Global| May 18 2006

Global| May 18 2006Leading Economic Indicators Dip, March Revised Up

by:Tom Moeller

|in:Economy in Brief

Summary

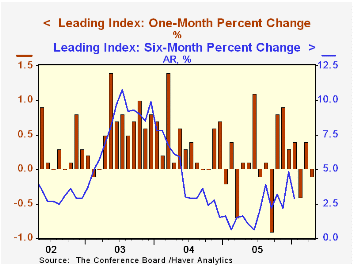

For April, the Conference Board's Composite Index of Leading Economic Indicators dipped 0.1% following a 0.4% March rise, initially reported as a 0.1% decline. Consensus expectations had been for a 0.1% April up tick. Six month growth [...]

For April, the Conference Board's Composite Index of Leading Economic Indicators dipped 0.1% following a 0.4% March rise, initially reported as a 0.1% decline. Consensus expectations had been for a 0.1% April up tick.

Six month growth in the leaders fell to 2.9% from an upwardly revised 4.8% the prior month. During the last ten years there has been a 43% correlation between the six-month change in the leading indicators and quarterly growth in real GDP.

The breadth of one month gain amongst the 10 components of the leading index halved to 35% in April. Over a six month span 80% of the index components have risen. A large positive contribution from vendor performance was offset by lower building permits, lower consumer sentiment and a lower real money supply.Most of the remaining index components had little m/m impact on the change in the leaders.

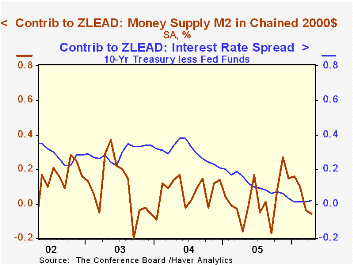

The spread between yields on the 10 year Treasury Note and Fed funds made a minimal 0.02 percentage point positive contribution to the leaders. The method of calculating the contribution to the index from the interest rate yield spread has been revised. A negative contribution will now occur only when the spread inverts rather than when declining as in the past. More details can be found here.

The leading index is based on eight previously reported economic data series. Two series, orders for consumer goods and orders for capital goods, are estimated.

The coincident indicators rose 0.2% for the third consecutive month. All of the four component series rose last month and during the last six months. During the last ten years there has been a 64% correlation between the change in the coincident indicators and real GDP growth.

The lagging indicators increased 0.3% following a revised 0.1% March increase. Last month, 78.6% of the series' components rose while the ratio of coincident to lagging indicators, a measure of actual economic performance versus excess, fell slightly.

Visit the Conference Board's site for coverage of leading indicator series from around the world.

Today's speech titled Basel II: Its Promise and Its Challenges by Federal reserve Board Chairman Ben S. Bernanke is available here

| Business Cycle Indicators | April | Mar | 6 Month Chg., AR | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|

| Leading | -0.1% | 0.4% | 2.9% | 2.3% | 7.4% | 5.0% |

| Coincident | 0.2% | 0.2% | 3.5% | 2.2% | 2.5% | 0.4% |

| Lagging | 0.3% | 0.1% | 1.6% | 3.5% | 0.0% | -0.0% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates