Global| Nov 15 2017

Global| Nov 15 2017U.S. CPI Well Behaved in October But Increases Are Accelerating

by:Sandy Batten

|in:Economy in Brief

Summary

The Consumer Price Index edged up 0.1% m/m (2.0% y/y) in October, exactly in line with the market's expectation from the Action Economics survey. The overall index had jumped a much larger-than-expected 0.5% m/m in September. The core [...]

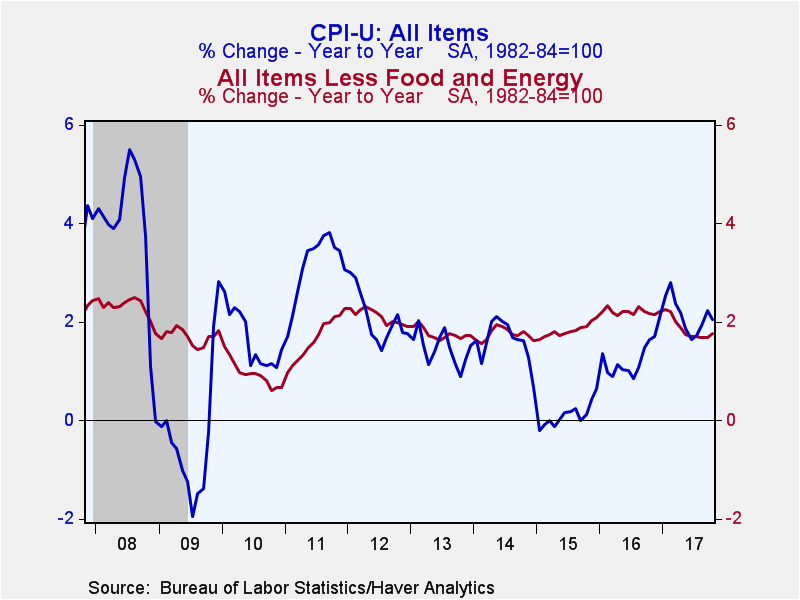

The Consumer Price Index edged up 0.1% m/m (2.0% y/y) in October, exactly in line with the market's expectation from the Action Economics survey. The overall index had jumped a much larger-than-expected 0.5% m/m in September. The core index (that is, excluding food and energy prices) rose 0.2% m/m (1.8% y/y) in October, up slightly from the 0.1% m/m increase in September. Again, the October increase was exactly in line with market expectations. Prices of wireless phone services which had surprisingly depressed core inflation readings earlier this year (particularly in the spring) posted their second consecutive 0.4% m/m increase after having posted monthly declines (at time outsized) throughout much of this year.

While the year-over-year paces of advance for both the overall and the core measures remain around the Federal Reserve's 2.0% target, both measures have accelerated meaningfully over the past three months. For the overall index, in October it is up 2.0% y/y and 2.0% AR over the past six months. But over the past three months it has risen at a 4.3% AR. Similarly for the core measure. It is up 1.8% both from a year ago and also at an annual rate over the past six months. However, for the past three months it has risen at a 2.4% annual rate.

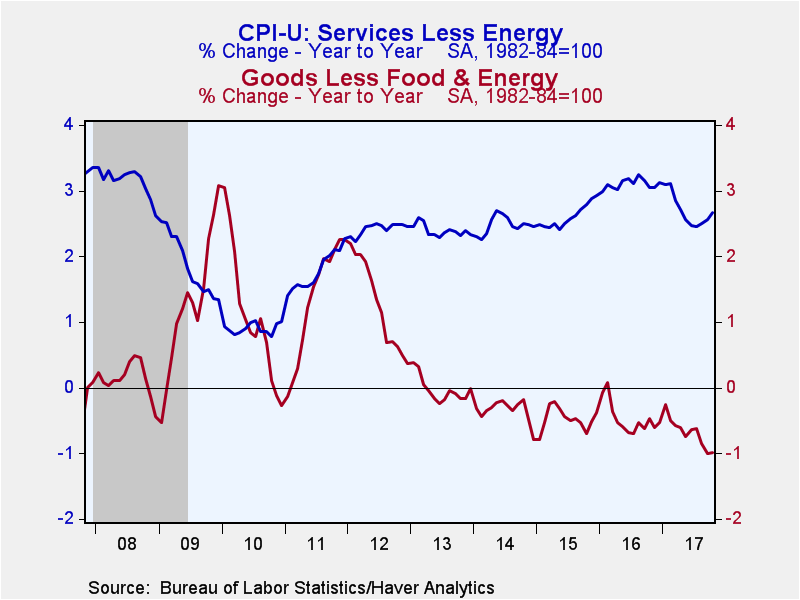

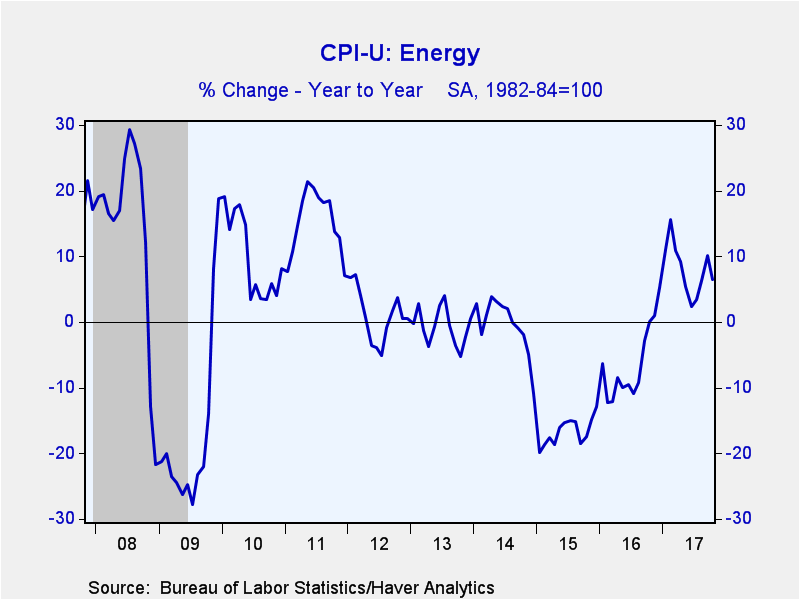

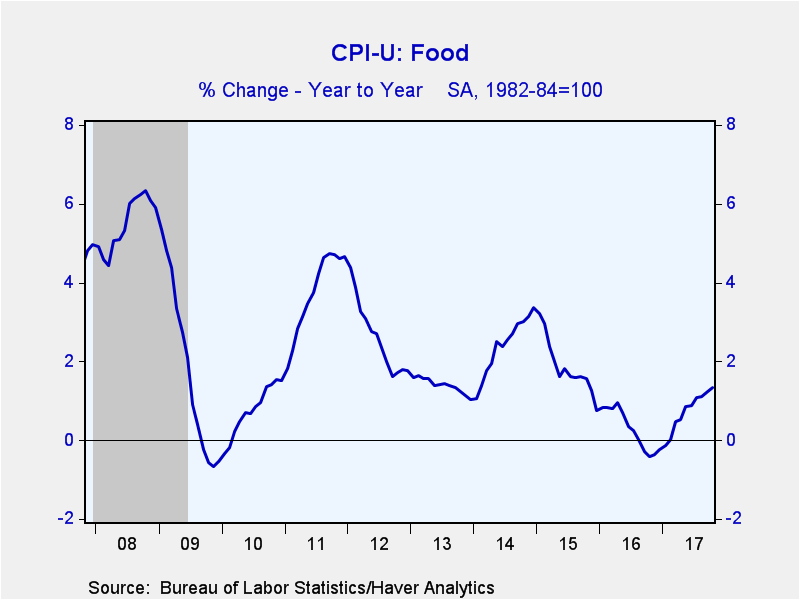

Led by a 2.4% m/m drop in gasoline prices in October (following a 13.1% m/m surge in September), energy prices fell 1.0% m/m (+6.4% y/y). In contrast, fuel oil prices jumped 2.3% m/m in October, and energy services prices rose 0.4% m/m after four consecutive monthly declines. The food index was unchanged in October (1.3% y/y) following slight increases (0.1% m/m) in August and September. Among the major grocery store food group indexes, the index for meats, poultry, fish and eggs was the only one to rise in October--up 0.6% m/m (1.5% y/y) following a 0.4% m/m decline in September. Price of new cars and trucks continued their decline, falling 0.2% m/m (-1.4% y/y) in October for their ninth consecutive monthly decline.

Services prices rose 0.3% m/m (2.6% y/y), up from a 0.2% m/m gain in September. Shelter costs rose 0.3% m/m (3.2% y/y) with lodging away from home up 1.6% m/m. Owners' equivalent rent was up 0.3% m/m (3.2% y/y) versus a 0.2% m/m rise in September. Prices of medical services rose 0.3% m/m (1.9% y/y) following a 0.1% m/m increase in September (the lowest reading in four months). Recreation costs fell 0.1% m/m (3.7% y/y) after three consecutive monthly increases.

The consumer price data can be found in Haver's USECON database with additional detail in CPIDATA. The Action Economics survey figure is in the AS1REPNA database.

| Consumer Price Index, All Urban Consumers (% chg) | Oct | Sep | Aug | Oct Y/Y | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|

| Total | 0.1 | 0.5 | 0.4 | 2.0 | 1.3 | 0.1 | 1.6 |

| Total less Food & Energy | 0.2 | 0.1 | 0.2 | 1.8 | 2.2 | 1.8 | 1.7 |

| Goods less Food & Energy | 0.1 | -0.2 | -0.1 | -1.0 | -0.5 | -0.5 | -0.3 |

| Services less Energy | 0.3 | 0.2 | 0.4 | 2.7 | 3.1 | 2.6 | 2.5 |

| Food | 0.0 | 0.1 | 0.1 | 1.3 | 0.3 | 1.9 | 2.4 |

| Energy | -1.0 | 6.1 | 2.8 | 6.4 | -6.6 | -16.7 | -0.3 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates