Global| Oct 01 2014

Global| Oct 01 2014U.S. ADP Employment Increase Remains Moderate M/M; Factory Hiring Jumps

by:Tom Moeller

|in:Economy in Brief

Summary

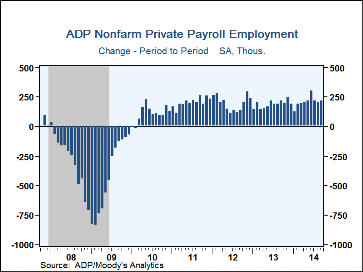

The ADP/Moody's National Employment Report indicated that hiring remained in the moderate growth range of the last six months. Private sector employment improved last month to 213,000 (2.2% y/y) following a 202,000 August increase, [...]

The ADP/Moody's National Employment Report indicated that hiring remained in the moderate growth range of the last six months. Private sector employment improved last month to 213,000 (2.2% y/y) following a 202,000 August increase, revised from 204,000. The y/y increase of 2.2% extended the steady pace in place since the middle of 2012. The Action Economics Forecast Survey had expected a 207,000 increase.

The ADP survey is based on ADP's business payroll transaction system covering 411,000 companies and nearly 24 million employees. The data are processed by Moody's Analytics Inc., then calibrated and aligned with the BLS establishment survey data. Extensive information on the methodology is available here.

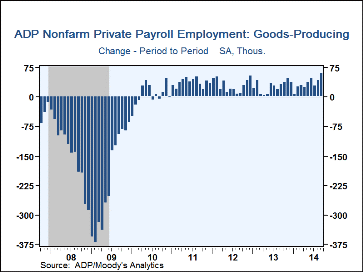

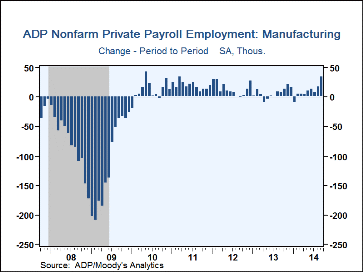

Hiring in the goods-producing sector gained 58,000 (2.2% y/y), the strongest increase since February 2006. Factory sector payrolls grew 35,000 (1.1% y/y) and was the largest increase since May 2010. Construction industry jobs increased 20,000 (4.1% y/y) down from 23,000 rise during August.

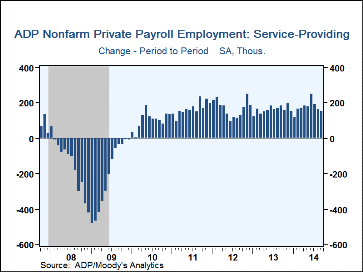

Service-providing payrolls grew 155,000 (2.2% y/y), off from the 160,000 August rise. Industry growth varied. Trade, transportation and utilities added 38,000 jobs (2.0%) after a 30,000 gain. Financial activities jobs increased a steady 6,000 (0.8% y/y). Professional and business services added 29,000 jobs (3.2% y/y), the smallest increase February 2010.

Small businesses' payrolls rose an improved 88,000 in September (2.2% y/y) after gaining 81,000 in August. Medium-sized firms added a lessened 48,000 (1.9% y/y) after a 72,000 rise. Large-size company payrolls were strong and improved 77,000 (2.6% y/y) after 48,000 in August.

The ADP National Employment Report data are maintained in Haver's USECON database; historical figures date back to April 2001. The figures in this report cover jobs only in the private sector. The expectation figure is available in Haver's AS1REPNA database.

| ADP/Moody's National Employment Report | Sep | Aug | Jul | Y/Y | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| Nonfarm Private Payroll Employment (m/m chg, 000s) | 213 | 202 | 217 | 2.2% | 2.0% | 2.3% | 1.8% |

| Small Payroll (1-49) | 88 | 82 | 96 | 2.2 | 2.1 | 2.5 | 1.1 |

| Medium Payroll (50-499) | 48 | 72 | 85 | 1.9 | 1.6 | 2.0 | 2.0 |

| Large Payroll (>500) | 77 | 48 | 36 | 2.6 | 2.3 | 2.4 | 2.7 |

| Goods-Producing | 58 | 42 | 27 | 2.2 | 1.6 | 2.2 | 1.7 |

| Manufacturing | 35 | 16 | 7 | 1.1 | 0.6 | 1.6 | 1.9 |

| Service-Producing | 155 | 160 | 189 | 2.2 | 2.0 | 2.3 | 1.8 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates