Global| Dec 30 2008

Global| Dec 30 2008U.S. Consumer Confidence Fell Back To A Historic Low

by:Tom Moeller

|in:Economy in Brief

Summary

Worry about jobs, income and the future shape of business conditions weighed heavily on consumer psychology. For December, the Conference Board indicated that consumer confidence fell and washed away a slight improvement in November. [...]

Worry about

jobs, income and the future shape of business conditions weighed

heavily on consumer psychology. For December, the Conference Board

indicated that consumer confidence fell and washed away a slight

improvement in November. The 15.0% month-to-month decline in confidence

was to an index level of 38.0 which was the lowest in the series'

history which extends back to 1967. The decline disappointed Consensus

expectations for a modest improvement in the December index to 45.5.

Worry about

jobs, income and the future shape of business conditions weighed

heavily on consumer psychology. For December, the Conference Board

indicated that consumer confidence fell and washed away a slight

improvement in November. The 15.0% month-to-month decline in confidence

was to an index level of 38.0 which was the lowest in the series'

history which extends back to 1967. The decline disappointed Consensus

expectations for a modest improvement in the December index to 45.5.

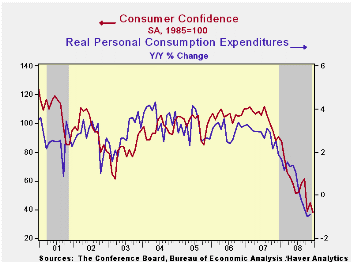

During the last ten years there has been a 82% correlation between the level of consumer confidence and the y/y change in real consumer spending.

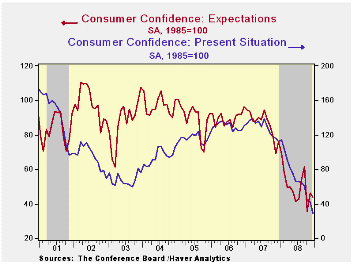

A decline in consumers' reading of current economic conditions was responsible for most of the decline in overall confidence this month. The index measure fell by nearly one-third from the November level and the latest reading was down by three-quarters from last December's figure.

The index of consumers' expectations fell a slight 5.2% month-to-month and it has been relatively stable this year near a historically low level.

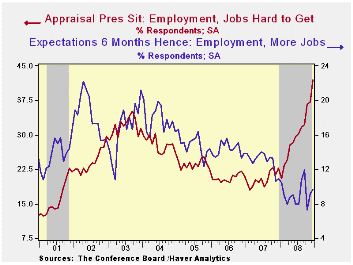

Only 7.7% of respondents thought that business conditions were good and 46.0% thought they were bad, up from 16.2% during all of last year. A gloomy reading of the current job market was notably evident as 42.0% thought that jobs were hard to get, double last year's percentage and up five percentage points just since last month.

Moving somewhat counter to the increase in gloom about the

short-term economy was that 2.5% of respondents planned to buy a home

during the next six months, up from 2.1% in November. The reading was,

however, still near the series' historic low. Also showing

slight m/m improvement were plans to buy an appliance or an automobile,

but both measures also still were near their all time lows.

Expectations for the inflation rate in twelve months fell further 5.8%, the lowest level since February.

The Conference Board figures referenced above are available in Haver's CBDB database.

| Conference Board (SA, 1985=100) | December | November | Y/Y % | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|

| Consumer Confidence Index | 38.0 | 44.7 | -58.1 | 57.9 | 103.4 | 105.9 |

| Present Situation | 29.4 | 42.3 | -74.0 | 69.8 | 128.8 | 130.2 |

| Expectations | 43.8 | 46.2 | -42.2 | 49.9 | 86.4 | 89.7 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates