Global| Dec 15 2006

Global| Dec 15 2006Q4 TANKAN Results Show Best Japanese Industry Performance in Many Years

Summary

The Bank of Japan's widely watched TANKAN survey showed stronger results across the board in the December report released today in Tokyo.Generally, these surveys are reported just after the beginning of a new quarter, but December is [...]

The Bank of Japan's widely watched TANKAN survey showed stronger results across the board in the December report released today in Tokyo.Generally, these surveys are reported just after the beginning of a new quarter, but December is an exception, with the release at mid-month, ahead of the year-end holidays.

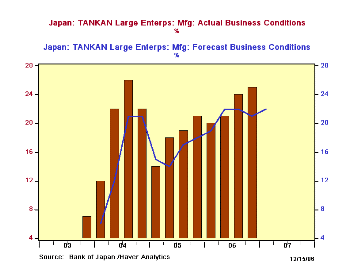

Large manufacturers, the "headline" group, saw favorable business conditions at 25% more firms than experienced negative conditions.Three months ago, a balance of 24% expected favorable conditions in December.December's actual result was the best since Q3 2004 at 26%.

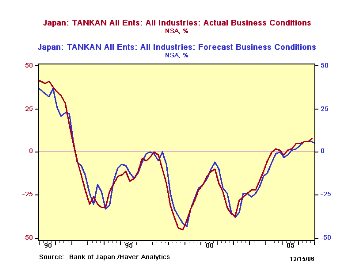

Other firm-size and industry groups also had stronger results than they had forecast three months ago. Large firms in all industries experienced favorable business at a net of 23%, compared to 20% forecast; medium-size firms at 10% versus 7% expected and at small firms, the numbers with favorable and unfavorable business conditions were equal, the first time this has occurred in the present configuration of the TANKAN survey, which began in early 2004.

Expectations for coming March outcomes indicate some moderation. It is frequently the case that these aggregate forecasts point to less breadth of expansion. This might not be surprising because more firms have done better in the current quarter, so the base is higher from which to expect further improvement. Assuming, that is, that "favorable" can be equated with "growing".

We take this opportunity, once again, to highlight Haver's "purist" interpretation of the TANKAN survey. In the 2004 reorganization, the fundamental definition of firm size was changed. It used to be based on the number of employees, but now, as seen in the table below, capital is used. This meant firms shifted from one category to another, particularly capital-intensive firms that have small numbers of employees but much capital; these include the important high-tech sector. So the very character of "large", "medium" and "small" changed from what those categories meant before. With the passage of time, of course, more history becomes available on the behavior of these new size categories. In the meantime, in the database "G10", we include a linked series of All Firms in All Industries (which is not affected by the change in "size" definition); the results here for Q4 2006 stand at +8%, the best reading in exactly 15 years, since Q4 1991.

| Business Conditions: % Favorable minus % Unfavorable |

Dec 2006

Sept 2006

June 2006

Mar 2006 | ||||||

|---|---|---|---|---|---|---|---|

| Forecast for Mar |

Actual | Forecast for Dec | Actual | Forecast for Sept | Actual | Forecast for Jun | |

| All Firms | 6 | 8 | 6 | 6 | 6 | 6 | 6 |

| Large Firms* | 20 | 23 | 20 | 22 | 21 | 20 | 20 |

| Manufacturing ("Headline Series") |

22 | 25 | 21 | 24 | 22 | 21 | 22 |

| Nonmanufacturing | 20 | 22 | 21 | 20 | 21 | 20 | 19 |

| Medium-Sized Firms** | 6 | 10 | 7 | 9 | 9 | 8 | 8 |

| Small Firms*** | -4 | 0 | -3 | -3 | -4 | -2 | -2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates