Global| Oct 26 2007

Global| Oct 26 2007Spain Employment Up 3.1% from Year Ago; Spanish Workers and Immigrants Both Gain

Summary

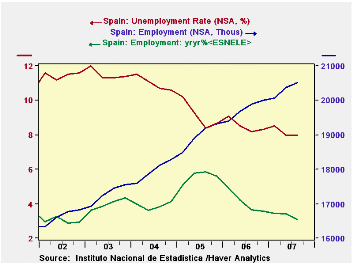

Spain's National Institute of Statistics reported Q3 labor force data today. Their formal term is "Economically Active Population Survey" or EAPS. Employment in this survey rose 143,300 from Q2 to 20.511 million workers, up 3.1% from [...]

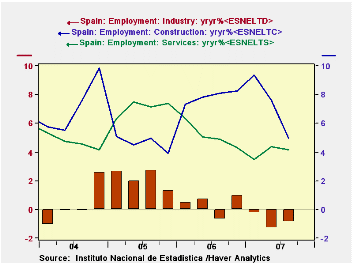

Spain's National Institute of Statistics reported Q3 labor force data today. Their formal term is "Economically Active Population Survey" or EAPS. Employment in this survey rose 143,300 from Q2 to 20.511 million workers, up 3.1% from a year ago. There were notable gains in services, up 4.2% from Q3 2006, and construction, up 4.9%. Employment in industry (mining and manufacturing) is falling off gradually and stood a 3.26 million in Q3 compared to a peak of 3.32 million in Q4 2006. That sector had shown vigorous growth from 1997 through 2003 and has been basically on a plateau since then, so the current reductions would not seem to be a sign of weakness. Construction employment, in contrast, has been growing rapidly since 1997, an average rate of 7.5%; the 4.9% in Q3 is actually the "slowest" since Q4 2005. The service sector, too, has shown vigor, with growth at nearly a 5% pace since 1995.

The Q3 unemployment rate was steady at 8.0%. There was a modest rise in the number of people unemployed, 32,000 from Q1 and 26,000 from a year ago. Unemployment has been restrained, however, in view of a notable advance in the number of economically active population. This rose 175,000 in Q3 and is up 3.0% from Q3 2006. The participation rate stands at a record 59.1% of the population over age 16, up 0.2% from Q2 and 0.7% from a year ago.

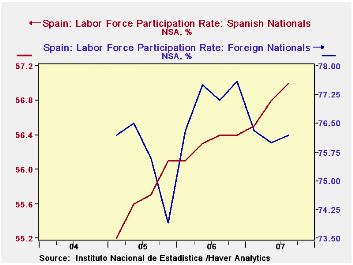

Since 2005, the Spanish labor force data have been distinctive in breaking out Spanish nationals and foreign nationals explicitly. Immigrant workers are important in many countries, and it is really worthwhile to have the Spanish statisticians compile this information. Foreign nationals constitute just under 14% of employment in Spain, 2.846 million of the total 20.511 million; their working numbers grew 328,400 in Q3 from the year earlier, 13.0%. They have a high participation rate, 76.2% in Q3, but one assumes that they come to Spain from their home country in order to seek out job opportunities. Not all are successful; their unemployment rate is 11.8%, higher than the year-ago 10.8%, but off from a recent high in Q1 of 12.6%. The participation rate among Spaniards is 57.0%; this is also up 0.2% from Q2. Their unemployment rate is 7.4%; their employment grew 286,500 over the last year, 1.6%. These series by citizenship group are too short still to do much for any precise econometric analysis, but the differential pattern of the two groups may already be helping describe forces on wages and factors that will affect the further expansion of Spanish industry and markets.

All of these data are in Haver's SPAIN database, as well as G10. The SPAIN database includes "country-sourced" data. In G10, Haver combines summary data for a number of major countries. Our analysts compile some select ratios and conduct seasonal adjustment on some series where it seems warranted. In that database, Spain's employment is seen to be up 91,600 from Q2, and the unemployment rate up 0.2% to 8.2%.

| SPAIN: "EAPS" Data, NSA | Q3 2007 | Q2 2007 | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Total Employment, Millions | 20.51 | 20.37 | 19.90 | 19.75 | 18.97 | 17.97 |

| Yr/Yr % Chg | 3.1 | 3.4 | 3.7 | 4.1 | 5.6 | 3.9 |

| Unemployment Rate (%) | 8.0 | 8.0 | 8.2 | 8.5 | 9.1 | 11.0 |

| Spanish Nationals, Millions | 17.66 | 17.61 | 17.38 | 17.29 | 16.90 | -- |

| Participation Rate (%) | 57.0 | 56.8 | 56.4 | 56.3 | 55.7 | -- |

| Foreign Nationals, Millions | 2.84 | 2.75 | 2.52 | 2.46 | 2.07 | -- |

| Participation Rate (%) | 76.2 | 76.0 | 77.1 | 77.1 | 75.5 | -- |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates