Global| Oct 15 2008

Global| Oct 15 2008PPI Still Troublesome

Summary

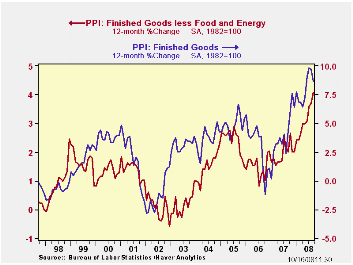

The PPI emitted mixed signals in September. The headline finished goods PPI dropped a sharp 0.4% as energy prices fell. But the core PPI for consumer goods rose by a sharp 0.5% an uncomfortable harbinger for the CPI core that is due [...]

The PPI emitted mixed signals in September. The headline

finished goods PPI dropped a sharp 0.4% as energy prices fell. But the

core PPI for consumer goods rose by a sharp 0.5% an uncomfortable

harbinger for the CPI core that is due for release tomorrow.

Wholesale food prices were tempered in September rising by

just 0.2%. Food in general has seen its inflation profile lowered as

its Yr/yr pace of 8.1% far exceed its three-month pace of 3.1%.

Finished energy prices are off sharply, dropping by 2.9% in

the month. They are also off at a 16.7% annual rate in the quarter.

That is the constructive side of the inflation trend. But the Fed looks

harder at core inflation and there trends are still worsening.

But for core consumer goods Yr/Yr inflation has gone from 4.4%

over 12 months to 5.1% over six months to 5.3% over three months. That

is an uncomfortable trend.

However, the weakness in the economy and the ongoing financial

crisis will put this PPI on the back burner. The Fed is not giving up

on fighting inflation instead it knows that economic conditions such as

these will snuff out inflation without special action by the central

bank. Extreme economic weakness does that.

For now the economy picture is mess. The economy is weakening

fast. The financial sector is in shambles and inflation is still

accelerating and moving out over the Fed's comfort zone. But we know

that is just a snap shot of an ever changing environment. In fact

inflation is about to be extinguished by the economic weakness that

appears to be getting worse. Meanwhile, the Fed and the Treasury have

made great strides in trying to contain the financial unraveling. Their

attempt at containment appears to be a success – so far. Aid for the

ailing economy has not yet moved up to the actionable stage but

Congress is making plans for a stimulus plan. This is one of those

times that you must look at the indicators with a broader perspective.

At another time this PPI report would be viewed as a bad PPI and as

trouble for the Fed. But in this environment the report will not gather

headlines – hardly even footnotes.

| Key Trends In Producer Prices | ||||||

|---|---|---|---|---|---|---|

| Sep-08 | PPI Trends By Type Of Good | CHANGE | ||||

| PPI | 1Mo:M/M | 3-Mo:ar | 6-Mo:ar | 1-Yr | Yr-Ago | Y/Y |

| Total PPI | -0.4% | -0.4% | 6.8% | 8.7% | 4.4% | 4.3% |

| Finished Consumer Goods | -0.6% | -2.3% | 7.5% | 10.2% | 5.2% | 5.0% |

| Consumer Foods | 0.2% | 3.1% | 6.1% | 8.1% | 5.8% | 2.3% |

| Finished Consumer Goods Excl Foods | -0.9% | -4.2% | 8.0% | 11.1% | 5.0% | 6.1% |

| Nondurables less Food | -1.3% | -6.8% | 9.7% | 14.1% | 7.0% | 7.1% |

| Consumer Nondurable Goods excl Food & Energy | 0.5% | 6.8% | 6.4% | 5.8% | 3.4% | 2.4% |

| Durable Goods | 0.4% | 3.5% | 3.5% | 2.5% | 0.8% | 1.7% |

| Finished Core Consumer Goods | 0.5% | 5.3% | 5.1% | 4.4% | 2.2% | 2.2% |

| Capital Goods | 0.5% | 5.6% | 4.8% | 3.7% | 1.6% | 2.1% |

| MFG Industries | 0.5% | 6.3% | 5.8% | 4.3% | 1.8% | 2.5% |

| Non-MFG Industries | 0.5% | 5.4% | 4.4% | 3.5% | 1.5% | 2.0% |

| Core PPI | 0.4% | 5.4% | 4.9% | 4.1% | 2.0% | 2.1% |

| Memo: Finished Energy | -2.9% | -16.7% | 12.4% | 22.3% | 10.3% | 11.9% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates