Global| Feb 09 2015

Global| Feb 09 2015Record German Trade Surplus as Euro Exchange Rate Adds to Excess

Summary

In the early 1970s when a lot of academic work was being done in economics on exchange rate systems in the wake of the scrappage of Bretton Woods, one of the things that were envisaged was that, in a system of flexible exchange rates, [...]

In the early 1970s when a lot of academic work was being done in economics on exchange rate systems in the wake of the scrappage of Bretton Woods, one of the things that were envisaged was that, in a system of flexible exchange rates, exchange rate movements would tend to rebalance trade flows when they got out of kilter.

In the early 1970s when a lot of academic work was being done in economics on exchange rate systems in the wake of the scrappage of Bretton Woods, one of the things that were envisaged was that, in a system of flexible exchange rates, exchange rate movements would tend to rebalance trade flows when they got out of kilter.

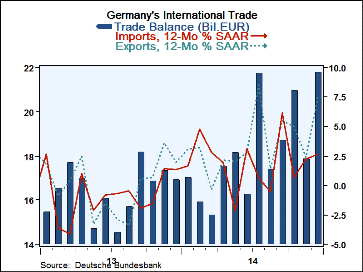

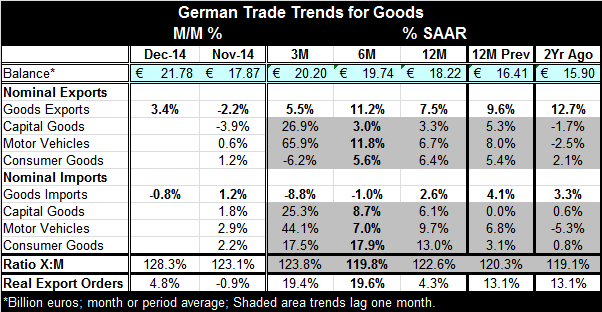

It hasn't worked like that in the real world. In today's new German trade report, we see a record surplus for Germany as the euro exchange rate continues to plunge and further augment German competitiveness in world markets, pushing the surplus toward even higher new highs. At the same time the U.S. experiences a strengthening dollar that is making its existing deficit larger at a time that energy market developments are further exacerbating the U.S. trade imbalance.

Countries have for much of the flexible rate post-Bretton Woods period used exchange rate policy for mercantilistic ends. And with GATT gone, replaced by the spineless WTO mechanism, `industry' level price-fixing may still be out of bounds but macroeconomic price-fixing through keeping exchange rates persistently undervalued is apparently just fine. The IMF is out of the business of exchange rate surveillance. The enduring and never ending string of U.S trade deficits is a testament to how countries peg to the dollar keeping the dollar too strong so they can have export-led growth. The persistent deficit phenomenon `explains' why U.S. deficits are never corrected by exchange rate movements and why there is persistent overconsumption in the U.S. where foreign goods are always artificially `too cheap.'

To pursue this strategy, the quid-pro-quo is that countries that maintain undervalued exchange rates must plough excess dollars back into the U.S., build up their foreign exchange reserves and hence why the U.S. deficits are always funded. The U.S. always is awash in liquidity. Borrowing to finance its balance of payments deficits comes with the territory. But it is not the territory that academics envisioned.

Germany has long been on the side of keeping its industry competitive as German workers hold an abject fear of inflation allowing them to be cowed to accepting wages that are too low in the name of `price stability.' German macroeconomic policy has since the EMU formation run the lowest inflation rate in the EMU year-in and year-out to cement and extend its competitiveness advantage. That is, until very recently, when the austerity policies lauded by Germany and low EMU inflation have forced other EMU members into a state of deflation with inflation rates below even the current low pace of German inflation (deflation).

The risk of having permanent surplus and deficit countries is that it creates ongoing transfers of wealth and raises financial market risks. Having some nations in a permanent state of deficit implies growing indebtedness. But we have also seen that counties with unbalanced export-led growth policies can fall on very hard times during episodes of global recession. While running a surplus is viewed as a virtue, doing it constantly is a form of beggar-thy-neighbor policy as it is evidence that the surplus country is ramping up its output and having growth by piggybacking on the economic growth in domestic demand elsewhere in the world on a persistent basis. True virtue in economics comes from a balanced approach.

This aspect of Germany's policy makes German surpluses a pariah in Europe where, as an EMU member, German surpluses seem help the deficits in other countries to look better when they all are aggregated at the EMU level. In fact, German surpluses are evidence that Germany, while Europe's strong economy, is not adding any locomotive effect to the region and is instead living off the paltry income growth in the community itself as well as elsewhere. Where does the Big Dog eat? Wherever it wants...

German exports by region have in fact worsened the trade picture for fellow EMU members. In 2014, compared with 2013, exports to EU countries increased by 5.4%, as German imports from those countries rose by just 3.6%. For the EMU alone, German exports representing 414.2 billion euros (+2.7%) were sent to the euro area countries, while the value of imported goods from those countries was 411.4 billion euros (+2.3%). In 2014, goods with value of 243.1 billion euros (+10.2%) were shipped from Germany to EU countries not belonging to the euro area, while the value of the imported goods which arrived from those countries was 188.5 billion euros (+6.6%). Germany ran surpluses and growing surpluses with the EU, EMU and with non-EMU members of the EU. For Europe, that is just about everywhere.

German exports of goods to countries outside the European Union (third countries) amounted to 476.2 billion euros in 2014, while imports from those countries totaled 316.6 billion euros. Compared with 2013, exports to third countries increased by 1.5%, while imports from those countries were down 0.9%. German trade was in surplus and improved in trade outside of the EU even given German dependence on imported energy. Falling energy prices helped that.

Germany is simply a trade predator. While the topical analysis of German trade statistics today is much more likely to laud these data as evidence of how well the German economy is doing, we knew this would be the result from driving the euro exchange rate lower. Some bad things will come from this.

The failure of policies in the euro area - a failure that stems from Europe's poor integration and its inability to deal with the heterogeneous conditions within the EMU- has left the region with no strategy but to dump the euro lower. Even this is going to create trouble in the euro area's one-size-fits-none policy zone. It is going to overheat the German economy and make Germany in need of a tighter monetary policy at a time that if it were run by the Bundesbank would appreciate the deutsche mark if it still existed. Instead, EMU monetary policy will run flat out as full tilt continuing to be as easy as it can be. Germany's growth will bubble up and spillover. The only countervailing Germany option will be to tighten fiscal policy even more. Of course, that would further weaken German domestic demand making Germany more reliant on export-led growth that will undermine fellow EMU members by poaching their domestic demand and providing less domestic demand in Germany for them to exploit.

In this way, the EMU is creating an internal dynamic that is harmful while at the same time exporting its excesses troubles and disequilibria to the rest of the world. The weak euro results from a very late stage and probably ineffective program of QE whose main effect is to drive the euro down at a time that the U.S. economy is performing better and the Federal Reserve is `on the brink' of initiating its first rate hike since the financial crisis.

Yes, we can completely understand why this is happening. We can also understand the distortive effects. We can see this as an ongoing pattern of substance abuse (systemic exchange rate abuse) and as part of a global pattern. In the end, the answer to all global problems is clear: someone somewhere needs stimulus and the solution is a weaker exchange rate and that means the U.S. will continue to run a deficit or will run a larger deficit. Japan has already gotten in line for this medicine ahead of Europe. At this point, understanding this mechanism is more a matter of understanding the arithmetic of international deficits than its economics. One man's surplus is another man's deficit.

So the German surpluses are large again and are growing. They are creating mischief. They will make the EMU aggregate trade situation `look better' while undermining the recoveries going on in other EMU members as Germans poach domestic demand to heat up their own export flows. So be careful how you weigh and measure this German surplus. Headlines are not always reporting the things that are in train under the surface. Oh yes, Germany is doing `better.' But it's a `better' than can make some things a lot worse.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.