Global| Mar 08 2012

Global| Mar 08 2012U.S. Flow-of-Funds Show Some Progress toward Financial Institution Recovery

Summary

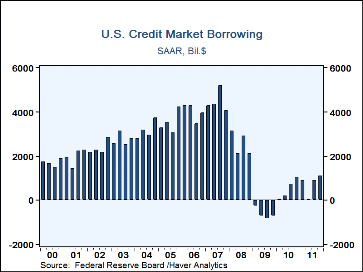

New Federal Reserve data indicate that credit market borrowing ran to an annualized $1,132 billion, seasonally adjusted, in Q4. This amount compares to a similar $946 billion in Q3 and a mere $95 billion in Q2. For 2011 as a whole [...]

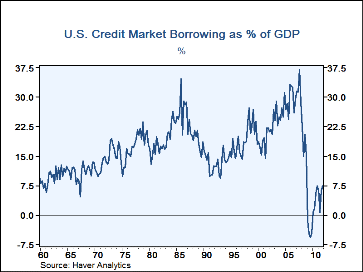

New Federal Reserve data indicate that credit market borrowing ran to an annualized $1,132 billion, seasonally adjusted, in Q4. This amount compares to a similar $946 billion in Q3 and a mere $95 billion in Q2. For 2011 as a whole U.S. markets saw $778 billion in borrowing, a second mild amount after 2009's outright net paydown of debt in the U.S. economy. Our summary table below extends back to 2007 to illustrate the sharp contrast with the pre-recession magnitude of borrowing then of $4,504 billion. And while the first graph shows the simple pattern of quarterly amounts, the second graph compares them to GDP, and we see that our current experience corrects from the historic peak of more than 37% in 2007.

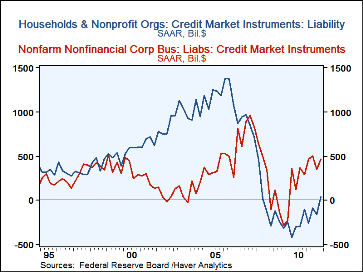

In Q4, the household sector were net borrowers of $43 billion, their first quarter of net borrowing since Q2 2008. The long intervening contraction in their liabilities reverses the upsurge in the pre-recession period, which is evident in the third graph showing a peak in the middle of 2006. Businesses, by contrast, had a much shorter contraction in their use of credit as they returned to moderate borrowing at the beginning of 2010.

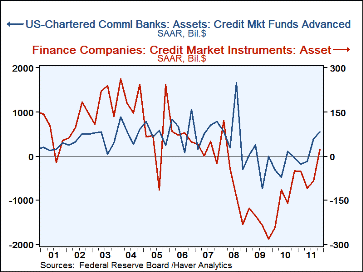

By far the largest adjustment, and one still in process, is that in the financial sector. Financial institutions paid down $609 billion in debt at an annual rate in Q4, bringing their total for 2011 to $556 billion. This is a much smaller paydown than in the two prior years, but still means that the financial sector, a set of institutions that exist in order to facilitate economic activity, is still acting as drag on it.

In Q4, however, several of these institutions showed signs of progress in their own recoveries. Domestic commercial banks had their second consecutive quarter as sizable net lenders, expanding their provision of credit by $536 billion, following $401 billion in Q3. Such expansion of standard bank credit can surely help the economy as a whole. Money market funds were net lenders in 2011; at $7 billion for the entire year, that's surely not much, but it follows credit withdrawals of $644 billion in 2009 and $410 billion in 2010. Finance companies were net lenders of $24 billion in Q4, their first positive quarter since Q1 of 2008.

These Flow-of-Funds data are in Haver's FFUNDS database. Most press reports emphasized recent developments in household net worth, but their varying emphasis from ours here only goes to highlight the broad and detailed coverage of this dataset.

| Flow of Funds (SAAR, Bil.$) | Year | |||||||

|---|---|---|---|---|---|---|---|---|

| Q4'11 | Q3'11 | Q2'11 | 2011 | 2010 | 2009 | 2008 | 2007 | |

| Total Credit Market Borrowing* | 1132 | 946 | 95 | 778 | 554 | -580 | 2613 | 4504 |

| Federal Government | 1321 | 1383 | 826 | 1068 | 1580 | 1444 | 1239 | 237 |

| Households | 43 | -159 | -84 | -114 | -279 | -231 | 4 | 867 |

| Nonfinancial Corporate Business | 461 | 353 | 500 | 445 | 285 | -132 | 341 | 824 |

| Financial Sectors | -609 | -494 | -1010 | -556 | -980 | -1844 | 902 | 1795 |

*Includes noncorporate business, state & local governments and the rest-of-the-world sector, not shown separately.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates