Global| Jul 10 2009

Global| Jul 10 2009Michigan Consumer Sentiment Slides This Month

by:Tom Moeller

|in:Economy in Brief

Summary

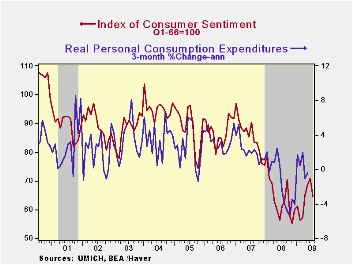

Worries about the prospects for the economy and its current position dropped the University of Michigan's July reading of consumer sentiment. The mid-July overall figure fell to 64.6 which was its lowest level since March. Consensus [...]

Worries

about the prospects for the economy and its current position dropped

the University of Michigan's July reading of consumer sentiment. The

mid-July overall figure fell to 64.6 which was its lowest level since

March. Consensus expectations had been for a reading of 71.0. During

the last ten years, there has been a 61% correlation between the level

of sentiment and the growth in real spending during the next five

months.

Worries

about the prospects for the economy and its current position dropped

the University of Michigan's July reading of consumer sentiment. The

mid-July overall figure fell to 64.6 which was its lowest level since

March. Consensus expectations had been for a reading of 71.0. During

the last ten years, there has been a 61% correlation between the level

of sentiment and the growth in real spending during the next five

months.

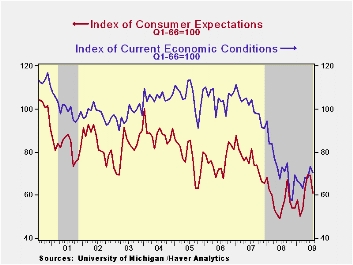

The expectations component of the index deteriorated the most. It posted a 12.0% m/m decline though it still was up y/y. Expectations for personal finances fell sharply with lower stock prices. Expected business conditions during the next five years also fell sharply to the lowest level since March and expectations for conditions during the next year fell to the lowest since April.

The

current economic

conditions gave back roughly half of its improvement during June. The

decline was led by a reversal of last month's rise in the index of

current buying conditions for large household goods. The reading of

current personal finances surprisingly rose, perhaps due to less debt,

and now it has returned to the April level.

The

current economic

conditions gave back roughly half of its improvement during June. The

decline was led by a reversal of last month's rise in the index of

current buying conditions for large household goods. The reading of

current personal finances surprisingly rose, perhaps due to less debt,

and now it has returned to the April level.

The opinion of government policy, which may eventually influence economic expectations, fell for the second month to its lowest level since February. An increased 33% of respondents thought that a poor job was being done by government while a reduced 25% thought that a good job was being done

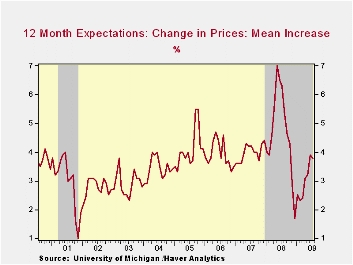

Inflation

expectations for the next year held roughly stable at 3.8%. That

compares to a low of 1.7% last December but remained down from a

reading which was as high as 7.0% last May.

Inflation

expectations for the next year held roughly stable at 3.8%. That

compares to a low of 1.7% last December but remained down from a

reading which was as high as 7.0% last May.

The University of Michigan survey data is not seasonally adjusted. The reading is based on telephone interviews with about 500 households at month-end; the mid-month results are based on about 300 interviews. The summary indexes are in Haver's USECON database with details in the proprietary UMSCA database.

| University of Michigan | Mid-July | June | May | July y/y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|---|

| Consumer Sentiment | 64.6 | 70.8 | 68.7 | 5.6% | 63.8 | 85.6 | 87.3 |

| Current Conditions | 70.4 | 73.2 | 67.7 | -3.7 | 73.7 | 101.2 | 105.1 |

| Expectations | 60.9 | 69.2 | 69.4 | 13.8 | 57.3 | 75.6 | 75.9 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates