Global| Jun 09 2014

Global| Jun 09 2014NABE Forecast of Improving Economic Growth is Little-Changed

by:Tom Moeller

|in:Economy in Brief

Summary

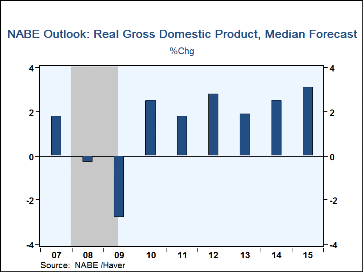

The National Association for Business Economics has released new forecasts for U.S. real economic activity. Expectations for 3.1% real GDP growth in 2015 following a 2.5% advance this year are unchanged. Quarterly growth is expected [...]

The National Association for Business Economics has released new forecasts for U.S. real economic activity. Expectations for 3.1% real GDP growth in 2015 following a 2.5% advance this year are unchanged. Quarterly growth is expected to hold steady at 3.1% next year. Forecasted personal consumption expenditures growth held at a moderate 2.9%, its quickest growth rate since 2006. Residential investment should continue to be the economy's strongest sector with an 11.2% increase after a lessened 3.8% rise this year. Growth in business investment in equipment & software is expected to remain firm at 4.0% while growth in spending on nonresidential structures should be roughly steady at 5.5%. The rate of inventory investment should diminish this year and next after a strong 2013 gain. Real net exports are expected to deteriorate slightly.

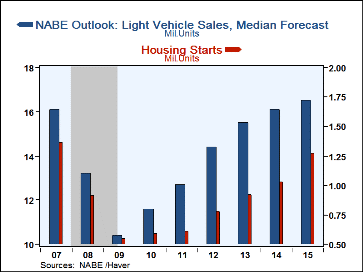

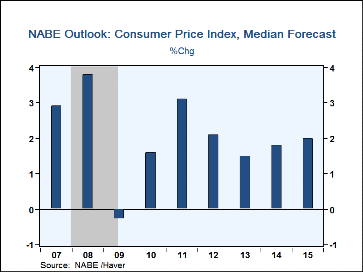

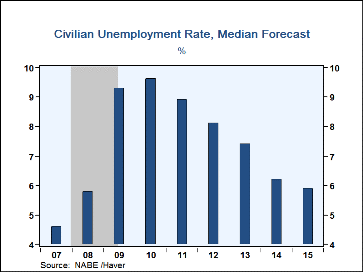

Forecasts for housing starts have been pared back slightly to 1.27 million in 2015 after 1.03 million during this year. Expected light vehicle sales held firm at 16.5 million after an expected 16.1 million this year. Forecasted average monthly gains in payroll employment have been raised slightly to 209,000 this year and next. The unemployment rate should average a lessened 5.9% next year after a downwardly revised estimate of 6.2% this year. The forecast for consumer price inflation remains low at 2.0% versus 1.8% projected for 2014.

The forecasted 3.75% interest rate on 10-year Treasury notes at the end of next year has been lowered slightly and compared to a downwardly revised 3.15% at the end of this year. The Fed is expected to raise rates in the third quarter of 2015. The forecasted 6.0% gains in corporate profits this year and next are little-changed. The Federal government budget deficit is expected to shrink to a lessened $475 billion in 2015, roughly one-third its $1.4 trillion peak in 2009.

The figures from the latest NABE report can be found in Haver's SURVEYS database.

| National Association For Business Economics | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|

| Real GDP (% Chg. SAAR) | 3.1 | 2.5 | 1.9 | 2.8 |

| Personal Consumption Expenditures | 2.9 | 2.9 | 2.0 | 2.2 |

| Nonresidential Structures | 5.5 | 4.4 | 1.3 | 12.7 |

| Producers' Durable Equipment & Software | 4.0 | 3.2 | 3.1 | 7.6 |

| Residential Investment | 11.2 | 3.8 | 12.2 | 12.9 |

| Change in Real Business Inventories (Bil. $) | 52.5 | 68.1 | 81.5 | 57.6 |

| Real Net Exports (Bil. $) | -407.5 | -407.8 | -412.3 | -430.8 |

| Real Government Consumption & Gross Investment | 0.5 | -0.7 | -2.2 | -1.0 |

| Housing Starts (Mil. Units) | 1.27 | 1.03 | 0.92 | 0.78 |

| Light Vehicle Sales (Mil. Units) | 16.5 | 16.1 | 15.5 | 14.4 |

| Payroll Employment Average Monthly Change (000s) | 209 | 209 | 194 | 186 |

| Unemployment Rate (%) | 5.9 | 6.2 | 7.4 | 8.1 |

| Consumer Price Index (Y/Y %) | 2.0 | 1.8 | 1.5 | 2.1 |

| Fed Funds Rate (%, Year End) | 0.750 | 0.125 | 0.125 | 0.125 |

| 10-Year Treasury Note (%, Year End) | 3.75 | 3.15 | 3.04 | 1.78 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.