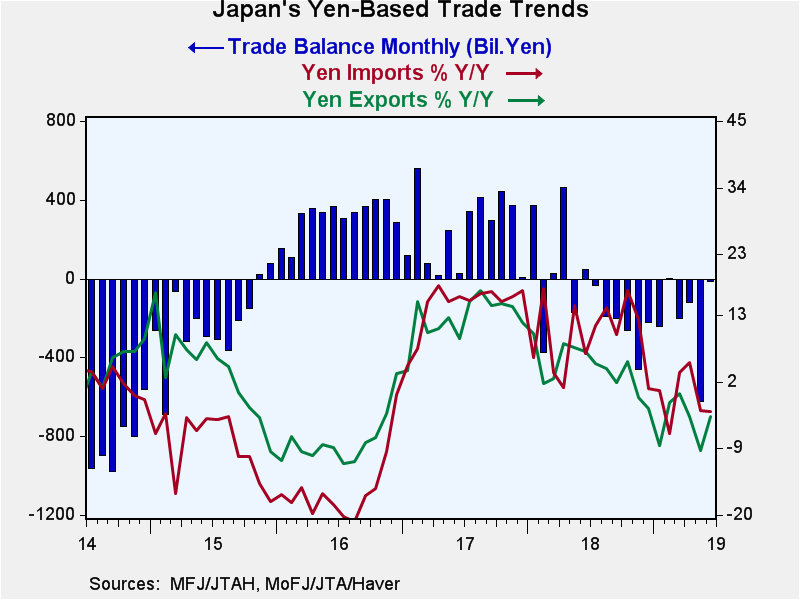

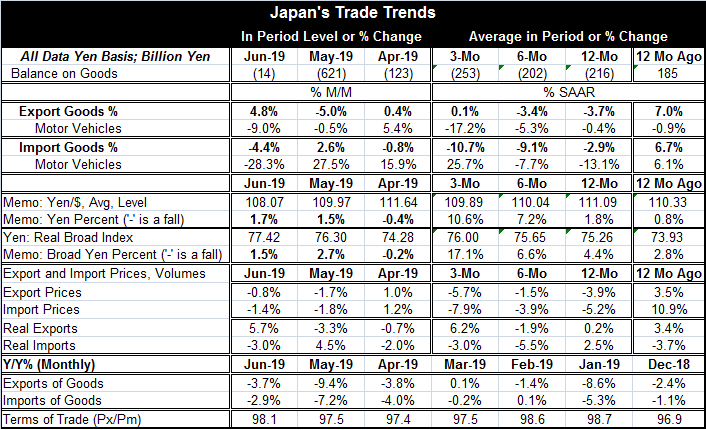

Japan's trade deficit shrunk in June. With the exception of May, it has been shrinking for several months on trend. May was a reversal and it also disrupts what otherwise would have been a decline in the moving average of the deficits.

With June trade data in hand, we can now see what made May the outlier: everything. In May Japan's exports fell by 5% whereas they rose by 0.4% in April and now rising by 4.8% in June. Japan's imports rose 2.6% in May after a 0.8% decline in April and now falling by 4.4% in June.

The data are still too close to the May numbers to really know which is the reality (or new reality) and which is the distortion (or if this is simply monthly volatility at work…another possibility). Contemporaneous data analysis can be tricky business. On trend (year-over-year), both export and import growth patterns show slowing. That should make the month of May the anomaly- except for exports which were quite weak in May.

Sequential growth rates bear out the notion that export growth is weak and that import growth is slowing and actually contracting. Japan's domestic indicators do not (yet) seem to be so weak as to imply growth contraction or weak enough domestic demand that imports should be contracting. Some of this is the illusion of price. Real imports are up by 2.5% over 12 months while real exports are up by a skinny 0.2%. Over shorter horizons, real exports show more spunk and imports post declines in real terms. Stronger export performance over a more recent period is not what we expect to see from Japan under these global conditions.

What happens when the proof of the pudding is not in the eating?

There is a lot of complaining about the trade war and tariffs yet there is little actual evidence of it in data. China is slowing and using the palliative of debt to try to prop up its growth rates. The yuan has weakened, taking some of the sting out of the U.S.-imposed tariffs. In U.S., data neither CPI nor PPI topical inflation measures show much if any tariff impact on pricing. More to the point, U.S. export and import prices show little or no impact as those prices continue to demonstrate very low trajectories.

Policy by anecdote: did you hear the one about...

In the very topical U.S. Federal Reserve Beige Book (released yesterday) which carries up-to-date commentary from firms that precede any data releases, we hear kvetching about tariffs and reports of how higher tariff prices are being passed through the system. There are anecdotal reports in papers about certain industries that are being hit. There are also reports of firms moving supply chains to avoid the tariffs. On balance, there is a lot of word of mouth about tariff disruption and very little evidence. The skew of information is so tilted to anecdotal that you could not take such a case to court; any responsible judge would throw it out on its own merits- not enough real evidence.

But we shall see. Many things are still in motion.

Tariff impacts or not?

Firms may have some incentive to eat price increases if they think the tariffs will be short-lived. But China has been willing to play the political game. And Trump-Xi (U.S.-China) have a relationship that would make the old TV series the ‘Odd Couple' seem perfectly normal. If China decides that Trump is in political trouble, it might try to stretch things out to see if a Democrat gets elected to close the trade deal with someone other than Trump. If that is the case, these tariffs and their disruption will have some staying power. In the U.S., right now the main impact of tariffs is on farmers. Economists have offered calculations to show how small the overall impact on prices and activity might prove to be. And if firms really are moving supply chains, the impact might be smaller still. But supply chain moving is an example of why bilateral negotiations are ultimately less effective than multilateral deals. If the U.S.-China cut a deal, there are always other low-wage Asia countries to take up the slack for those firms that may not like the new China under a new deal.

Bilateral/multilateral

Perhaps people forget that when the U.S. pushed the yen up so sharply from roughly 200 to the dollar to a low of about 85 to the dollar, U.S. trade deficits did not really get smaller. Earlier in response to ‘orderly marketing agreements' Japanese automakers had set up some shop in the U.S. When the yen moved sharply higher, the remaining Japanese firms did not give up producing or go out of business; they moved some operations to other much lower wage Asian economies. Sony began to produce electronics in the Philippines. Toyota moved plants abroad at least one to Thailand, that I have visited. And Japan's trade links with China intensified. We have a global economy. Bilateral deals will not define it. They may be necessary in the case of a state like China that would be so difficult to encompass in a multilateral deal. But as I argue above, a bilateral deal with China may not turn out to be all it is cracked up to be.

The crossfire

In the meantime, Japan and others get caught up in the crossfire. Singapore's exports fall. Growth of manufacturing output around the world goes on pause as everyone waits to see what the fallout will be. And the U.S. still has trade negotiations with the EU and Japan to consummate. There are unrelated risks from Brexit too. Today's data from Japan are just another piece in a puzzle that does not seem to want to fit together. Eventually the pieces will fall into place. But for now, there is a lot of confusion, a lot of rhetoric, a smoking gun, and yet no one seems to have been shot.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates