Global| Nov 15 2007

Global| Nov 15 2007Kazakhstan's Oil and Metals Exports Bring Revenue for Investment Spending

Summary

The Kazakhstani economy is growing rapidly, benefiting from strong oil revenues. New data on trade through September indicate a sizable surplus, owing much to oil and gas exports. Further, separate data on fixed capital investment [...]

The Kazakhstani economy is growing rapidly, benefiting from strong oil revenues. New data on trade through September indicate a sizable surplus, owing much to oil and gas exports. Further, separate data on fixed capital investment show continuing strong growth in infrastructure spending and other capital projects.

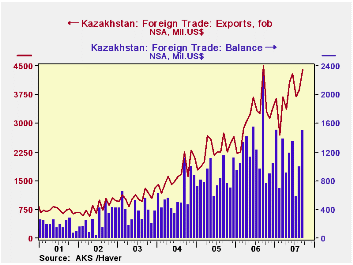

The summary trade balance was reported about 10 days ago, with a surplus in September of $1.6 billion, up from $1.1 billion in August, but smaller than the $2.4 billion a year ago. The factor in the smaller surplus this year than last is a reduction in the value of oil exports from $3.1 billion in September 2006 to $2.6 billion this September, according to the detail data published today. Even so, other exports gained noticeably, and total exports were only very little different, $4.41 billion this September compared with $4.50 billion last year.

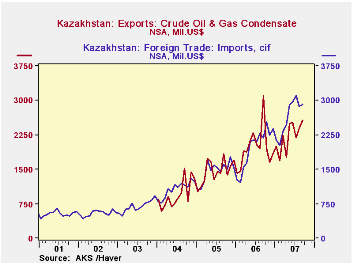

The slack was taken up by sizable gains in various metals and metal products. What the Kazakhs refer to as ferro-alloys and flat ferrous metals, along with lead and precious metals, all contributed. Rising world prices for steel scrap and lead, among others, are no doubt responsible. And while oil exports were down in the latest month, they remain generally quite large, bringing sizable quantities of dollars into the country. Note in the table below and the second graph, the uncanny match between the value of oil exports and total imports: oil revenue is very nearly covering Kazakhstan's demand for outside products.

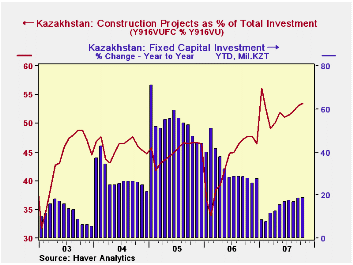

This favorable natural resource trade situation is fueling (if you will) a prolonged building boom. Monthly data on "fixed capital investment" show sustained growth, running through October at 19% year-on-year. This is "slower" than in 2004-2006, but it remains vigorous. Of KZT245 million per month so far this year, about 30% has been in the oil and gas industry, a quarter in "real estate, renting and business activity" and about an eighth in transportation and communication infrastructure. By type of investment, just over half is in construction projects and just under a third is in machinery and tools.

Data on Kazakhstan are contained in Haver's EMERGECW database.

| Kazakhstan | Oct 2007 | Sept 2007 | Aug 2007 | Year Ago | Monthly Averages | ||

|---|---|---|---|---|---|---|---|

| 2006 | 2005 | 2004 | |||||

| Trade Balance, Mil.$ | -- | 1,597 | 1,096 | 2,361 | 1,214 | 852 | 609 |

| Exports | -- | 4,412 | 3,864 | 4,495 | 3,188 | 2,311 | 1,674 |

| Oil & Gas | -- | 2,563 | 2,401 | 3,094 | 1,968 | 1,450 | 951 |

| Other | -- | 1,849 | 1,463 | 1,401 | 1,220 | 861 | 723 |

| Imports | -- | 2,815 | 2,769 | 2,134 | 1,973 | 1,460 | 1,065 |

| Fixed Investment, Mo Avg YTD, Mil.KZT |

245.3 | 237.3 | 223.0 | 206.8 | 234.2 | 183.7 | 127.6 |

| % Change | 18.8% | 18.5% | 16.9% | 27.9% | 27.4% | 44.1% | 21.6% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.