Global| Dec 10 2009

Global| Dec 10 2009U.S. Flow of Funds Indicates Expansion In Household Net-Worth To Highest In A Year

by:Tom Moeller

|in:Economy in Brief

Summary

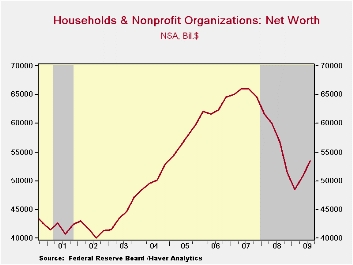

The financial health of U.S. households continued to improve last quarter, as indicated by the Federal Reserve's latest flow-of-funds figures. Household net worth increased $2.7 trillion to $53.4 trillion after a downwardly revised [...]

The

financial health of U.S. households continued to improve last quarter,

as indicated by the Federal Reserve's latest flow-of-funds figures.

Household net worth increased $2.7 trillion to $53.4 trillion after a

downwardly revised $2.3 trillion 2Q increase. Financial asset holdings

improved by $2.4 trillion as the stock market moved higher after a $1.9

trillion 2Q rise. Lower interest rates raised the value of Treasury

security holdings by $168 billion and tangible asset values

rose by $294 billion following the $391 billion 2Q rise. These gains

were helped, finally, by an improved value of real estate holdings.

Despite the gains, however, the value of households' real estate

holdings remained 27.9% below the late-2006 peak.

The

financial health of U.S. households continued to improve last quarter,

as indicated by the Federal Reserve's latest flow-of-funds figures.

Household net worth increased $2.7 trillion to $53.4 trillion after a

downwardly revised $2.3 trillion 2Q increase. Financial asset holdings

improved by $2.4 trillion as the stock market moved higher after a $1.9

trillion 2Q rise. Lower interest rates raised the value of Treasury

security holdings by $168 billion and tangible asset values

rose by $294 billion following the $391 billion 2Q rise. These gains

were helped, finally, by an improved value of real estate holdings.

Despite the gains, however, the value of households' real estate

holdings remained 27.9% below the late-2006 peak.

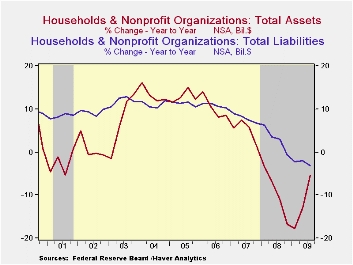

Household

financial positions also improved due to the reduction of liabilities,

though that was small when compared to the rise in assets. Total

liabilities fell $12.0 billion. While the decline was the fifth in the

last six quarters, it paled versus recent $30-to-$300 quarterly

reductions. Mortgage debt reduction was the largest, down for the sixth

straight quarter, but consumer credit started to grow again along with

bank loans.

Household

financial positions also improved due to the reduction of liabilities,

though that was small when compared to the rise in assets. Total

liabilities fell $12.0 billion. While the decline was the fifth in the

last six quarters, it paled versus recent $30-to-$300 quarterly

reductions. Mortgage debt reduction was the largest, down for the sixth

straight quarter, but consumer credit started to grow again along with

bank loans.

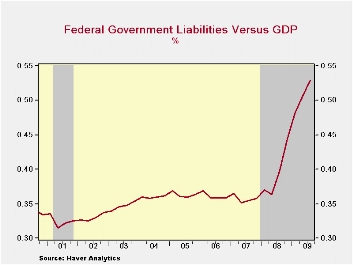

The Federal Government has shared in none of the balance

sheet improvement. The government's debt outstanding rose by nearly

one-third during last quarter versus 3Q '08 to $7.5 trillion as

spending rose and tax revenues sagged. The Federal Government's debt

outstanding rose to 52.9% of GDP. Elsewhere, there's been a strong

aversion to credit market liabilities with y/y declines posted by the

household and the noncorporate business sectors. Deleveraging in the

financial sector also has been impressive. The 5.2% y/y decline in

liabilities dropped the level to its lowest in a year.

End of Year

The Federal Government has shared in none of the balance

sheet improvement. The government's debt outstanding rose by nearly

one-third during last quarter versus 3Q '08 to $7.5 trillion as

spending rose and tax revenues sagged. The Federal Government's debt

outstanding rose to 52.9% of GDP. Elsewhere, there's been a strong

aversion to credit market liabilities with y/y declines posted by the

household and the noncorporate business sectors. Deleveraging in the

financial sector also has been impressive. The 5.2% y/y decline in

liabilities dropped the level to its lowest in a year.

End of Year

| Flow of Funds (Y/Y % Chg.) | % of Total Outstanding | 3Q '09 | 2Q '09 | End of Year | ||

|---|---|---|---|---|---|---|

| 2008 | 2007 | 2006 | ||||

| Total Credit Market Debt Outstanding | -- | 1.1 | 2.9 | 5.0 | 10.4 | 9.8 |

| Federal Government | 13.6% | 30.1 | 35.9 | 24.2 | 4.9 | 3.9 |

| Households | 25.9% | -1.8 | -1.2 | 0.3 | 6.7 | 10.0 |

| Nonfinancial Corporate Business | 13.8% | 1.8 | 2.8 | 5.1 | 13.2 | 8.4 |

| Nonfarm, Noncorporate Business | 6.9% | -5.3 | -1.7 | 5.5 | 14.2 | 14.7 |

| Financial Sectors | 31.3% | -5.2 | -1.0 | 5.5 | 13.4 | 9.9 |

| Trillions of $ | ||||||

| Net Worth: Households & Nonprofit Organizations | -- | $53.423 | $50.757 | $51,379 | $64.507 | $64.520 |

| Tangible Assets: Households | -- | $23.069 | $22.775 | $23.891 | $28.036 | $29.735 |

| Financial Assets: Households | -- | $44.415 | $42.055 | $41.706 | $50.788 | $48.192 |

| Total Liabilities: Households | -- | $14.061 | $14.073 | $14.218 | $14.318 | $13.408 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates