Global| Feb 14 2018

Global| Feb 14 2018U.S. CPI Rises More than Expected in January

by:Sandy Batten

|in:Economy in Brief

Summary

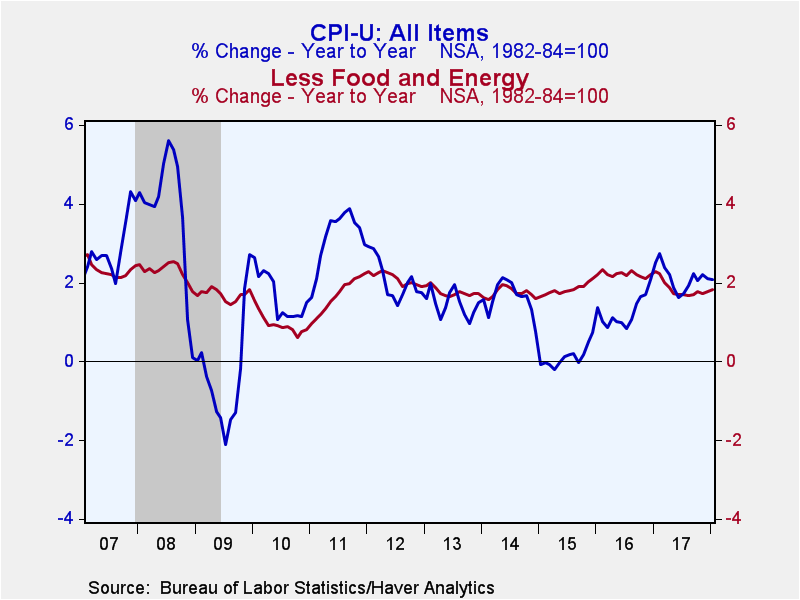

The Consumer Price Index jumped up 0.5% m/m (2.1% y/y) in January following a 0.2% m/m rise in December. The core index (that is, excluding food and energy prices) increased a more modest 0.3% m/m (1.8% y/y) after a 0.2% m/m gain in [...]

The Consumer Price Index jumped up 0.5% m/m (2.1% y/y) in January following a 0.2% m/m rise in December. The core index (that is, excluding food and energy prices) increased a more modest 0.3% m/m (1.8% y/y) after a 0.2% m/m gain in December. That was the largest monthly increase for the core index since January 2017. Both January increases were larger than the consensus expectation in the Action Economics Forecast Survey, which had looked for a 0.3% m/m rise in the headline index and a 0.2% m/m rise in the core index.

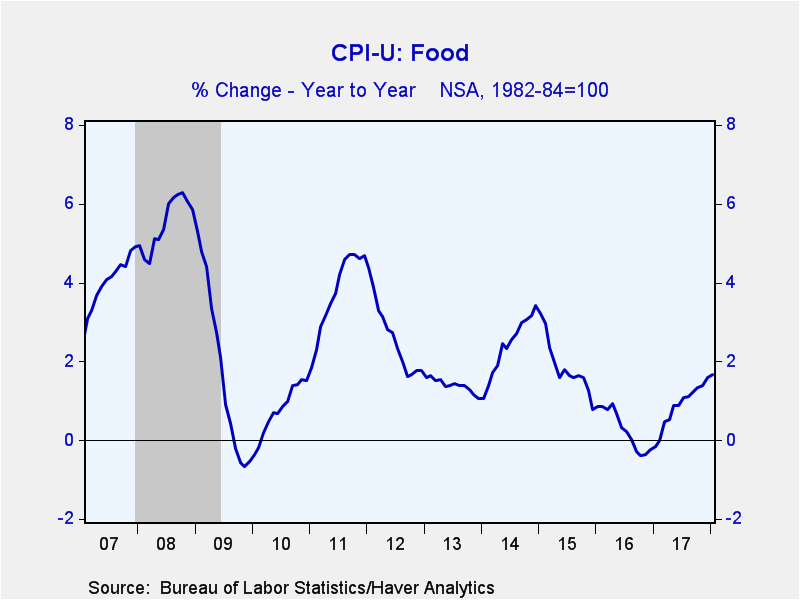

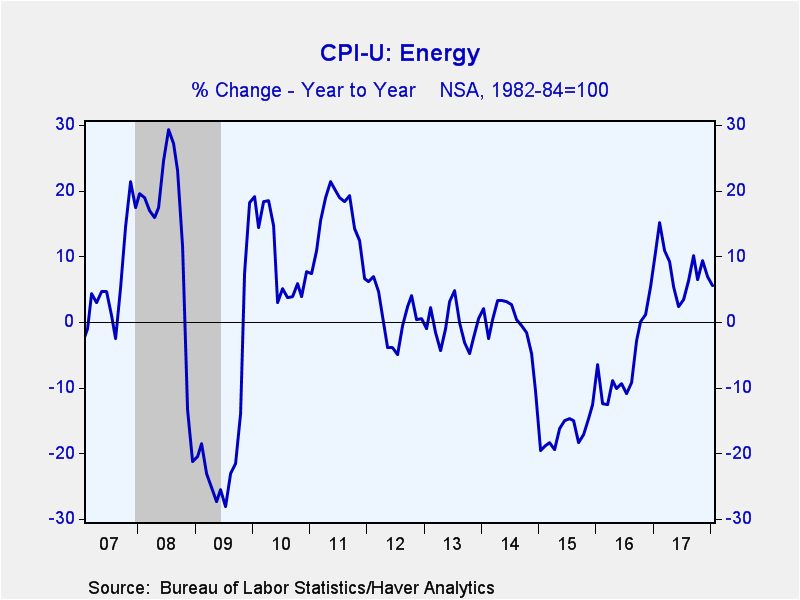

The seasonally adjusted monthly increase in the headline index in January was relatively broad based though a 5.7% m/m surge (8.5% y/y) in gasoline prices contributed 40% of the monthly rise. In contrast, food prices were well behaved in January, rising 0.2% (1.7% y/y), the same monthly increase is in December. Also, there were a couple of quirky price increases that boosted the core but were either idiosyncratic or temporary. Apparel prices jumped 1.7% m/m (-0.7% y/y) in January after having declined in each of the three preceding months. Moreover, not seasonally adjusted apparel prices rose an outsized 1.4% m/m in January. It is extremely unusual for not seasonally adjusted consumer apparel prices to rise in January. This is only the third January increase in the past 68 years. So, given this and the recent trend, it is unlikely that apparel prices are suddenly a new engine of inflation. Furthermore, vehicle insurance prices posted an outsized 1.3% m/m (8.5% y/y) increase in January--its largest monthly increase in 16 years. These two price increases contributed 0.11 percentage point (or more than a third) to the January rise in the core index.

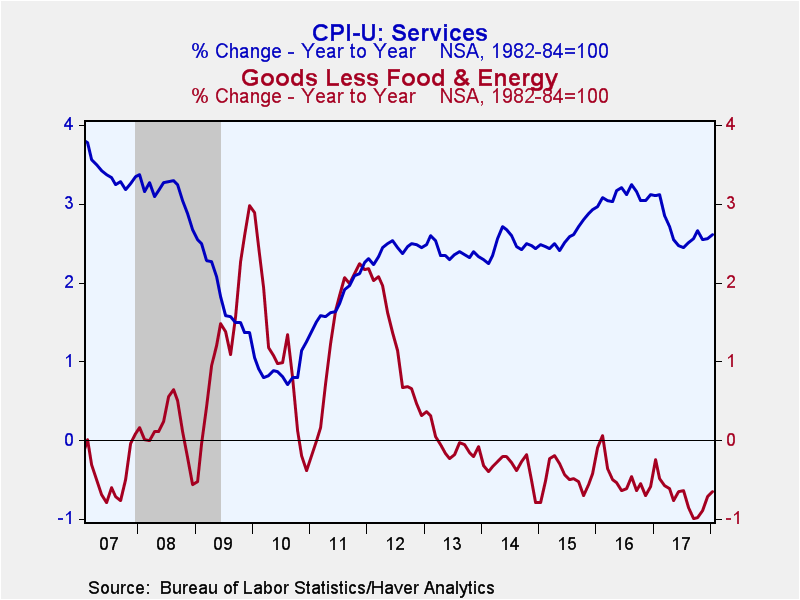

Reflecting the jump in energy prices, goods prices surged 1.0% m/m (1.2% y/y) in January following a 0.1% m/m rise in December. Services prices continued their relatively inertial march higher, rising 0.3% m/m (2.6% y/y). The y/y rate of advance for services prices has been unchanged for four consecutive months.

While the January report has more than its usual share of oddities and though the year-over-year rates of advance for both the overall and the core measures remain around or below the Federal Reserve's 2.0% target, inflation momentum by both measures has accelerated over the past three and six months. The overall index was up 2.1% y/y in January but was up 4.4% AR over the past three months and 4.1% AR over the past six months. Similarly for the core measure. In January it was up 1.8% from a year ago but up 2.9% AR over the past three months and 2.6% AR over the past six months.

The consumer price data can be found in Haver's USECON database with additional detail in CPIDATA. The Action Economics survey figure is in the AS1REPNA database.

| Consumer Price Index, All Urban Consumers (% chg) | Jan | Dec | Nov | Jan Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Total | 0.5 | 0.2 | 0.3 | 2.1 | 2.1 | 1.3 | 0.1 |

| Total less Food & Energy | 0.3 | 0.2 | 0.1 | 1.8 | 1.8 | 2.2 | 1.8 |

| Goods less Food & Energy | 0.4 | 0.2 | -0.1 | -0.7 | -0.7 | -0.5 | -0.5 |

| Services less Energy | 0.3 | 0.3 | 0.2 | 2.6 | 2.7 | 3.1 | 2.6 |

| Food | 0.2 | 0.2 | 0.0 | 1.7 | 0.9 | 0.3 | 1.9 |

| Energy | 3.0 | -0.2 | 3.2 | 5.5 | 7.9 | -6.6 | -16.7 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates