Global| Sep 24 2003

Global| Sep 24 2003Mortgage Applications Down Again

by:Tom Moeller

|in:Economy in Brief

Summary

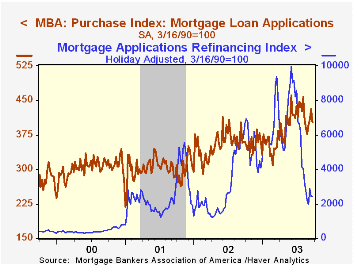

The index of mortgage applications compiled by the Mortgage Bankers Association fell 3.7% last week. The decline pulled the average level of applications in September to its lowest since June of last year. A 7.0% w/w decline in [...]

The index of mortgage applications compiled by the Mortgage Bankers Association fell 3.7% last week. The decline pulled the average level of applications in September to its lowest since June of last year.

A 7.0% w/w decline in purchase applications led the drop. So far in September purchase applications are 2.2% ahead of the August average.

Despite the latest decline, the level of purchase applications is up 11.8% from a year ago. During the last ten years there has been a 56% correlation between the y/y change in purchase applications and the change in new plus existing home sales.

Applications to refinance fell a slight 0.4% w/w but are down nearly two-thirds from a year ago.

Interest rates on a conventional 30-Year mortgage fell for the third straight week with the effective rate at 6.11% versus a recent high of 6.64% in early August. The effective rate on a 15-year mortgage was stable w/w at 5.51% but it too is down from a high of 6.07%.

The Impact of Low Interest Rates on Financial Institutions is discussed in this paper from the Federal Reserve Bank of Dallas.

The Mortgage Bankers Association surveys between 20 to 35 of the top lenders in the U.S. housing industry to derive its refinance, purchase and market indexes. The weekly survey accounts for more than 40% of all applications processed each week by mortgage lenders. Visit the Mortgage Bankers Association site here.

| MBA Mortgage Applications (3/16/90=100) | 9/19/03 | 9/12/03 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|

| Total Market Index | 699.6 | 726.7 | 799.7 | 625.6 | 322.7 |

| Purchase | 402.1 | 432.4 | 354.7 | 304.9 | 302.7 |

| Refinancing | 2,429.7 | 2,438.5 | 3,388.0 | 2,491.0 | 438.8 |

by Tom Moeller September 24, 2003

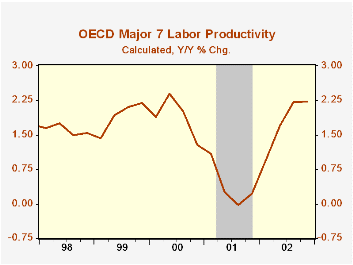

The US Department of Labor recently reported that in 2002, growth in manufacturing output per hour was fastest in Sweden (7.6%) and Korea (7.2%).

The 6.4% gain in US factory sector productivity was the fastest in fifteen years. Productivity growth in Italy was negative.

The complete report comparing productivity and unit labor costs internationally is available here .

Jack E. Triplett and Barry P. Bosworth examine productivity in the US service sector in this paper from the Federal Reserve Bank of New York. They conclude that service productivity growth after 1995 rivals that in the rest of economy.

A slowdown in the growth of patents granted may not be reason to worry. Analysis from the Federal Reserve Bank of San Francisco can be found here.

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates