Global| Dec 09 2013

Global| Dec 09 2013U.S. Financial Account Shows Moderately Increased Borrowing in Q3

Summary

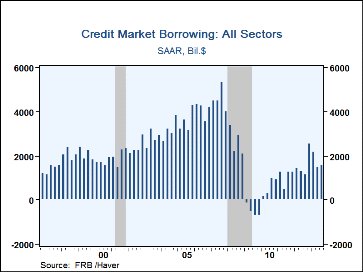

Federal Reserve financial accounts data (formerly known as the "flow of funds") for Q3 show the net volume of credit market borrowing at a $1.57 trillion annual rate, moderately larger than the $1.48 trillion in Q2. Q2 is mildly [...]

Federal Reserve financial accounts data (formerly known as the "flow of

funds") for Q3 show the net volume of credit market borrowing at a $1.57

trillion annual rate, moderately larger than the $1.48 trillion in Q2. Q2 is

mildly revised from $1.37 trillion reported in September. Q3's credit demand

amounted to 9.3% of GDP, compared to 8.9% in Q2. This remains far smaller than a

20-year average ranging around 17-18%.

Federal Reserve financial accounts data (formerly known as the "flow of

funds") for Q3 show the net volume of credit market borrowing at a $1.57

trillion annual rate, moderately larger than the $1.48 trillion in Q2. Q2 is

mildly revised from $1.37 trillion reported in September. Q3's credit demand

amounted to 9.3% of GDP, compared to 8.9% in Q2. This remains far smaller than a

20-year average ranging around 17-18%.

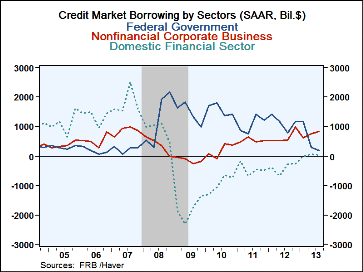

Federal government borrowing in Q3 was low again, at $174 billion, down from $300 billion in Q2 and compares to an average during the last five years of $1.24 trillion each quarter. All these figures are quoted at seasonally adjusted annual rates.

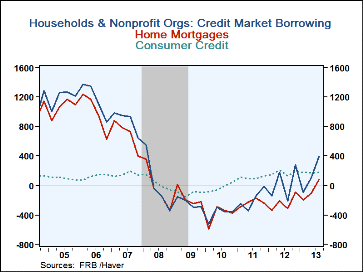

Households and nonfinancial corporations both increased their borrowing in Q3. Households used $393 billion, up from $105 billion in Q2 and a net liquidation of $86 billion in Q1. Notably, they were net borrowers of mortgages in Q3, adding $87 billion in mortgage debt; it was the first net addition since Q1 2009 and, while seemingly small, the largest amount since Q1 2008. Consumer credit borrowing picked up marginally to a $179 billion annual rate from $173 billion in Q2. Within the consumer credit category, auto loans advanced at a $102 billion pace, extending a strengthening trend, and student loans picked up to $137 billion, continuing a sawtooth quarterly pattern. Credit card debt was nearly flat, edging up just $3 billion, and "other" consumer credit was liquidated by about $63 billion. Other types of depository institution loans to the household sector expanded $132 billion, up from $36 billion in Q2.

Nonfinancial corporations' borrowing was $830 billion in Q3, firming from Q2's $774 billion. Of the Q2 amount, $729 billion was in corporate bonds, while borrowing from depository institutions continued to be sluggish, at just $57 billion, up trivially from Q2's $55 billion.

The Financial Accounts data are in Haver's FFUNDS database. Associated information is compiled in the Integrated Macroeconomic Accounts produced jointly with the Bureau of Economic Analysis (BEA); these are carried in Haver's USNA database.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.