Global| Dec 06 2018

Global| Dec 06 2018U.S. ADP Private Sector Payroll Growth Eases

by:Tom Moeller

|in:Economy in Brief

Summary

The ADP National Employment Report indicated that private nonfarm payrolls increased 179,000 during November following a 225,000 October rise, revised from 227,000. Expectations had been for a 195,000 gain in the Action Economics [...]

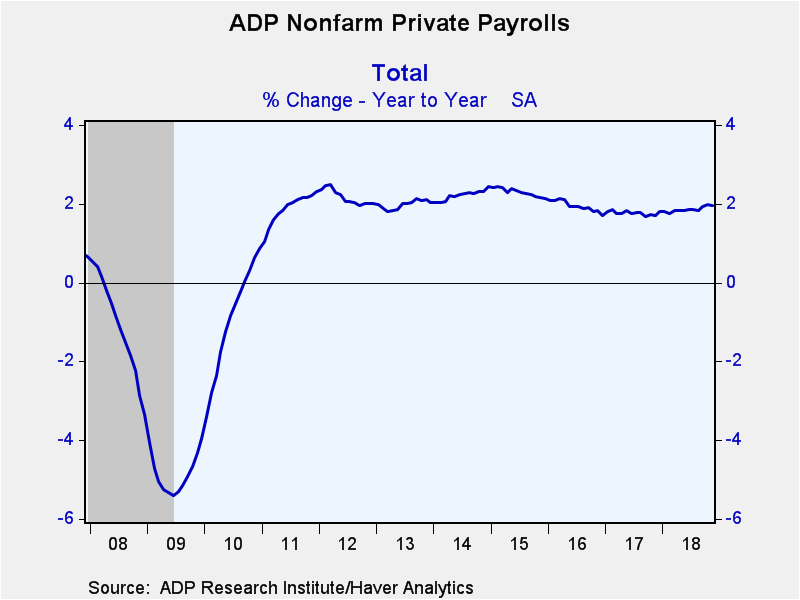

The ADP National Employment Report indicated that private nonfarm payrolls increased 179,000 during November following a 225,000 October rise, revised from 227,000. Expectations had been for a 195,000 gain in the Action Economics Forecast Survey. So far this year, private nonfarm payrolls have risen by 201,000 on average per month versus a 185,000 average during 2017. During the last ten years, there has been a 96% correlation between the change in the ADP figure and the change in nonfarm private-sector payrolls as measured by the Bureau of Labor Statistics.

The ADP National Employment Report is calculated from ADP's business payroll transaction system covering 411,000 companies and nearly 24 million employees. The data is calibrated and aligned with the Bureau of Labor Statistics establishment survey data and is produced by the Automatic Data Processing Research Institute in collaboration Moody's Analytics Inc. The ADP data only cover private sector employment.

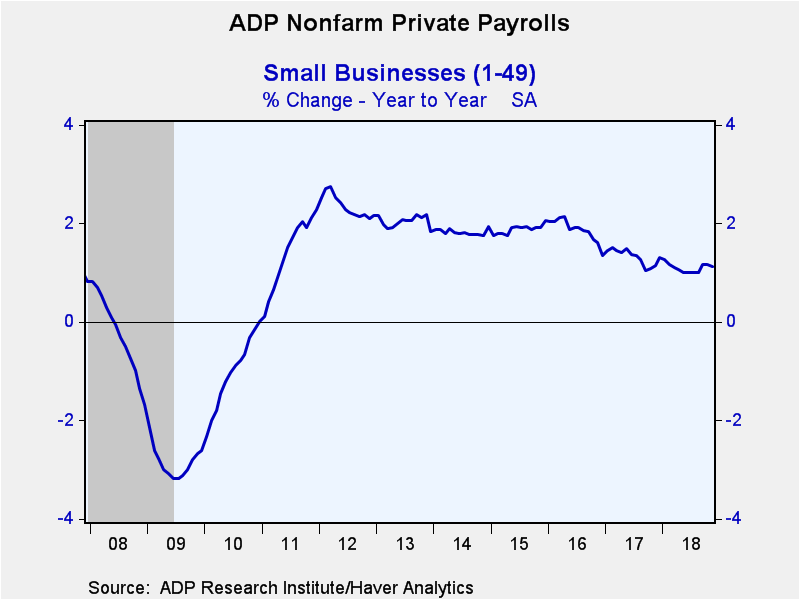

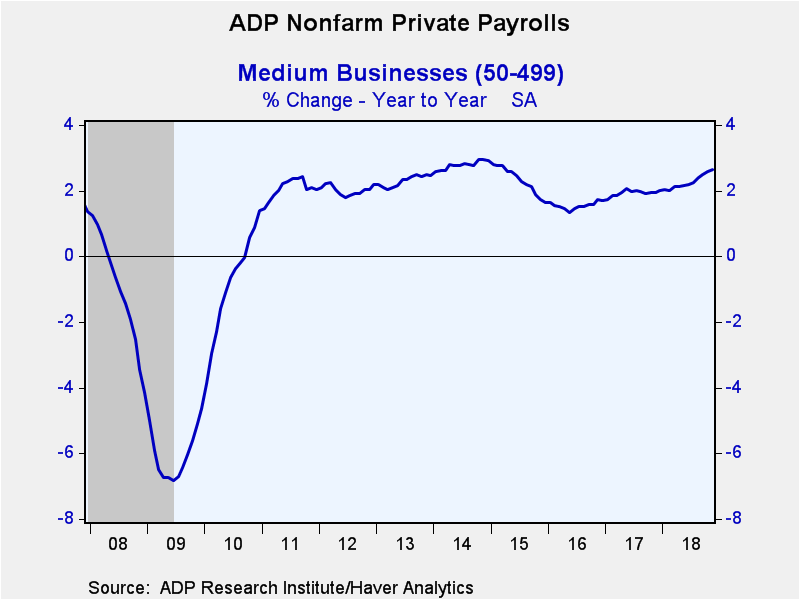

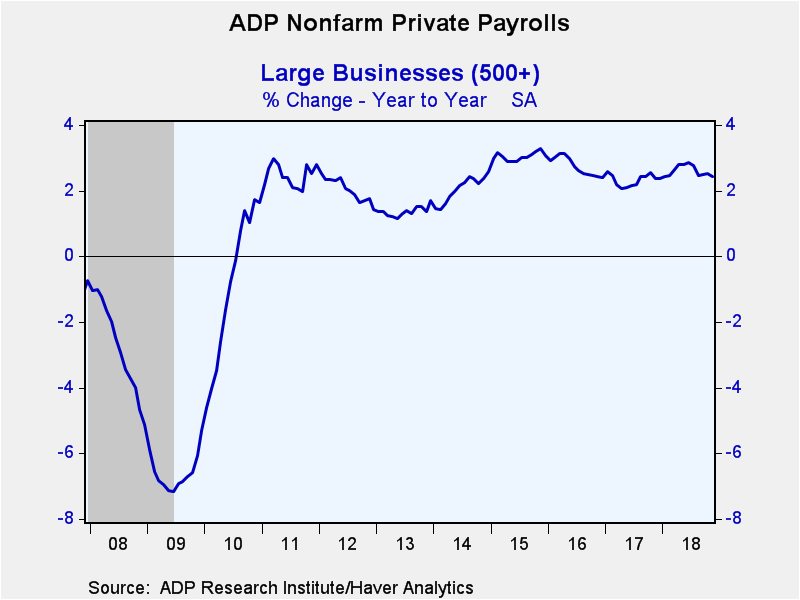

Small business payrolls increased 46,000 (1.1% y/y) following a 30,000 rise. The three-month average gain of 39,000 compared to a January high of 78,000. Medium-sized payrolls gained 119,000 (2.6% y/y) and a steady 102,000 on a three-month basis. Large payrolls rose a lessened 13,000 (2.4% y/y) and a firm 62,000, on average, during the last three months.

Goods-producing payrolls increased 16,000 (2.3% y/y) in November, down versus 36,000 on a three-month basis. Construction sector payrolls rose 10,000 (3.1% y/y), below the 20,000 three-month average. Manufacturing sector employment edged 4,000 higher (1.6% y/y) and by a slightly reduced 12,000 during the last three months. Natural resource and mining sector payrolls grew a weaker 2,000 (7.3% y/y) and by a lessened 3,000 during the last three months.

Private service sector payrolls advanced a steady 163,000 (1.9% y/y). Professional and business services payrolls rose 59,000 (2.8% y/y) after a 37,000 rise. Leisure & hospitality employment gained a lessened 26,000 (2.1% y/y). Jobs in education health services rose a strengthened 41,000 (2.1% y/y). Trade, transportation & utilities increased 18,000 (1.3% /y), down from 50,000 in October. Employment in the financial services sector rose 8,000 (1.5% y/y), less than the 14,000 Q3 average, and information sector employment eased 1,000 (0.1% y/y) after a 7,000 rise.

The ADP National Employment Report data can be found in Haver's USECON database; historical figures date back to April 2001 for the total and industry breakdown, and back to January 2005 for the business size breakout. The expectation figure is available in Haver's AS1REPNA database

| ADP/Moody's National Employment Report | Nov | Oct | Sep | Nov Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Nonfarm Private Payroll Employment (m/m chg, 000s) | 179 | 225 | 209 | 2.0% | 1.8% | 1.9% | 2.3% |

| Small Payroll (1-49) | 46 | 30 | 42 | 1.1 | 1.3 | 1.9 | 1.9 |

| Medium Payroll (50-499) | 119 | 95 | 93 | 2.6 | 1.9 | 1.5 | 2.3 |

| Large Payroll (>500) | 13 | 100 | 74 | 2.4 | 2.3 | 2.7 | 3.0 |

| Goods-Producing | 16 | 44 | 47 | 2.3 | 1.5 | 0.8 | 2.0 |

| Construction | 10 | 19 | 32 | 3.1 | 3.1 | 4.3 | 5.3 |

| Manufacturing | 4 | 21 | 11 | 1.6 | 0.7 | 0.2 | 1.2 |

| Service-Producing | 163 | 181 | 162 | 1.9 | 1.8 | 2.2 | 2.3 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates