Global| May 27 2005

Global| May 27 2005U.S. Consumer Sentiment A Bit Better

by:Tom Moeller

|in:Economy in Brief

Summary

The University of Michigan's reading of consumer sentiment for all of May did fall 0.9% from the prior month to 85.9 but that was better than the mid-month reading of a 2.7% decline. Consensus expectations had been for a level of [...]

The University of Michigan's reading of consumer sentiment for all of May did fall 0.9% from the prior month to 85.9 but that was better than the mid-month reading of a 2.7% decline. Consensus expectations had been for a level of 86.0.

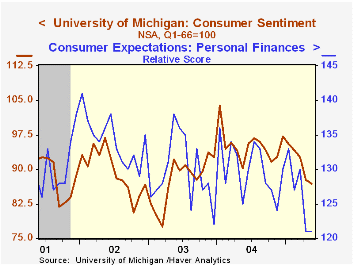

Sentiment still is down in each of the last five months and is off 16.3% from the January '04 peak. During the last ten years there has been a 75% (inverse) correlation between the level of consumer sentiment and the y/y change in real PCE, although the correlation has fallen in recent years.

The reading of current economic conditions recovered late in the month and rose for the first full month since January. Buying conditions for large household goods recovered sharply.

Consumer expectations recovered though expectations about personal finances remained depressed.

The University of Michigan survey is not seasonally adjusted.The mid-month survey is based on telephone interviews with 250 households nationwide on personal finances and business and buying conditions. The survey is expanded to a total of 500 interviews at month end.

| University of Michigan | May | April | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Consumer Sentiment | 86.9 | 87.7 | -3.7% | 95.2 | 87.6 | 89.6 |

| Current Conditions | 104.9 | 104.4 | 1.3% | 105.6 | 97.2 | 97.5 |

| Consumer Expectations | 75.3 | 77.0 | -7.7% | 88.5 | 81.4 | 84.6 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates