Global| Nov 09 2016

Global| Nov 09 2016OECD Area LEIs Are Flat

Summary

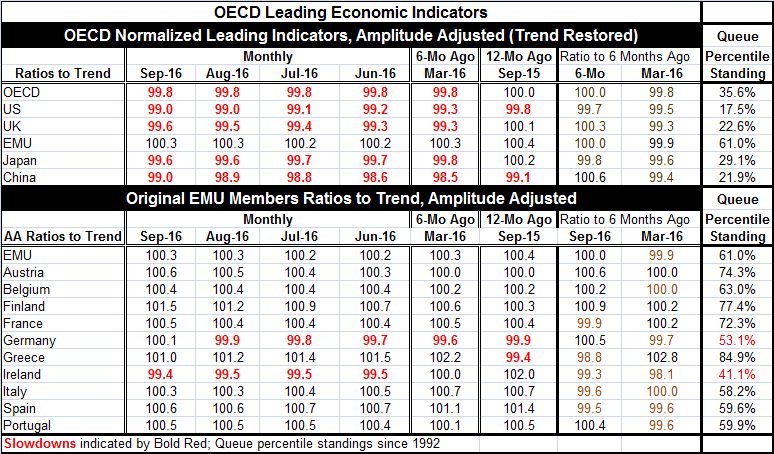

The latest data show the OECD LEIs are truly flat. Most OECD country-level or area LEIs still hover below the neutral position of 100 (with the EMU being the exception). The U.K. and China LEIs, while still below 100, each saw small [...]

The latest data show the OECD LEIs are truly flat. Most OECD country-level or area LEIs still hover below the neutral position of 100 (with the EMU being the exception). The U.K. and China LEIs, while still below 100, each saw small upticks in their respective indices in September.

The latest data show the OECD LEIs are truly flat. Most OECD country-level or area LEIs still hover below the neutral position of 100 (with the EMU being the exception). The U.K. and China LEIs, while still below 100, each saw small upticks in their respective indices in September.

No momentum

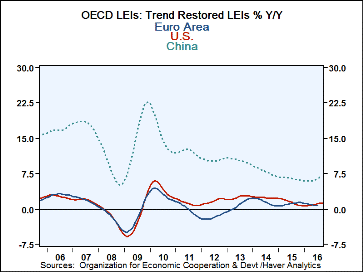

Over the last six months, the OECD index is unchanged as is the EMU index. The U.S. index is lower on balance as is Japan. Higher over six months are the U.K. and China.

No vigor

On balance, there is not much vigor in this report but neither is there deterioration. Compared to 12-months ago, only the U.S. is stronger. These OECD LEIs are closing in a slightly weak position and have been stuck there for some time. The good news is that despite this weakness there is no further deterioration. The bad news is that after all the effort from monetary stimulus, economic conditions still are not improving.

EMU doing OK

In the EMU, all members except Ireland are above the key neutral reading of 100. Germany has moved up from a multi-month period of being below 100 to see its index at 100.1 in September. Of 10 early EMU members, five are better on balance over six months and five are worse off.

A new dawn of sorts

Of course, the global growth picture is turned upside down this morning with the wholly unexpected election of Donald Trump as President of the United States. Markets have been in turmoil since Trump began to look viable last night in the early U.S. election returns. Foreign markets have been put through the wringer. Markets today in the U.S. trading hours show less stock market weakness and in fact weakness turned to gains! But bonds are selling off with the yield on the U.S. 10-year treasury now closing in on the 2% level.

Common threads to learn from

It looks like the Trump bump and Brexit surprise have something in common. Clearly, despite thinking, we are in a modern economy with all sorts of technology and knowledge at our finger tips we find we are still woefully misinformed on a lot of things. Markets were surprised by the Trump victory and by the Brexit vote and decision to leave the EU. Economists have been unable to forecast local or global economies very well. For all of our advanced econometric models, we cannot figure out how to restart growth or anything else to do to make monetary policy more effective. Economists have not been able to punch their way out of a paper bag in this recovery. It is a good time to a pause and to reconcile the limits of our knowledge.

The bias of power

People in power are interested in wielding it. They will try this or that. They may simply want to reassure us that they are not powerless. But I think for all of our technology and all the talk of forming expectations we have fallen short. We should raise questions about the usefulness of economic theories that emphasize the importance of setting expectations at a time when it is clear that our expectations and policymakers' forecasts are not accurate and often are substantially wrong or at least importantly flawed. Should policy really be guided by such things? Should market participants hitch their wagons to a flawed outlook? And when expectations and forecasts prove to be substantially wrong, what happens? We have to regroup! Do we reset expectations again? If so, do we trust them this time? I think these issues are partly plaguing the Fed. It can no longer be a global thought leader because its outlook has been too wrong for too long. Today is another one of those periods when forecasts have been wrong. So we are regrouping. We need to rethink the future, to reimagine what policy can do and where we are headed. I doubt that anyone is setting expectations very firmly in this environment. The OECD LEIs tell us to set our sights low because nothing is changing except the guard. And we are still unsure what that means.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates