Global| Jan 22 2007

Global| Jan 22 2007Stock Markets and Political Risk

Summary

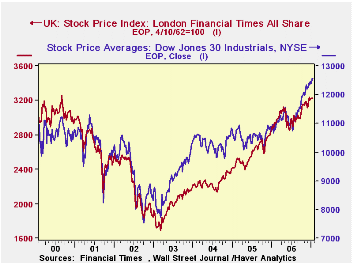

Stock markets at home and abroad were generally ebullient in the last half of 2006 and most continued to rise so far in 2007.In the United States and the United Kingdom the Dow Jones Average and the FTSE 500 surpassed record prices [...]

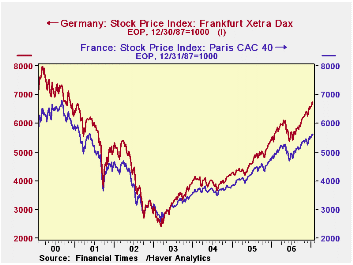

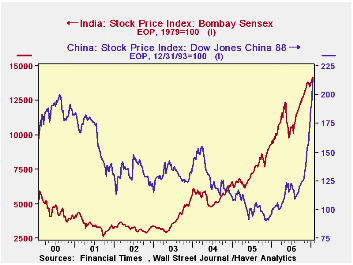

Stock markets at home and abroad were generally ebullient in the last half of 2006 and most continued to rise so far in 2007.In the United States and the United Kingdom the Dow Jones Average and the FTSE 500 surpassed record prices set back in 2000 as shown in the first chart.  Stock markets in France and Germany have not surpassed 2000 levels, but they are getting close as shown in the second chart. The stock market in China has also surpassed its 2000 levels and in India where the stock market only began to surge in 2003, it has broken new records in 2007 as can be seem in the third chart. Data in the first three charts are end of the period weekly data.

Stock markets in France and Germany have not surpassed 2000 levels, but they are getting close as shown in the second chart. The stock market in China has also surpassed its 2000 levels and in India where the stock market only began to surge in 2003, it has broken new records in 2007 as can be seem in the third chart. Data in the first three charts are end of the period weekly data.

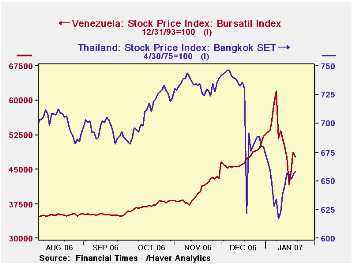

There were however, two markets--Venezuela and Thailand--that experienced severe shocks as a result of political risks.  The imposition of capital controls in Thailand and of nationalization in Venezuela sent the stock markets in these countries reeling. The fourth chart shows the daily prices of stocks on the Venezuelan and Thai stock exchanges. The Thailand stock market was buffeted by the military coup of September 19th and more severely by the imposition of capital controls on December 19th.

The imposition of capital controls in Thailand and of nationalization in Venezuela sent the stock markets in these countries reeling. The fourth chart shows the daily prices of stocks on the Venezuelan and Thai stock exchanges. The Thailand stock market was buffeted by the military coup of September 19th and more severely by the imposition of capital controls on December 19th. The controls were intended to restrain the rise of the baht which had appreciated from the greatly increased capital inflows. At that time the Set Index fell 15% in one day. The Bank of Thailand since rescinded the controls and the market recovered but is still well below levels reached before the controls were imposed. The effect of capital inflows on the exchange rate in those countries whose currencies are allowed to float remains a serious problem for many emerging markets.

The controls were intended to restrain the rise of the baht which had appreciated from the greatly increased capital inflows. At that time the Set Index fell 15% in one day. The Bank of Thailand since rescinded the controls and the market recovered but is still well below levels reached before the controls were imposed. The effect of capital inflows on the exchange rate in those countries whose currencies are allowed to float remains a serious problem for many emerging markets.

It was the prospect of nationalization that hit the Venezuelan stock market. As in the case of Thailand, the market has since recovered, but remains below earlier levels. The re election of Chavez and the election of populist leaders in other Latin American countries have increased the possibility of further political risks.

| Stock Price Indexes | Jan 19 2007 | Dec 29 2006 | Jun 30 2006 | Jan 19/Dec 29 % | Dec 29/Jun 30 % |

|---|---|---|---|---|---|

| US Dow Jones Average | 12,565 | 12,463 | 11,150 | 0.82 | 11.77 |

| UK FTSE 4/10/62=100 | 3,229 | 3,222 | 2,968 | 0.21 | 8.59 |

| France CAC 40 12/31/87=100 | 5,614 | 5,542 | 4,966 | 1.32 | 11.56 |

| Germany Extra Dax 12/30/87=100 | 6,747 | 6,597 | 5,683 | 2.28 | 16.08 |

| China 88 12/31/93=100 | 215 | 188 | 122 | 13.98 | 54.16 |

| India Bombay Sensex Index 1979-100 | 14,183 | 13,787 | 10,609 | 2.87 | 29.95 |

| Thailand SET Index 4/30/75=100 | 658.17 | 679.84 | 678.13 | -3.19 | 0.25 |

| Venezuela Bursatil Index 12/31/93=100 | 47,722 | 52,234 | 30,747 | -8.64 | 69.88 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates