Global| Dec 07 2012

Global| Dec 07 2012U.S. Consumer Sentiment Weakens Markedly in Early December

Summary

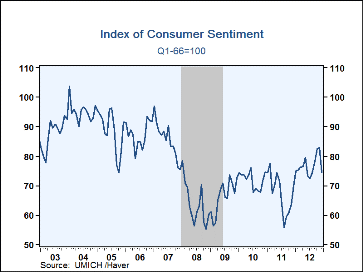

The University of Michigan's Index of Consumer Sentiment dropped sharply in early December to 74.5 (Q1 1966 = 100) from 82.7 in November. This move negated market forecasts for a steady reading of 82.8, and returned the index about to [...]

The University of Michigan's Index of Consumer Sentiment dropped sharply in early December to 74.5 (Q1 1966 = 100) from 82.7 in November. This move negated market forecasts for a steady reading of 82.8, and returned the index about to its August value of 74.3 after a three-month improvement that had carried the measure back to pre-recession levels.

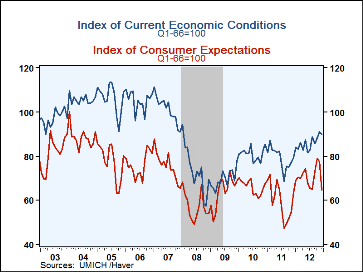

Notably, consumers' judgment of current conditions held up pretty well, edging lower by less than 1 point to 89.9 from 90.7 for November. This means both November and December readings are above September's 85.7 and October's 88.1, suggesting that Hurricane Sandy did not have a visible impact on people's feeling about the economy. However, their expectations suffered significantly in recent weeks, as that subset of the index fell to 64.6 from 77.6 in November. This 13.0-point drop is one of four equally steep one-month plunges in the last 25 years. We would guess that people are distressed over the lack of movement in the fiscal cliff negotiations in Washington and concerned about impending tax hikes and the spending sequester that could result.

The Reuters/University of Michigan survey data are not seasonally adjusted. The readings are based on telephone interviews with over 300 households. Data can be found in Haver's USECON database. The forecast figure is from Action Economics and can be found in Haver's AS1REPNA database.

| University of Michigan (Q1'66 = 100) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Mid-Dec | Nov | Oct | Sep | Dec 2011 | 2012 | 2011 | 2010 | |

| Consumer Sentiment | 74.5 | 82.7 | 82.6 | 78.3 | 69.9 | 76.7 | 67.3 | 71.8 |

| Current Economic Conditions | 89.9 | 90.7 | 88.1 | 85.7 | 79.6 | 85.9 | 79.1 | 80.9 |

| Consumer Expectations | 64.6 | 77.6 | 79.0 | 73.5 | 63.6 | 70.8 | 59.8 | 66.0 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.