Global| Jun 02 2014

Global| Jun 02 2014U.S. Construction Spending Growth is Modest

by:Tom Moeller

|in:Economy in Brief

Summary

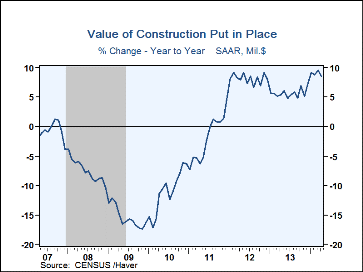

The value of construction put-in-place during April improved 0.2% (8.6% y/y) following a 0.6% March increase, revised from 0.2%. So far in 2014, the value of construction spending has risen 0.7%, a result held back by severe winter [...]

The value of construction put-in-place during April improved 0.2% (8.6% y/y) following a 0.6% March increase, revised from 0.2%. So far in 2014, the value of construction spending has risen 0.7%, a result held back by severe winter weather. The latest increase disappointed expectations for a 0.6% rise in the Action Economics Forecast Survey.

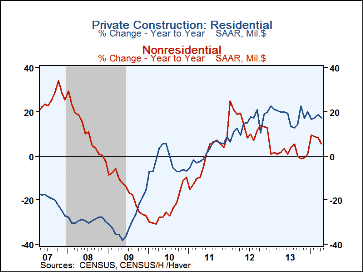

Private sector construction outlays slipped marginally in April (+1.7% y/y) after a 0.7% March gain. Residential building added minimally (17.2% y/y) to gains near 1.5% in the prior two months. Single-family homebuilding strengthened 1.3% (14.5% y/y) after a 0.7% March rise. Multi-family building jumped 2.7% (31.2% y/y), but spending on improvements declined 2.2% (15.8% y/y). Nonresidential construction spending slipped minimally (+5.6% y/y) and remained down 3.5% during the last four months.

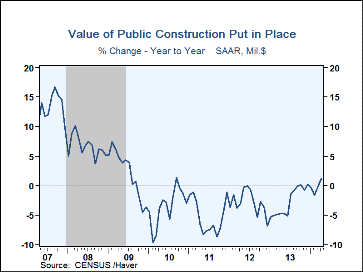

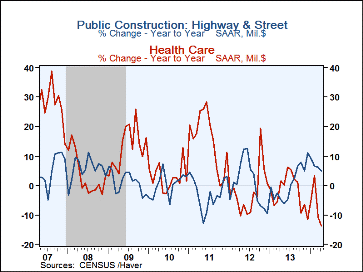

The value of public sector building activity improved 0.8% (1.2% y/y) but remained down slightly so far this year. Spending on power plants fell 5.1% (+15.6% y/y) while spending on highways & streets declined 1.7% (+4.9% y/y), the third decline this year. To the upside, educational building gained 3.0% (4.9% y/y) and health care building rose 1.6% (-13.8% y/y).

The construction spending figures are in Haver's USECON database and the expectations figure is contained in the AS1REPNA database.

The Slowdown in Residential Investment and Future Prospects from the Federal Reserve Bank of Cleveland is available here.

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates