Global| Oct 23 2017

Global| Oct 23 2017U.K. Industrial Situation Deteriorates

Summary

U.K. orders fell to -2 in October from a level of 7 in September, dropping into negative territory (the number of firms saying orders are expanding is lower than the number that is saying orders are contracting). But the -2 reading is [...]

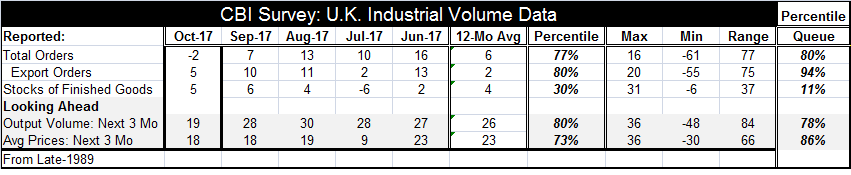

U.K. orders fell to -2 in October from a level of 7 in September, dropping into negative territory (the number of firms saying orders are expanding is lower than the number that is saying orders are contracting). But the -2 reading is still one with an 80th percentile standing, marking it as still a relatively strong reading despite its negative value. Export orders also fell, dropping to 5 from September's 10 and holding onto a 94th percentile queue standing. Stocks of finished goods slipped to 5 in October from 6 in September, displaying a low 11th percentile queue standing.

U.K. orders fell to -2 in October from a level of 7 in September, dropping into negative territory (the number of firms saying orders are expanding is lower than the number that is saying orders are contracting). But the -2 reading is still one with an 80th percentile standing, marking it as still a relatively strong reading despite its negative value. Export orders also fell, dropping to 5 from September's 10 and holding onto a 94th percentile queue standing. Stocks of finished goods slipped to 5 in October from 6 in September, displaying a low 11th percentile queue standing.

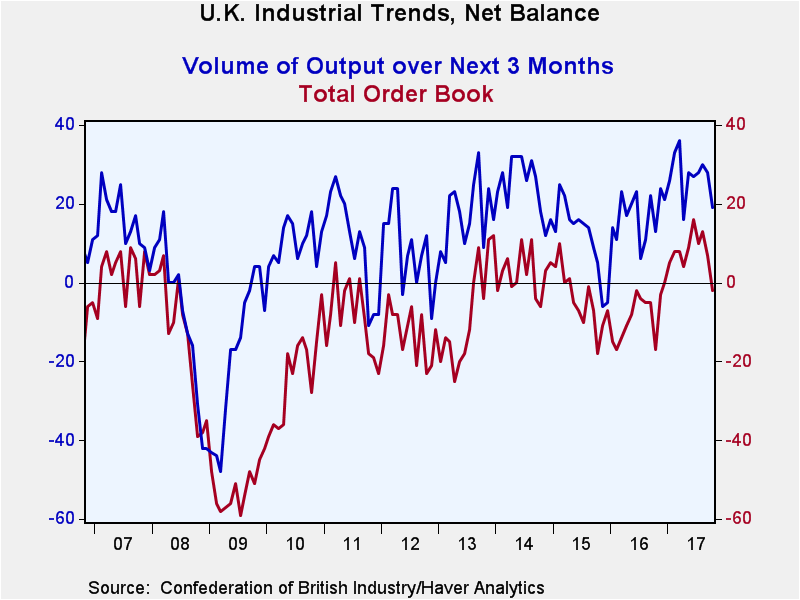

The forward-looking indicator for output volume over the next three months fell sharply to 19 from 28 to a 78th percentile queue standing. Average prices expected for the next three months held steady at a reading of 18 which has an 86th percentile queue standing.

The readings for total orders, output volume over the next three months, and average prices over the next three months are substantially below their 12-month averages. Export orders and the stock of finished goods are slightly above their 12-month averages. Despite all the concerns about Brexit, foreign orders are (so far) holding up better than domestic orders.

However, Brexit is never far from anyone's mind in the U.K. The Mayor of London today warned that firms were not bluffing when they threatened to move business out of the U.K. unless some orderly transition could be arranged. The kind of uncertainty that Brexit raises for businesses operations in the U.K. is simply lethal to most firms. They need to be able to plan. They need to know whether investment in their current operation makes sense. If a firm in London is doing business in another EU member country, it needs to know how its business and products are going to be treated when the deal from the arrangement for Brexit closes.

Markit PMI data will be on tap this week and we will get a broader reading on the U.K. as well as on how the rest of the world is doing. The U.S. reported regional surveys from two Federal Reserve district banks in New York and Philadelphia last week reported vibrant business in the U.S. However, there is some suspicion the hurricane-related demands may be stoking U.S. manufacturing temporarily. Moreover, the broad national U.S. ISM indexes and the Markit indexes are giving different reading on the state of the U.S. economy. While U.S. GDP is set to be released this week for Q3, there is already industrial output data in hand for the quarter showing the industrial output decline in Q3 and it managed to do that while logging strong PMI readings across all the months.

PMI data are not the be-all and end-all. The CBI U.K. survey is another survey of that ilk aggregating up/down responses on industries counting up those that expand vs. those that contract to form a final verdict across certain categories of questions and in various 'industries.' The surveys are useful partly because they are so timely, but they can be distorted. PMI surveys are about the breadth of expansion or increases and 'breadth' is highly-correlated with 'strength' but breadth is not strength. It's important to keep that in mind when vetting data from these sorts of surveys. It is one of the reasons I also like to benchmark the meaning of the survey with the percentile queue standing that is associated with a PMI or raw 'up vs. down' value. In the case of the CBI, zero is the magic number that divides expansion from contraction. Yet, we find overall U.K. orders are at a -2 reading and that such a reading also has an 80th percentile queue standing (higher only 20% of the time). The -2 raw score looks weak. But is something that is only stronger 20% of the time really weak? Alternatively, is something that is stronger only 20% of the time really strong if that thing is showing more weakening than strengthening across respondents? These are good questions to bear in mind as you vet the CBI survey and prepared for the Markit PMIs (whose key value is a boom-bust line at 50).

On balance, U.K. industry is losing some momentum. Orders are weakening and so is the outlook for volume; prices are still firmer than most other categories. Because of the weak pound sterling, exporters in the U.K. still show a stronger orders standing than domestic enterprises. But where things stand now is just a snapshot in time. The real question is where are things headed? The Brexit talks continue to go slowly and remain as an issue and as a negative one for the outlook. Plus, momentum is fading.

Financial institutions have had the hardest time deciding what to do especially since new rules governing the future financial relationships between the U.K. and the EU have not been set. And lots of bankers are expats and lot of bankers are British. If banking were to move from London, presumably a number of various local nationals would be employed but there are also a lot of British expats that would likely want to move and would need the correct papers and authorizations. When the U.K. lease on Hong Kong ran out and reverted to China, Hong Kong and Shanghai Bank moved the domicile and incorporation of its headquarters. Similarly, banks operating in the U.K. will have to think about offices and headquarters issues (Do they need to move HQ?; change their incorporation?; set up a subsidiary?; or operate out of a branch?). Especially in a world where banking regulation has divided up the world like a Japanese lunch box, these issues matter. Catalonia is trying to secure its independence from Spain. Spain is invoking rules to extend its reach into Catalonia. No one is sure what is happening here. But several local banks have reported thinking about changing the domicile of their headquarters and incorporation. These sorts of things mean a great deal in the modern economy because they determine your regulator, your lender of last resort, your provider of liquidity, and set the rules you must follow in your operations. The Brexit talks do need to speed up and seek clarity.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.