Global| Aug 12 2008

Global| Aug 12 2008JOLTS: Job Openings Stable in June, Hires Up

by:Tom Moeller

|in:Economy in Brief

Summary

For June, the Bureau of Labor Statistics reported in the Job Openings & Labor Turnover Survey (JOLTS) reported that the number of job openings ticked down 0.1% (-15.0% y/y) from May. The dip followed a 0.5% gain during May. Since [...]

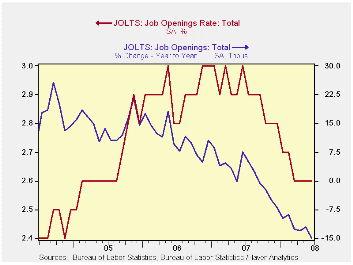

For June, the Bureau of Labor Statistics reported in the Job Openings & Labor Turnover Survey (JOLTS) reported that the number of job openings ticked down 0.1% (-15.0% y/y) from May. The dip followed a 0.5% gain during May. Since their peak in January of 2007, the number of job openings have fallen 14%.

The job openings rate was unchanged during June at 2.6%. The latest figures are down from near 3% one year ago. The job openings rate is the number of job openings on the last business day of the month as a percent of total employment plus job openings.

The actual number of job openings in the manufacturing sector rose 0.4% (-25.6% y/y) in June from an upwardly revised May figure. Professional & business services job openings recovered declines during the prior two months with a 9.9% (-0.6% y/y) increase. Job openings in the education & health sectors rose by 6.3% (-2.8% y/y) after three consecutive months of decline but job openings in retail trade reversed the May increase with a 10.5% (-21.5% y/y) drop.

By region, openings in the West were off by one quarter from the year ago level. In the South they fell 11.2% y/y and in the Midwest openings fell a like 11.9%. In the Northeast job openings also fell 8.5% y/y

The hires rate ticked up to 3.1% but remained near the low for this cycle.The hires rate is the number of hires during the month divided by employment.The latest figure was near the lowest since 2003. The actual number of hires rose 5.1% (-10.5% y/y). Hires in the trade & transportation sectors rose sharply m/m but remained down 4.6% from one year earlier.

The job separations rate held stable m/m at 3.1%, down from 3.7% at the peak. Separations include quits, layoffs, discharges, and other separations as well as retirements. The level of job separations fell 3.5% y/y.

The JOLTS survey dates only to December 2000 but has since followed the movement in nonfarm payrolls, though the actual correlation between the two series is low.

A description of the Jolts survey and the latest release from the U.S. Department of Labor is available here.

| JOLTS (Job Openings & Labor Turnover Survey) | June | May | June '07 | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|

| Job Openings, Total | ||||||

| Rate (%) | 2.6 | 2.6 | 3.0 | 2.8 | 3.0 | 2.8 |

| Total (000s) | 3,627 | 3,631 | 4,267 | 3,974 | 4,272 | 3,863 |

| Hires, Total | ||||||

| Rate (%) | 3.1 | 3.0 | 3.5 | 41.9 | 43.4 | 43.1 |

| Total (000s) | 4,333 | 4,123 | 4,843 | 57,771 | 59,153 | 57,501 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates