Global| Sep 06 2007

Global| Sep 06 2007Q2 Productivity Revised Up, But So Was Compensation

Summary

Nonfarm labor productivity was revised to 2.6% in Q2 from 1.8% reported a month ago. The revision was marginally above market forecasts, which called for 2.5%, based on the most recent revision to GDP. Compensation per hour last [...]

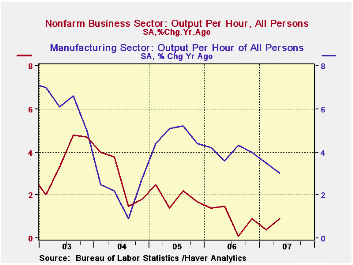

Nonfarm labor productivity was revised to 2.6% in Q2 from 1.8% reported a month ago. The revision was marginally above market forecasts, which called for 2.5%, based on the most recent revision to GDP.

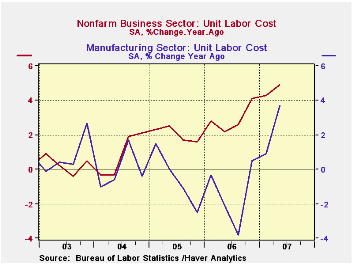

Compensation per hour last quarter was a bit higher than the original 3.9% increase, and is now estimated at 4.1%.

Despite the upward move in compensation, unit labor costs are revised here to just 1.4%, compared to the originally reported 2.1% and modestly lower even than the 1.6% forecast growth.

Factory sector productivity growth was also revised higher, but just slightly to 1.8% from 1.6% in the last report. Compensation in manufacturing is now seen up 3.4% in the quarter compared with 2.8% reported last month. This makes the year/year rate 6.8%, up from 6.2% in the prior report; these are both stronger than anytime since Q4 2003. Year-to-year changes in manufacturing unit labor costs were minimal from mid-2001 until Q1 this year, but in Q2, the compensation and productivity numbers yielded a 3.7% rise. Granted, the quarter-to-quarter growth was greatest in Q4 2006 and Q1 2007, but productivity in factories has been sluggish for three consecutive quarters, suggesting that unit labor costs are still subject to upward pressure presently, not relief.

| Non-farm Business Sector (SAAR) | Q2 '07 (Rev) | Q2 '07 (Old) | Q1 '07 | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Output per Hour | 2.6% | 1.8% | 0.7% | 0.9% | 1.0% | 1.9% | 2.7% |

| Compensation per Hour | 4.1% | 3.9% | 5.9% | 5.8% | 3.9% | 4.0% | 3.6% |

| Unit Labor Costs | 1.4% | 2.1% | 5.2% | 4.9% | 2.9% | 2.0% | 0.9% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates