Global| Jan 23 2002

Global| Jan 23 2002U.S. Budget Deficit Growing

by:Tom Moeller

|in:Economy in Brief

Summary

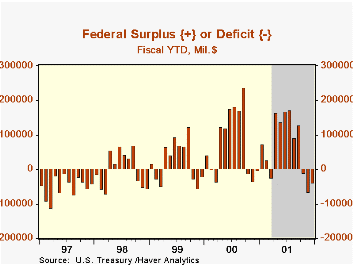

The US budget balance improved to surplus in December due to a seasonal surge in revenues. The fiscal year-to-date budget deficit nevertheless remained at it's deepest since 1998. Receipts rose sharply in most major categories with [...]

The US budget balance improved to surplus in December due to a seasonal surge in revenues. The fiscal year-to-date budget deficit nevertheless remained at it's deepest since 1998.

Receipts rose sharply in most major categories with individual income tax receipts actually up versus last year. Corporate income tax receipts were down 28.1% versus last year.

Expenditures were down versus November due to across-the-board declines amongst categories.

The Congressional Budget Office today announced that it expects a $21B budget deficit for FY 2002 and a $14B deficit in 2003.

| US Government Finance | Dec '01 | Nov '01 | Fiscal YTD | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Budget Balance | $26.6B | $-54.3B | $-37.1B | $127.2B | $236.9B | $124.4B |

| Revenues | 55.0% | -22.9% | 0.9% | -1.7% | 0.8% | 6.1% |

| Outlays | -8.1% | 5.4% | 8.4% | 4.2% | 5.0% | 3.1% |

by Tom Moeller January 23, 2002

Chain store sales rose 0.7% in the latest week, building on a 0.6% gain during the prior week. For the first three weeks of January sales were up 2.0% versus December.

The results were encouraging and an improved tone to sales is confirmed by the Redbook Store sales figures.

During the last five years there has been a 56% correlation between the annual percent change in chain store sales and retail sales at general merchandise stores.

| BTM-UBSW (SA, 1977=100) | 01/19/02 | 01/12/02 | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Total Weekly Retail Chain Store Sales | 400.0 | 397.4 | 3.8% | 2.1% | 3.4% | 6.7% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates