Global| May 04 2006

Global| May 04 2006Retail Trade Stagnates in Europe, But Shows Some Vigor in Slovenia and South Africa

Summary

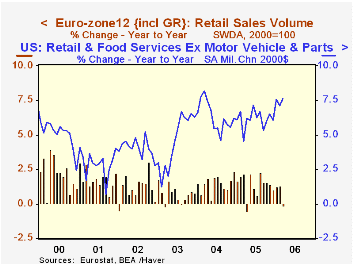

Retailers in several diverse regions are seeing mixed demand, according to data available today for February and March. In the EuroZone12 (the grouping that includes Greece throughout), sales were down 0.8% in March after a 0.1% [...]

Retailers in several diverse regions are seeing mixed demand, according to data available today for February and March. In the EuroZone12 (the grouping that includes Greece throughout), sales were down 0.8% in March after a 0.1% decrease in February. The March drop carried the total down 0.2% below the year-ago amount. As seen in the table below, retailing in the major European nations has hardly been robust over recent years, and these latest data indicate that the trend is not improving. Food stores are the leader in the downward movement, but sales volume at nonfood stores is also weakening.

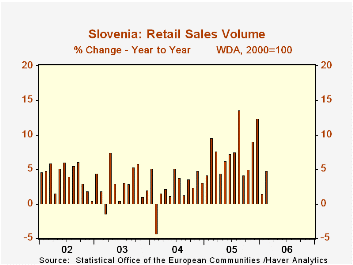

Just on the south side of the Euro-Zone, Slovenia's retail sector looks fairly mixed. Total sales fell in both January and February, but some of February's weakness is due to quirks in the arithmetic of combining the food and nonfood segments into a common index. Each of these categories actually increased, food stores by 2.0% and nonfood outlets by 1.3%. Food recovered somewhat from a steep 13.5% fall in January. In general, though, consumers in Slovenia have been increasing their spending in stores, with 2005 showing total growth of 7.6%.

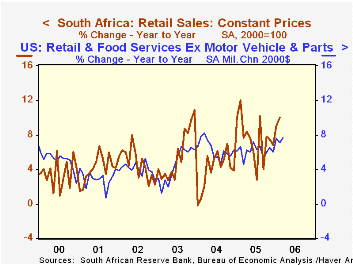

Significantly further south, retail trade in South Africa seems to be going strong. After a hesitation in January, sales in February expanded 3.8%, putting the year-on-year gain at 10.4%.

All of these retail sales figures are seasonally adjusted and adjusted for inflation. They also exclude motor vehicles. To give these data some context, we consulted some US information, the retail sales dataset prepared by the BEA, which includes comparable adjustments. These sales were flat in March and eased by 0.2% in February. So they've slowed too, then, in the last couple of months, although they remain a hefty 7.6% ahead of a year ago. Thus, while European consumers appear to be dragging, in other select regions, they have been spending at a good clip. Now that gasoline prices have taken off again, it will be interesting to see what the reaction of these other spending patterns will be.

The EuroZone data are contained in Haver's EUROSTAT database as is that for Slovenia. Other Slovenia data are in EMERGECW, and South Africa in EMERGEMA. The US series is from those compiled by the BEA from the original Census data; these appear in USECON in the menu just beneath the main Census entry and also in USNA in the Underlying Detail tables.

| Mo/Mo & Yr/Yr % Changes, SA* | Mar 2006 | Feb 2006 | Jan 2006 | Year Ago | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|

| EuroZone12 | -0.8 | -0.1 | 0.5 | -0.2 | 1.3 | 1.5 | 0.7 |

| Food | -1.0 | -0.1 | 0.8 | -0.9 | 0.7 | 1.2 | 1.3 |

| Nonfood | -0.5 | -0.1 | 0.2 | 0.5 | 1.8 | 1.7 | 0.2 |

| Slovenia | -- | -1.1 | -5.3 | 4.8 | 7.6 | 2.6 | 3.0 |

| Food | -- | 2.0 | -13.5 | -1.7 | 7.4 | 3.3 | -1.3 |

| Nonfood | -- | 1.3 | 0.4 | 12.7 | 7.1 | 2.6 | 8.0 |

| South Africa | -- | 3.8 | -1.0 | 10.4 | 6.7 | 9.7 | 4.9 |

| United States** | 0.0 | -0.2 | 2.2 | 7.6 | 6.1 | 6.3 | 4.5 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.