Global| Sep 08 2015

Global| Sep 08 2015NFIB Survey Shows Strong Labor Markets But Modest Activity

by:Sandy Batten

|in:Economy in Brief

Summary

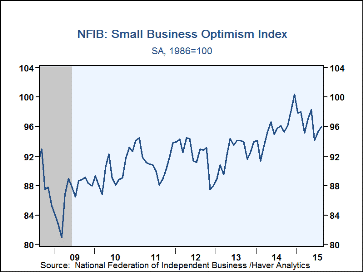

The National Federation of Independent Business reported that the small business outlook was little changed in August. Its Small Business Optimism Index edged up to 95.9 in August from 95.4 in July, but remains below the 96.8 average [...]

The National Federation of Independent Business reported that the small business outlook was little changed in August. Its Small Business Optimism Index edged up to 95.9 in August from 95.4 in July, but remains below the 96.8 average for the past twelve months. According to the NFIB, the August reading is consistent with overall economic growth of 2% over the first half of 2015. Of the 3,938 surveys sent, 656 usable responses were received. Five of the index's 10 components posted gains in August, 3 fell, and 2 were unchanged. Two components (job openings and earnings trends) posted solid 4-point gains in August. Respondents did not appear to have been affected much by the turmoil in global equity markets and the associated Chinese currency devaluation, though many surveys were returned prior to the Chinese action.

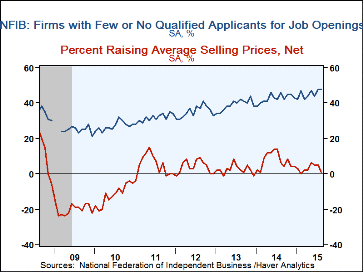

There was somewhat of a dichotomy between labor market indicators and economic activity indicators. Employment measures were quite strong while those associated with overall activity were more modest. The percentage of firms increasing employment jumped from +2 to +10, the highest reading since 2005. Hiring intentions edged up to +13, but this is the third highest reading of this cycle. The percentage of firms reporting that they had positions they were unable to fill returned to +29, the highest reading since 2006. And fully 48% of responding firms noted that there were few or no qualified applicants for their job openings-tied for the highest reading in the history of the series (dating back to 2004). Wage indicators were relatively benign in August, wage increase flat and wage intentions down 2 points, but this is most likely a temporary respite as both have been generally trending up. All in all, the labor market gauges seem to point to relatively tight conditions.

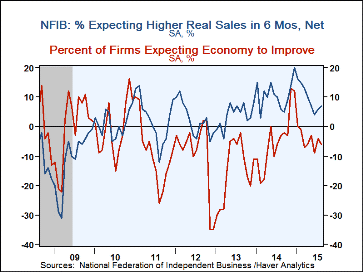

In contrast, the gauges of economic activity showed more moderation. One of the most important for current activity is the inventory satisfaction measure which continues to indicate that respondents think that their inventories are too high. This measure posted its second consecutive reading of -6 (this means that 6% more respondents think their inventories are too high than are too low). This is the lowest reading on this measure since the depths of the 2008-09 recession and points to inventory normalization ahead. Overall, inventories added more than 1%-point to real GDP growth in the first half of 2015. The indication from small businesses is that, for their part, inventories could turn to a slight drag in the second half. The percentage of firms reporting higher sales rose 3%-points but remained in negative territory, indicating that more firms are still reporting declining sales. Expected real sales volumes did post a small (1%-point) gain in August, but the reading of +7 is a long way down from the +20 posted at the beginning of this year.

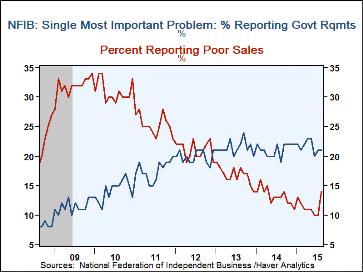

Of the problems that small businesses perceive, government requirements and taxes continue to take the lead. Indeed, the gauge measuring concerns over government requirements is currently fluctuating in a range that it hasn't seen since the mid-1990s.

Roughly 24 million small businesses exist in the U.S. and they create 80% of all new jobs. The typical NFIB member employs 10 people and reports gross sales of about $500,000 a year. The NFIB figures can be found in Haver's SURVEYS database.

| National Federation of Independent Business | Aug | Jul | Jun | Aug '14 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|

| Small Business Optimism Index (SA, 1986=100) | 95.9 | 95.4 | 94.1 | 96.1 | 95.6 | 92.4 | 92.2 |

| Firms Expecting Higher Real Sales In Six Months (SA, Net %) | 7 | 6 | 4 | 6 | 11 | 4 | 2 |

| Firms Expecting Economy To Improve (SA, Net %) | -6 | -4 | -9 | -3 | -5 | -15 | -9 |

| Firms Planning to Increase Employment (SA, Net %) | 13 | 12 | 9 | 10 | 10 | 6 | 4 |

| Firms With Few or No Qualified Applicants For Job Openings (SA, %) | 48 | 48 | 44 | 46 | 43 | 39 | 35 |

| Firms Reporting That Credit Was Harder To Get (SA, Net %) | 4 | 4 | 4 | 5 | 6 | 6 | 8 |

| Firms Raising Average Selling Prices (SA, Net %) | 1 | 5 | 5 | 6 | 8 | 2 | 4 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.