Global| Nov 21 2007

Global| Nov 21 2007Japanese Trade Surplus Widens in October with Strong Exports to China and Europe

Summary

Japan's trade balance widened in October, slightly from September and more noticeably from a year ago. The October surplus was ¥1,073 billion, up from ¥1,051 billion in September and ¥933 in October 2006, all calculated from the [...]

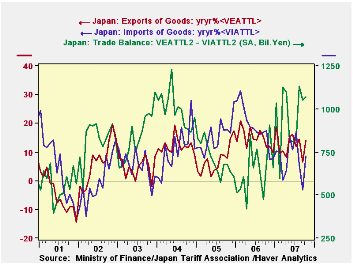

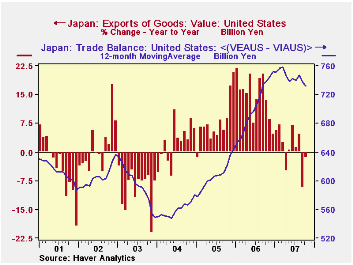

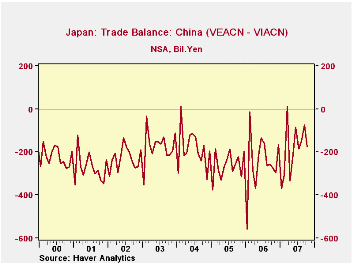

Japan's trade balance widened in October, slightly from September and more noticeably from a year ago. The October surplus was ¥1,073 billion, up from ¥1,051 billion in September and ¥933 in October 2006, all calculated from the Ministry of Finance's seasonally adjusted data. Before seasonal adjustment, the surplus was ¥1,013 billion compared with just ¥613 billion the year earlier.Exports strengthened anew, following some moderation in September; they increased ¥124 billion from September to ¥7,179 billion after falling ¥192 billion then from August. They were up 13.9% from a year ago. Chemicals, manufactured goods, non-electrical machinery and "other" all grew more than the total, while the largest contribution came from motor vehicles. They were up 21.3% year/year or ¥235 billion. Imports rose ¥103 billion in October to ¥6,106 billion, seasonally adjusted, yielding a third consecutive yearly increase less than 10%, this one 8.6% or ¥513 billion. More than half of this increase was "mineral fuels", ¥278 billion. Thus, ironically this month, the rise in oil imports was almost completely covered by an increase in exports of motor vehicles.The trade pattern among various countries has been interesting. The trade surplus with the US is diminishing due to smaller exports. From yearly growth averaging ¥177 billion per month in 2006, the 12 months through October saw just a ¥26 billion average increase with September down from a year ago by ¥146 billion and October down ¥23 billion.This has reduced the surplus from ¥783 billion in October 2006 to ¥717 billion this October. In contrast, the deficit with China is decreasing as Japanese exports there are up 19.3% from a year ago, while imports have increased only 7.2%. There was a similar move in October with the EU, although the trend there is for a growing surplus. October exports to Europe surged 24% while imports rose only 9.8%. This yielded a nice increase in the surplus to ¥476 billion from ¥315 billion in October 2006.

| JAPAN, Bil.¥ | Oct 2007 | Sept 2007 | Aug 2007 | Year Ago | Monthly Averages | ||

|---|---|---|---|---|---|---|---|

| 2006 | 2005 | 2004 | |||||

| Trade Balance | 1,073 | 1,051 | 1,133 | 933 | 658 | 726 | 996 |

| Exports, SA* | 7,179 | 7,054 | 7,247 | 6,448 | 6,271 | 5,471 | 5,097 |

| Yr/Yr %Chg | 13.9% | 6.5% | 14.5% | -- | 14.6% | 7.3% | 12.1% |

| Imports, SA* | 6,106 | 6,003 | 6,114 | 5,756 | 5,612 | 4,746 | 4,101 |

| Yr/Yr %Chg | 8.6% | -3.2% | 5.8% | -- | 18.3% | 15.7% | 10.9% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.