Global| Jun 18 2020

Global| Jun 18 2020State & Pandemic Assistance Continuing Claims at 30.9 million; 19.5% of Labor Force

Summary

• Initial jobless claims edged down to a still extremely-elevated 1.508 million in the week ending June 13. • Federal Pandemic Unemployment Assistance new filers rise to 760.526. • Continuing claim for state programs ticked down to [...]

• Initial jobless claims edged down to a still extremely-elevated 1.508 million in the week ending June 13.

• Federal Pandemic Unemployment Assistance new filers rise to 760.526.

• Continuing claim for state programs ticked down to 20.5 million; PUA at 9.3 million.

• Thirty-one states had insured unemployment rates above 10%, two over 20%.

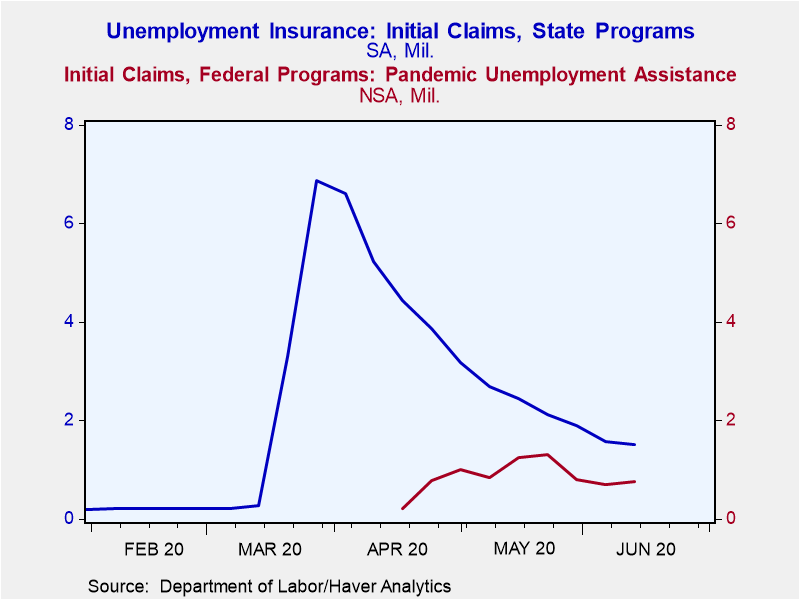

Initial jobless claims for unemployment insurance decreased to 1.508 million during the week ending June 13 from a slightly upwardly-revised 1.566 million (was 1.542 million). The Action Economics Forecast Survey anticipated 1.256 million claims. While substantially lower than the weekly peak of 6.9 million new filers in late March, the current level of initial claims remains well above the previous record of 695,000 set in 1982. The four-week moving average of initial claims, which smooths out week-to-week volatility, but is less important at the moment because of the rapidity of changing conditions, decreased to 1.774 million from 2.008 million.Claims for the federal Pandemic Unemployment Assistance (PUA) program, which covers individuals such as the self-employed who are not qualified for regular/state unemployment insurance, increased to 760.526 in the week ending June 13 from a downwardly-revised 694,463 (was 705,676). PUA claims peaked at 1.310 million in the week ending May 23. Numbers for this and other federal programs are not seasonally adjusted.

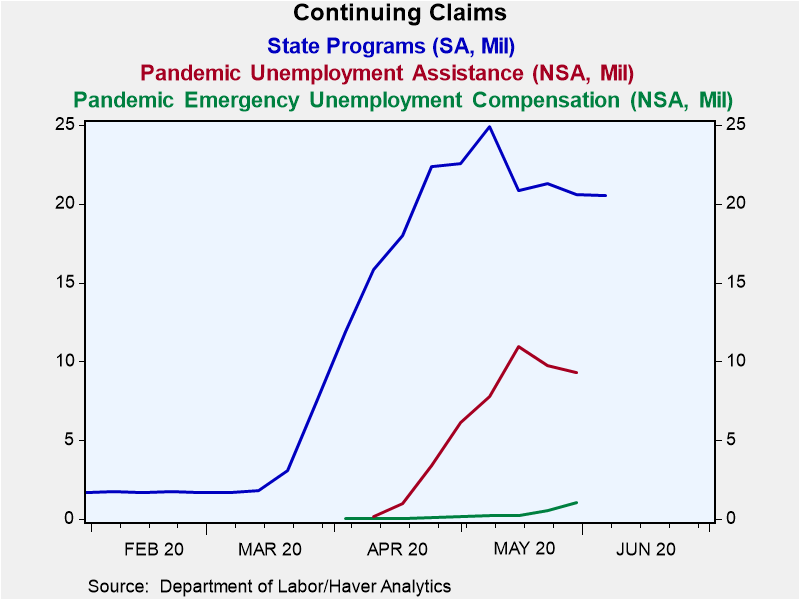

Continuing claims for unemployment insurance edged down to 20.544 million in the week ending June 6, from a downwardly-revised 20.606 million (was 20.929 million). Continuing PUA claims, which are lagged an additional week, declined to 9.281 million from 9.725 million (was 9.716 million). Pandemic Emergency Unemployment Compensation claims nearly doubled to 1.077 million in the week ending May 30. This program covers people who were unemployed before COVID but exhausted their state benefits and are now eligible to receive an additional 13 weeks of unemployment insurance, up to a total of 39 weeks.

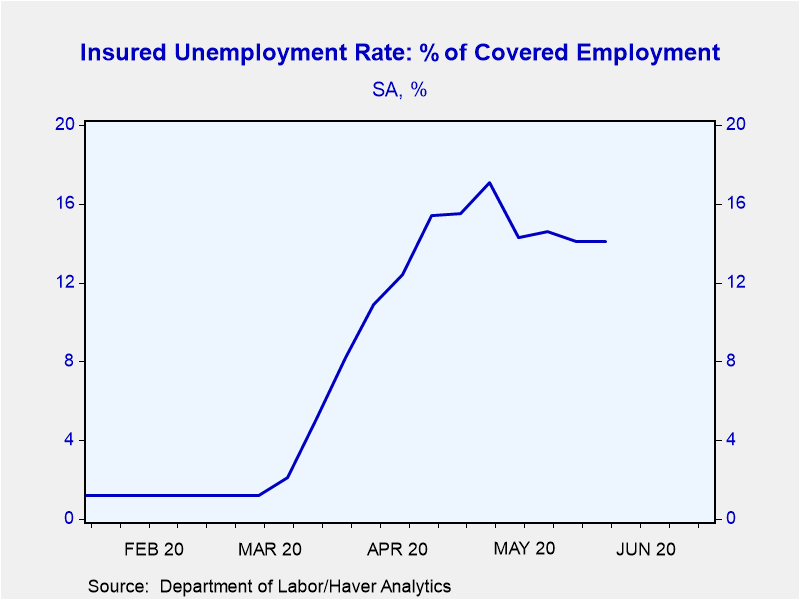

The insured rate of unemployment was unchanged at 14.1% in the week ending June 6; the previous week was revised down from 14.4%. However, this data does not include the federal pandemic assistance programs. If you include the latest data available, which is lagged one additional week, the number of continuing claims totals 30.9 million or represents 19.5% of the labor force. This is unchanged from the previous week – which was revised down from 31.2 million – and the peak of 32.4 million two weeks prior.

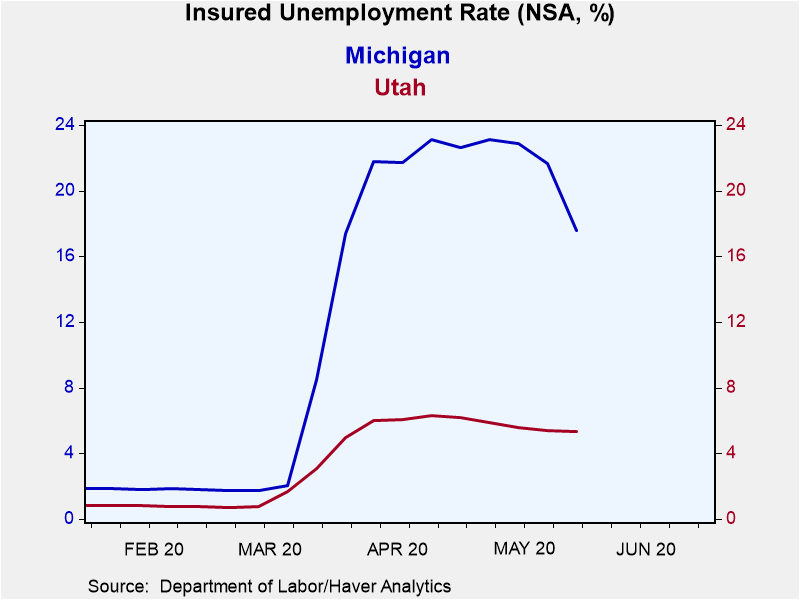

The state insured rates of unemployment – which do not include federal programs – continued to show wide variation with South Dakota at just 4.9% and Nevada at 24.2%. Thirty-one states had rates over 10%, and two states were over 20%. The largest states ranged between 9.9% for Texas and 18.0% for New York. The state rates are not seasonally adjusted.

Data on weekly unemployment claims going back to 1967 are contained in Haver's WEEKLY database, and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics Forecast Survey, carried in the AS1REPNA database.

| Unemployment Insurance (SA, 000s) | 06/13/20 | 06/06/20 | 05/30/20 | Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 1,508 | 1,566 | 1,897 | 589 | 218 | 221 | 244 |

| 4-wk Average | 1,774 | 2,008 | 2,288 | -- | -- | -- | -- |

| Initial Claims Pandemic Unemployment Assistance (NSA) | 761 | 694 | 799 | -- | -- | -- | -- |

| Continuing Claims | -- | 20,544 | 20,606 | 1,125 | 1,701 | 1,756 | 1,961 |

| 4-week Average | -- | 20,815 | 21,907 | -- | -- | -- | -- |

| Continuing Claims Pandemic Unemployment Assistance (NSA) | -- | -- | 9,281 | -- | -- | -- | -- |

| Insured Unemployment Rate (%) | -- | 14.1 | 14.1 |

1.2 |

1.2 | 1.2 | 1.4 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates