Global| Nov 26 2013

Global| Nov 26 2013U.S. Consumer Confidence Falls Further in November

by:Sandy Batten

|in:Economy in Brief

Summary

Consumer confidence fell further in November - to 70.4 after having plunged in October from September's 80.2. The outsize October move had been attributed mostly to the federal government shutdown and budget battle that had transpired [...]

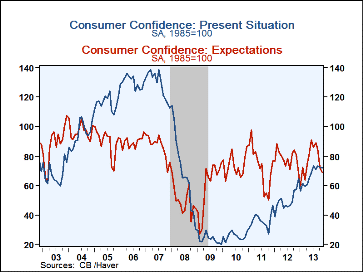

Consumer confidence fell further in November - to 70.4 after having plunged in October from September's 80.2. The outsize October move had been attributed mostly to the federal government shutdown and budget battle that had transpired during the first half of October. This is the lowest reading on consumer confidence since April. The market consensus had looked for a small rebound in confidence in November. The decline in overall confidence continued to be driven by considerably more pessimistic expectations. The expectations index has fallen nearly 22 points since June.

Consumer confidence fell further in November - to 70.4 after having plunged in October from September's 80.2. The outsize October move had been attributed mostly to the federal government shutdown and budget battle that had transpired during the first half of October. This is the lowest reading on consumer confidence since April. The market consensus had looked for a small rebound in confidence in November. The decline in overall confidence continued to be driven by considerably more pessimistic expectations. The expectations index has fallen nearly 22 points since June.

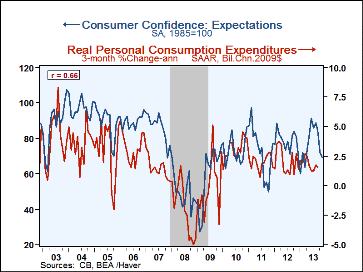

Historically, changes in consumer confidence have been linked to changes in personal consumption. So, the significant hit to consumer confidence this fall clearly poses some risk to the upcoming Christmas-selling season. Indeed, surveys of purchase intentions (for homes, major appliances, autos over the next six months) experienced significant declines in November.

Looking at the detail, confidence continued to fall in the under 35 and under age group (where the October drop had been concentrated) but rebounded slightly in the over 55 age group. By income strata, confidence of those earning less than $15,000 and of those earning more than $50,000 took another significant step down in November, while confidence in the income groups in between rose slightly.

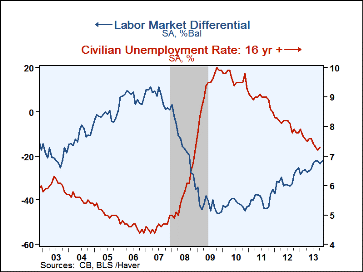

The labor market differential (the difference between respondents' appraisal of jobs plentiful and jobs hard to get) continued to edge up. Historically, this differential has had a close relationship with the unemployment rate. So, its continued improvement points to further improvement in the unemployment rate.

The Consumer Confidence data is available in Haver's CBDB database.

| Conference Board (SA, 1985=100) | Nov | Oct | Sep | Y/Y % | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|

| Consumer Confidence Index | 70.4 | 72.4 | 80.2 | -1.54 | 67.1 | 58.1 | 54.5 |

| Present Situation | 72.0 | 72.6 | 73.5 | 25.44 | 49.8 | 36.1 | 25.7 |

| Expectations | 69.3 | 72.2 | 84.7 | -14.34 | 78.6 | 72.8 | 73.7 |

| Consumer Confidence By Age Group | |||||||

| Under 35 Years | 79.7 | 83.7 | 109.4 | -17.41 | 86.5 | 77.3 | 70.4 |

| Aged 35-54 Years | 78.7 | 82.0 | 87.4 | 8.55 | 68.5 | 59.8 | 55.1 |

| Over 55 Years | 59.6 | 57.9 | 62.9 | -0.83 | 56.7 | 47.3 | 47.4 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.