Global| Nov 01 2012

Global| Nov 01 2012New ADP Survey Shows 158,000 October Payroll Increase

Summary

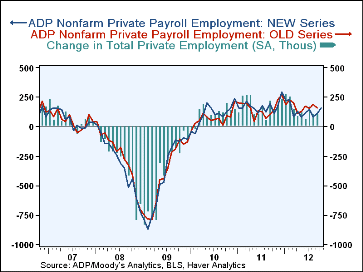

An expanded employment survey sample for the Automatic Data Processing (ADP) payroll gauge shows a net gain in private payrolls of 158,000 jobs for October. This is stronger than the new ADP survey reading in September of 113,000 and [...]

An expanded employment survey sample for the Automatic Data Processing (ADP) payroll gauge shows a net gain in private payrolls of 158,000 jobs for October. This is stronger than the new ADP survey reading in September of 113,000 and the official BLS report of 104,000. Forecasters had looked for 140,000, according to the Action Economics survey.

An expanded employment survey sample for the Automatic Data Processing (ADP) payroll gauge shows a net gain in private payrolls of 158,000 jobs for October. This is stronger than the new ADP survey reading in September of 113,000 and the official BLS report of 104,000. Forecasters had looked for 140,000, according to the Action Economics survey.

The U.S. Bureau of Labor Statistics will announce October payroll employment tomorrow. Economists expect a 121,000 worker increase in private sector jobs.

The new survey is still based on ADP's own business payroll transaction system, but the sample size has increased from 344,000 U.S. companies to 406,000, raising the number of employees covered to 23 million from 21 million. These data are now processed by labor economists at Moody's Analytics, Inc., using a variety of techniques to try to calibrate and align them with the BLS data. Moody's has replaced Macroeconomic Advisers, Inc., as the analyst firm producing the computations. Industry detail now includes professional and business services and trade and transportation services, as well as the manufacturing, construction and financial activities reported before. Extensive information on the methodology is given on the ADP website, here. The first graph shows both the new and the old ADP series along with the official BLS series; the entire history of the ADP data has been revised.

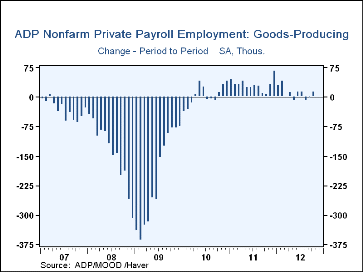

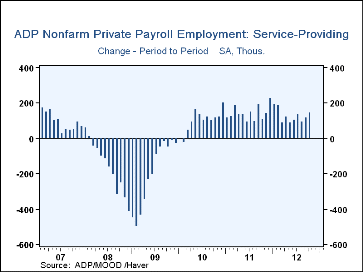

Service-producing payrolls are estimated with a 144,000 increase in October after 118,000 increase in September. Goods-producing sector payrolls are estimated to have risen 14,000 after edging down 4,000; this includes an 8,000 decrease in manufacturing for October, less severe than a 15,000 decline now shown for September. More favorably, the construction industry is seen with a 23,000 increase, up from September's 12,000 and the largest since last December's 31,000. Overall, October's payroll strength is seen at large-size firms (500+ employees), with an 81,000 gain, the biggest since May 2010 and among the largest ever in this series. Medium-size firms (50-499 employees) had a 27,000 increase in October and small-size firms' payrolls were up 50,000.

The ADP National Employment Report data are maintained in Haver's USECON database; historical figures in the new series date back to March 2001. The figures in this report cover only private sector jobs and exclude employment in the public sector. The expectations figures are available in Haver's AS1REPNA database.

| ADP/Moody's National Employment Report | Oct | Sep | Aug | Y/Y | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|

| Nonfarm Private Payroll Empl (m/m chg, 000s) | 158 | 113 | 83 | 1.7% | 1.7% | -0.8% | -5.3% |

| Small Payroll (1-49) | 50 | 40 | 23 | 1.5 | 1.0 | -0.8 | -3.2 |

| Medium Payroll (1-49) | 27 | 28 | 14 | 1.4 | 2.0 | -0.6 | -6.6 |

| Large Payroll (>500) | 81 | 41 | 46 | 2.4 | 2.7 | -1.1 | -6.9 |

| Goods-Producing | 14 | -4 | -9 | 1.1 | 1.6 | -4.3 | -13.0 |

| Manufacturing | -8 | -15 | -16 | 0.5 | 1.6 | -2.7 | -11.5 |

| Service-Producing | 114 | 118 | 91 | 1.8 | 1.8 | -0.1 | -3.5 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates