Global| Oct 04 2017

Global| Oct 04 2017PMIs Pick Up As Asia Continues to Lag; European Manufacturing Gauges Show Same Distortions As in the U.S.

Summary

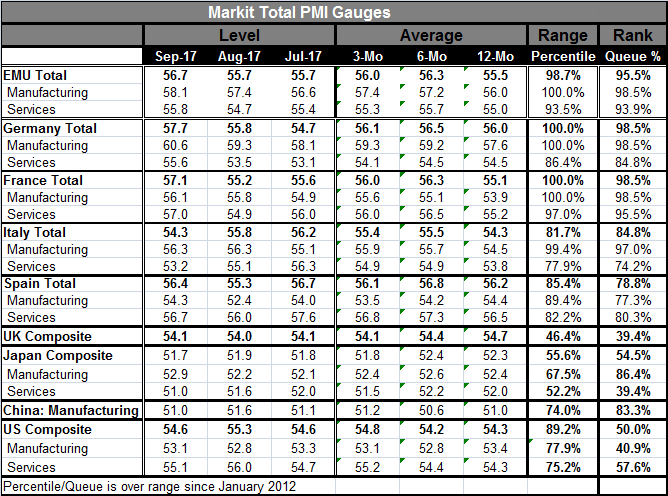

The table chronicles the various composite manufacturing and services PMIs offered by Markit (we use Markit readings for the U.S. here except in the left chart). The EMU and U.S. readings are on a strong rise, but those gains may not [...]

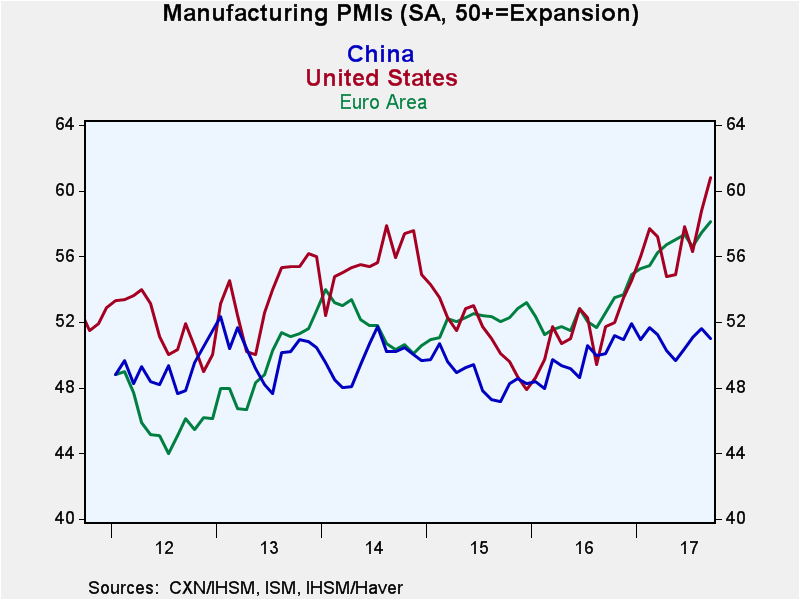

The table chronicles the various composite manufacturing and services PMIs offered by Markit (we use Markit readings for the U.S. here except in the left chart). The EMU and U.S. readings are on a strong rise, but those gains may not be what they seem. China is lagging. In fact, on a broader view, much of Asia is lagging as well. This, on the face of it, does not appear to be the kind of expansion we had experienced prior to the Great Recession and financial crisis.

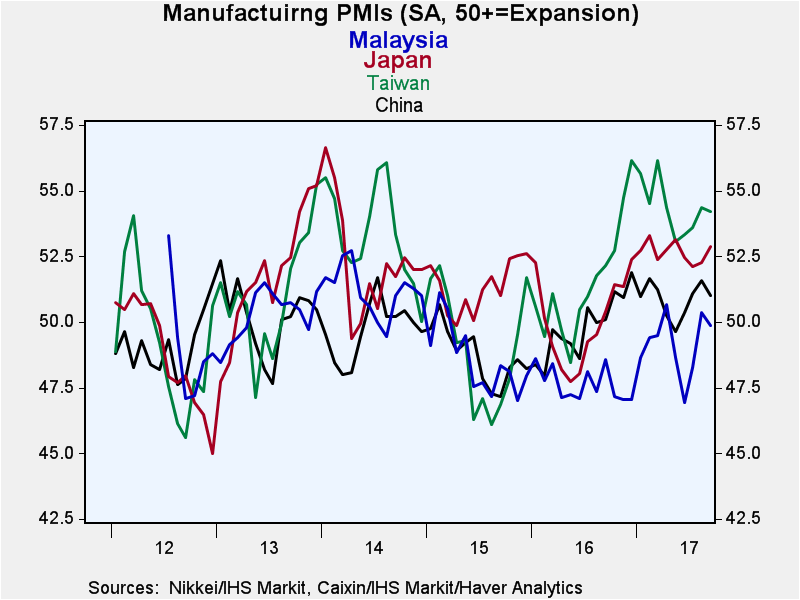

For this group of Asian economies the Markit PMIs for manufacturing show Taiwan is the consistently strongest over the last few years. While it is the strongest of the lot now, it has slid and is currently off-peak. Japan also has picked up but in 2017 its PMI is flat-lining on diffusion readings around 52. China has been locked in a range from below 52 to showing contraction. Its manufacturing PMI is still range-bound and slightly weaker this month. The Malaysian PMI has become more unstable and has recovered from its 2015-2016 lows, but this month it is still a notch below steady as its manufacturing PMI shows contraction. In addition (not pictured above), the Indonesian manufacturing PMI is just above breakeven at 50.4 and the remaining BRIC countries (India, Brazil and Russia) all have manufacturing PMI readings below 52. Among the BRIC countries, India is the relative weakest with a PMI standing in the 31st percentile of its historic queue of data. Brazil, in contrast, has a high 88th percentile queue standing, but that is only because of its recent substantial weakness. It 'earns' this high ranking despite a manufacturing diffusion reading in September of 50.9.

The average scores for manufacturing in the most highly developed economies are relatively strong. Even Japan logs a relatively strong PMI queue standing because, like Brazil, Japan has been weak for much of this period and as a result, a weak PMI level gives it a relatively high standing on current comparisons. China has a similar set of conditions in play. Korea has a manufacturing index of 50.6 in September that boasts a strong in its 80th percentile standing; yet, the raw diffusion reading is not strong; it barely registers growth.

What seems clear is that the rebound that is in play stems from the most advanced economies and it is not being very fully transmitted to the developing economies, at least not yet. The U.S. has become the 'champion' of trade pressures, pushing back against those economies that have made their living by exporting and exploiting the developed country demands especially the U.S. market. The Trump administration is on a path to monitor changes in trade balances and this might be holding growth back in some places. It is a bit surprising that the manufacturing sectors in the U.S. and the EMU are on the upswing faster than in Asia and in many traditional export powers especially since Asian economies are still among the world's most competitive.

In the U.S., the ISM manufacturing index is even stronger than the Markit index; yet, its relationship to actual production seems to have slipped. U.S. output is relatively moderate and is out of sync with the strong U.S. ISM gauge. Today's nonmanufacturing ISM report in the U.S. also has spiked (although the Markit services gauge weakened in September). There is some sense that the U.S. ISM data may have picked up an uptick in activity related to rebuilding in the wake of two voracious hurricanes. Growth is rebounding as yesterday vehicle sales surprised with a huge gain on hurricane replacement sales. However, that is a true one-off event and it will not drive growth in the future.

We are left with a less than complete understanding of the rebound. On closer inspection, we see in Europe the same phenomenon that we have identified in the United States. That is that the relationship between manufacturing IP to PMI readings has shifted. It has shifted in such a way that the same PMI reading now corresponds to a weaker gain in IP than it used to. This casts some doubt on what the improving PMI values really mean. Some of the developed economy rebound may simply be an illusion. Since a PMI reading today corresponds to a weaker IP gain that it used to, when the current PMI is rising we have a less clear idea how that PMI value should be related to the past or to other topical conventional data. This in fact helps to 'explain' why the PMIs have such strong diffusion values while the industrial output and other indicators are still not performing quite so well.

It's possible that this slow growth policy allows the breadth of the industrial gains to spread more thoroughly; thus, providing gains in the breadth of output without giving us the same strength. This notion gets back to the issue that diffusion indexes are only about breadth while and IP index is only about strength. When we use one as a proxy for the other, it is not surprising that sometimes our conclusions misfire. One take on the strong PMIs is that they report statistical distortion more than real blockbuster gains. And that idea actually fits better with today's report, for example, on retail sales in Europe that show retail sales in the EMU fell for the second straight month. Meanwhile, the service sector PMIs also are very strong. Note that I have not been able to evaluate them relative to history as independent service sector output data are hard to come by. My conclusions on distortion at this point only pertain to manufacturing. But one is left to wonder whether both services and manufacturing are distorted. For example, the service sector PMIs show more strength than EMU unemployment gauges reflect; yet, service sector jobs would be the key variable linking unemployment to service sector improvement.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates