Global| Nov 11 2005

Global| Nov 11 2005OECD Leaders Up Again

by:Tom Moeller

|in:Economy in Brief

Summary

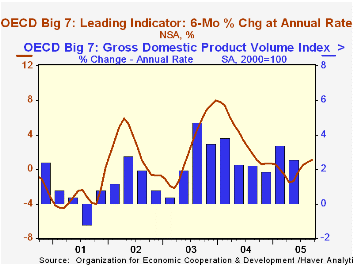

The modest 0.2% increase in the September Leading Index of the Major 7 OECD economies marked the fourth consecutive gain and it improved the leaders' six month growth rate to 1.1%, the best in twelve months.The increase reflected [...]

The modest 0.2% increase in the September Leading Index of the Major 7 OECD economies marked the fourth consecutive gain and it improved the leaders' six month growth rate to 1.1%, the best in twelve months.The increase reflected improvement in Japan & Europe but declines in North America.

During the last ten years there has been a 68% correlation between the change in the leading index and the q/q change in the GDP Volume Index for the Big Seven countries in the OECD.

The leading index for Japan jumped 1.0%, the most for any month since early 2002, as share prices increased and the interest rate yield spread widened. The six month growth rate surged to 2.3%, the best since early 2004, and its correlation with real growth in Japan has been a meaningful 42% during the last ten years.

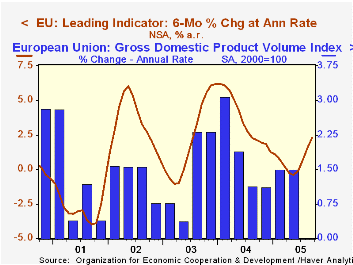

Leaders in the European Union (15 countries) rose for the fourth month and the 0.5% increase lifted the six month growth rate to 2.3%, the highest in a year. During the last ten years there has been a 60% correlation between the change in the leading index and the q/q change in the GDP volume index for the European Union.

German leaders increased for the fifth consecutive month. A 0.5% gain raised six month growth to 3.3% as new orders bounced back from an August drop and the business climate improved. The correlation between the leaders and the change in the German GDP volume index has been a low 19% during the last ten years.

The French leaders rose for the third consecutive month. The 0.5% increase pulled the six month growth rate into positive territory for the first time since March with a 0.3% growth rate and the correlation between the leaders with growth in France's GDP volume index has been a higher 43% during the last ten years. The Italian leading index showed perhaps the most meaningful monthly improvement with a 0.8% gain that followed an upwardly revised 0.9% August increase. The six month growth rate improved to 1.9%, the best since early 2004, although its correlation with GDP growth has been a low 0.9% during the last ten years.

The UK leaders increased just 0.1% but it was the fourth rise in as many months. The gain raised the six month growth rate to 0.2% and its correlation with real GDP growth has been 29% during the last ten years.

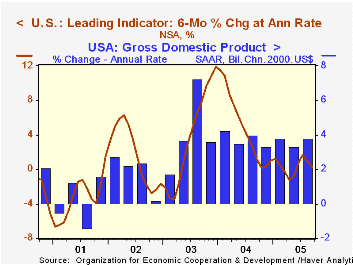

The U.S. leaders fell for the second consecutive month and the 0.3% decline lowered the six month growth rate to 0.3%, the worst since May. The correlation between the leaders and real GDP growth has been a high 58% during the last ten years. The Canadian leaders also fell and the 0.5% decline dropped six month growth to -1.0%. The leaders' growth also has been highly correlated with Canadian real GDP growth, to the tune of 49% during the last ten years.

The latest OECD Leading Indicator report is available here.

What Caused The Great Moderation? Some Cross-Country Evidence from the Federal Reserve Bank of Kansas City is available here.

| OECD | Sept | Aug | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Composite Leading Index | 102.51 | 102.31 | 0.6% | 102.03 | 97.59 | 96.30 |

| 6 Month Growth Rate | 1.1% | 0.8% | 3.5% | 2.6% | 2.2% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates