Global| Dec 30 2008

Global| Dec 30 2008U.S. Chain Store Sales Ticked Up But Still Near Lows

by:Tom Moeller

|in:Economy in Brief

Summary

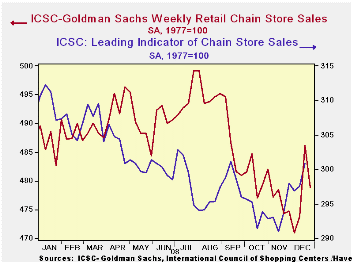

Chain store sales during Christmas week gave nothing to cheer about, according to the International Council of Shopping Centers-Goldman Sachs Index. The level of sales last week fell 1.5% and that reversed about half of the prior [...]

The ICSC-Goldman Sachs retail chain-store sales index is constructed using the same-store sales (stores open for one year) reported by 78 stores of seven retailers: Dayton Hudson, Federated, Kmart, May, J.C. Penney, Sears and Wal-Mart.

Perhaps better news on sales are in store. The weekly leading indicator of chain store sales from ICSC-Goldman Sachs jumped another 1.1% after a 0.2% rise during the prior week. And since the lows of several weeks ago the index has recovered 3.4%.The chain store sales figures are available in Haver's SURVEYW database.

| ICSC-UBS (SA, 1977=100) | 12/27/08 | 12/20/08 | Y/Y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|

| Total Weekly Chain Store Sales | 478.9 | 486.1 | -1.8% | 1.4% | 2.8% | 3.3% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates